Hey there, @Wdhm.

It's my priority to ensure that you'll have your UC-CR4 form amounts calculated correctly. Let's get this matter sorted so you can get back on track.

Let's start with updating your tax table to the latest release. An outdated one can be the reason why UC-CR4 amounts are not calculating accurately.

To do that:

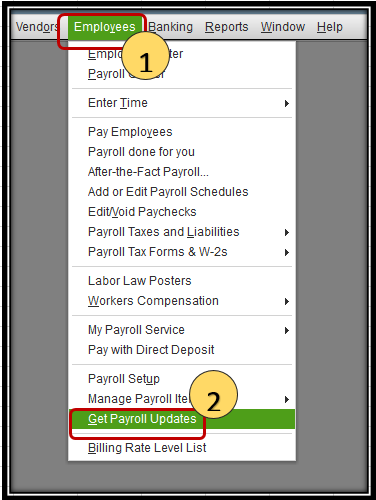

- Select Employees.

- Press on Get Payroll Updates.

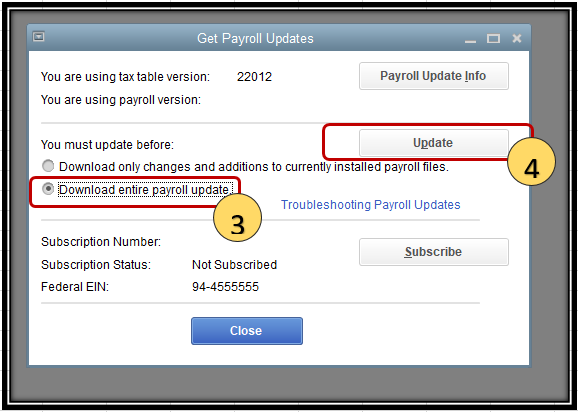

- Select the Download Entire Update checkbox.

- Hit on Download Latest Update. An informational window appears when the download is complete.

To give you more details about the benefit of running a payroll update regularly in QuickBooks Desktop, please see this guide: Learn how to get the newest payroll tax table in QuickBooks Desktop Payroll to stay compliant with p...

Once done, open the form again. Make sure that the date of the form is correct.

However, if the same thing happens, let's pull up the Payroll Detail Review report, which provides detailed information about how QuickBooks Desktop calculates tax amounts on your employee's paychecks and year-to-date transactions.

To run the report, please follow these steps:

- Go to Reports at the top menu bar.

- Select Employees & Payroll.

- Choose Payroll Detail Review.

- Select the correct date range.

- Click the Customize button, and go to Filters.

- Under Choose Filter, enter Payroll Item in the search field.

- Click on the Payroll Item drop-down and select AL unemployment.

- Press on OK.

From there, you'll be able to see the tax amounts and make necessary corrections for the incorrect calculation.

I'd be adding these resources below that can help you adjust your liabilities if you need to do so, and on how to fix issues with the State Unemployment (SUI) tax in the system:

Please let me know how it goes. I'll be right here to assist you further if there's anything else that you need. Keep safe!