Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowThis is pretty ridiculous. I have been using Quickbooks online for well over 10 years and this line only recently started showing up in the past few years. It is confusing and really shouldn't be there at all.

The above process didn't work for me either. But I did notice that the payment date preceded the invoice date. So I changed the invoice date to the day before the payment &, voila, "Unapplied Cash" zeroed out.

None of the above options worked for me either. But when I checked the invoice date it was AFTER the deposit date. So, I simply changed the invoice date to the date before the deposit date, and, voila, "Unapplied Cash" line went away.

I have this issue with journal entries. We do journal entries at the end of the month to record the monthly sales. How do we connect the deposits to the journal entry so that there are no unapplied cash income.

Thanks

Thanks for following this thread, CT837A.

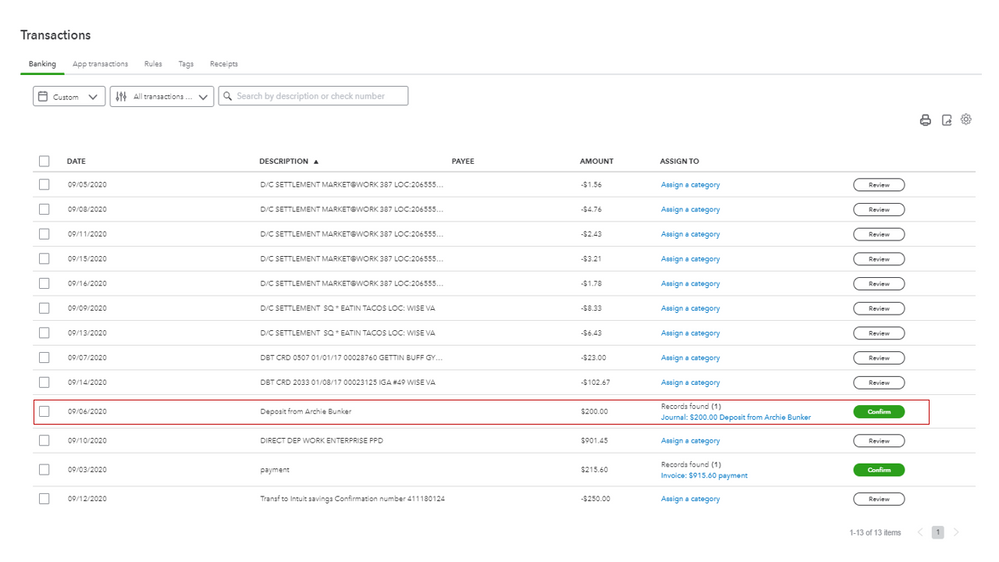

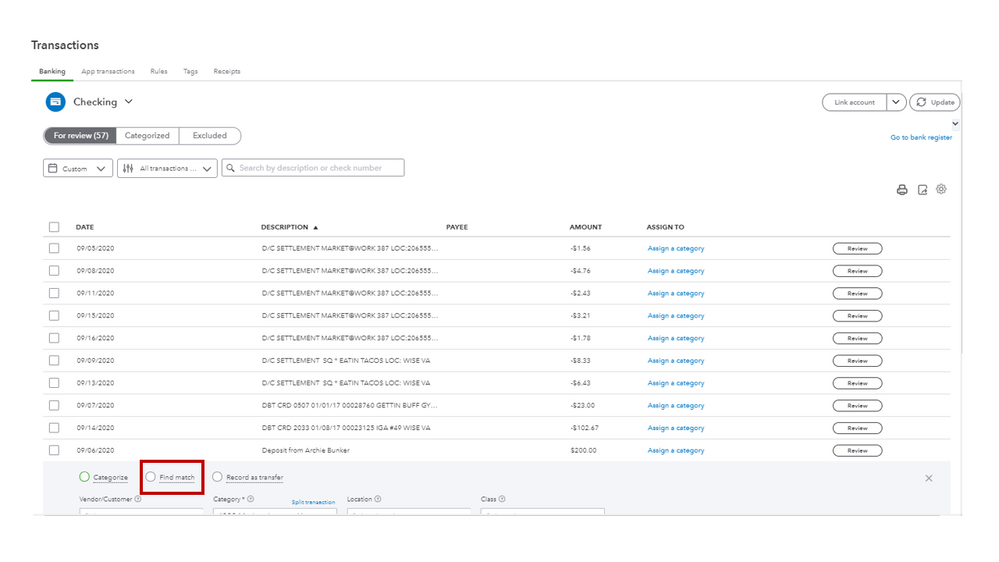

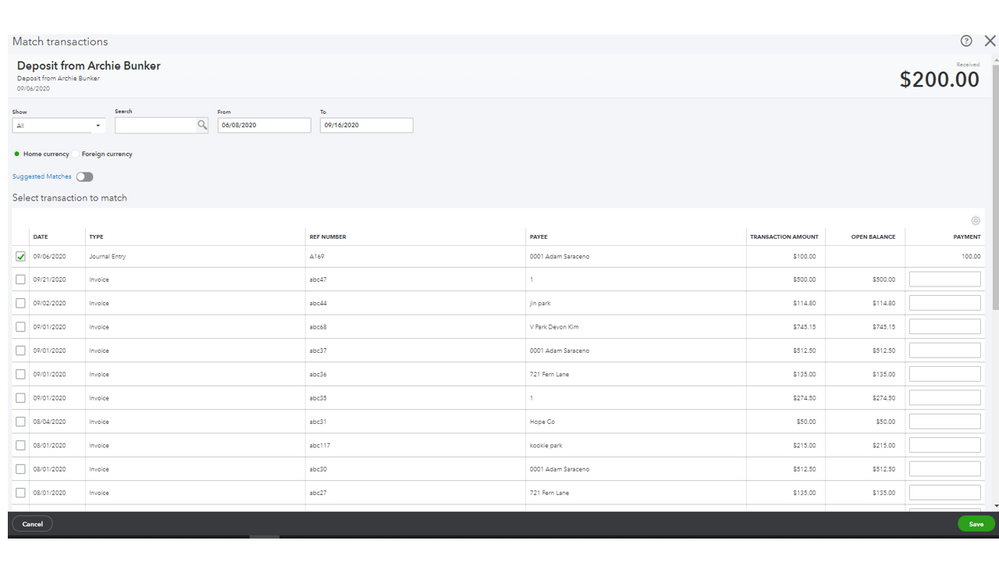

We’ll have to use the Find Match feature to connect the journal entries to the deposits. This way, the unapplied cash income will no longer show in your account. I’ll help and guide you on how to do this task in your account.

Check this article for more insights into this process: Categorize and match online bank transactions in QuickBooks Online. It includes instructions on how to review and classify downloaded data.

For future reference, see the following resource: Unapplied cash payment income on your profit and loss. From there, you’ll learn how to match a payment to an open invoice. Also, it contains solutions on how to handle if you’re unable to find a match to an open entry.

Drop a comment below if you still need help connecting a journal entry to a deposit. I’ll be glad to assist further. Have a great rest of the day.

Can you provide an example of how you fix this issue with a journal entry?

I'd like to help and share what I know about Journal entry in QuickBooks Online, ngranados.

A journal entry is another way of making entries in liability, sales, asset purchase, etc . Creating a journal entry balances your books in a way. You can create a journal entry for the following:

As far as how to handle the Journal Entry, it's best to consult with your accountant since they will know your account. There are multiple ways to handle Journal Entries and it depends on a few different factors. This is to make sure everything is accurate.

For more details, see this article: Create a journal entry in QuickBooks Online.

Be sure to get back to me if you have additional questions. It would be my pleasure to help. Have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here