Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowI'm here to help your credit card payments come up as an expense in QuickBooks Self-Employed, mpmlmft.

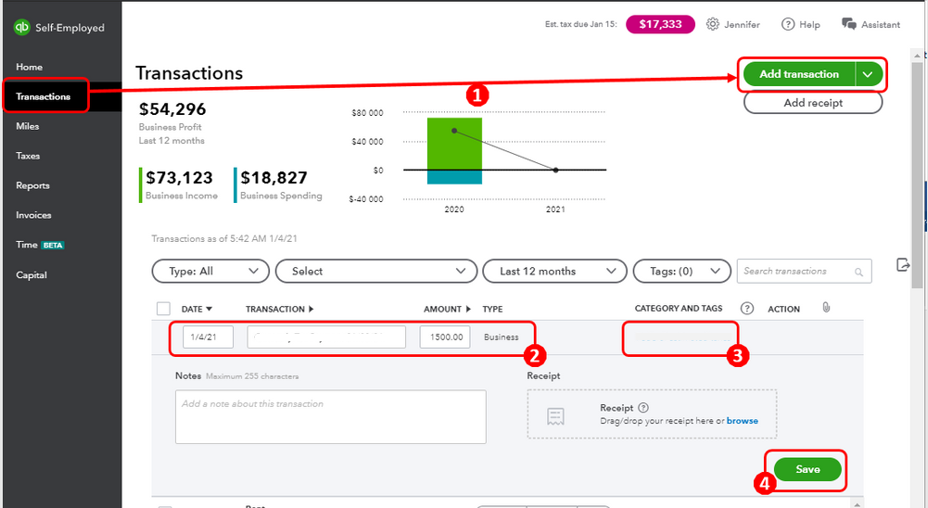

To report your credit card payments as an expense in QuickBooks Self-Employed, you can simply enter them as an Expense transaction.

Here's how:

You can take a look at the following article. This will provide you lists of categories to help guide you in tagging or categorizing your transactions as well as organizing them accurately in QuickBooks: Updates to expense categories in QuickBooks Self-Employed.

Additionally, you can visit the following write-up regarding how Schedule C categories show up on your financial reports: Schedule C and expense categories in QuickBooks Self-Employed.

Keep in touch if you need any more assistance with this or there's something else I can do for you. I always got your back. Have a good day and keep safe.

Hi, mpmlmft.

Hope you're doing great. I wanted to see how everything is going about the credit card payments you had yesterday. Was it resolved? Do you need any additional help or clarification? If you do, just let me know. I'd be happy to help you at anytime.

Looking forward to your reply. Have a pleasant day ahead!

Why would one want a credit card payment to show as and expense when the purchase on the credit card is recorded as an expense.

I am having somewhat the same issue. Sometimes QBO records them as credit card payments to pay down the card and other times it is recorded as an expense. Can you shed light on what I am doing wrong.

In QuickBooks Online (QBO), managing credit card transactions can be confusing, Jonnybegood. Here's a detailed explanation to help you understand the difference between recording a credit card purchase and making a payment to the credit card company.

When you use a credit card to make a purchase, QBO records the transaction as an expense since it initially affects your accounts payable.

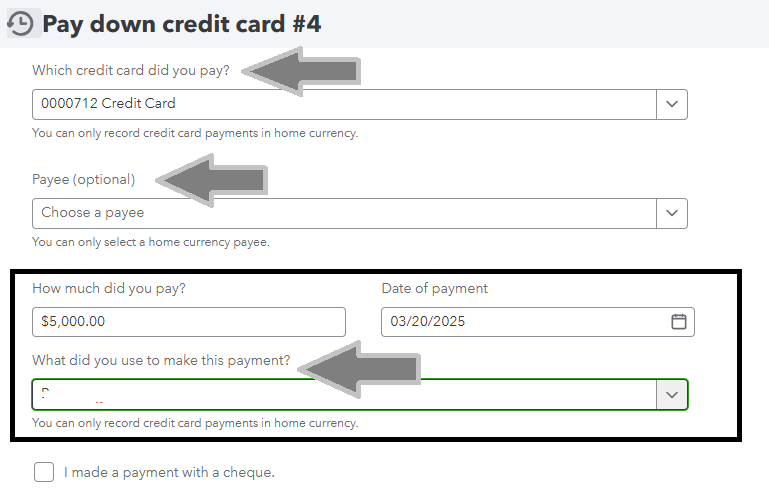

Later, when you make a payment to pay off the credit card balance, it is recorded as a transfer between accounts (from your bank account to your credit card account) to offset the liability (credit card balance). This is how the Pay Down Credit Card feature works.

Here's are the steps you need to follow when processing a credit card payment or pay them through a check:

1. Choose the + New.

2. Click the Pay Down Credit Card under the Other column.

3. Select the credit card you made the payment to.

4. Enter the payment amount and date of the payment.

5. Pick the bank account you paid the credit card with.

6. Choose the I made a payment with a check if you made a payment with a check.

7. Pick the Save and Close button.

When QBO recognizes the credit card payment as an expense, it only depends on how the payment is recorded. You'll want to review the Account Register to see what account are affected and the transaction history.

You can also refer to this page for more guidance regarding Paying down a credit card: Record your payments to credit cards in QuickBooks Online.

Moreover, reconciling your accounts regularly not only ensures accuracy in your financial records but also helps you quickly identify and rectify errors, leading to better financial management of your business: Reconcile an account in QuickBooks Online.

Additionally, we have a knowledgeable team of experts ready to provide immediate support tailored to your business's unique needs. You'll want to consider our QuickBooks Live Expert Assisted service. They will assist you in navigating your plan's features, accounts, customers, and vendors.

If there's anything else you need from us about managing your expenses, feel free to comment below. I'm always here to help in any way I can. Have a great rest of your day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here