Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowHi, finance.

I'm here to help you select an account and set up your credit card to QuickBooks Online (QBO).

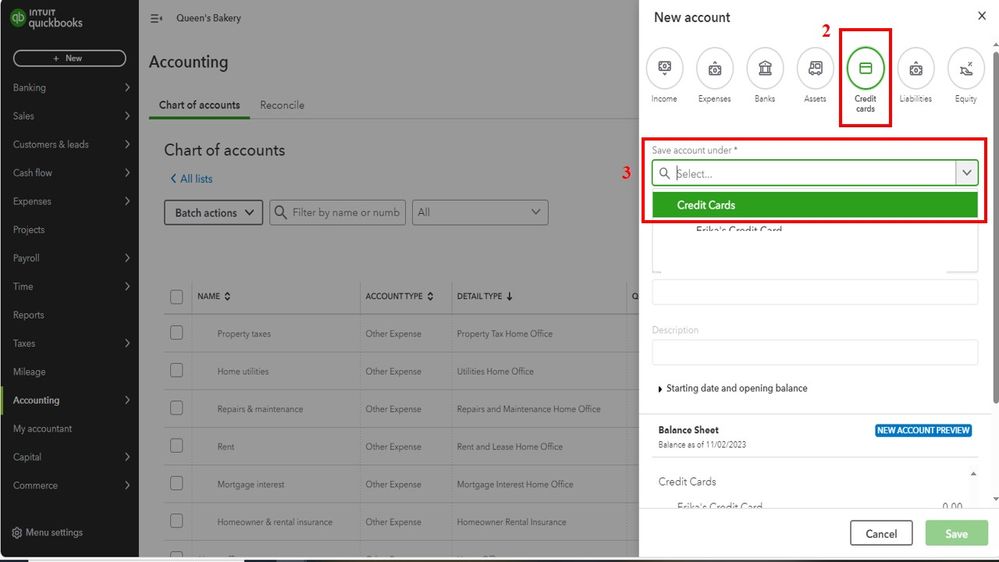

Credit cards are considered liabilities, but in QBO, we record them as credit cards. Even though they are classified as credit cards, they are still liabilities.

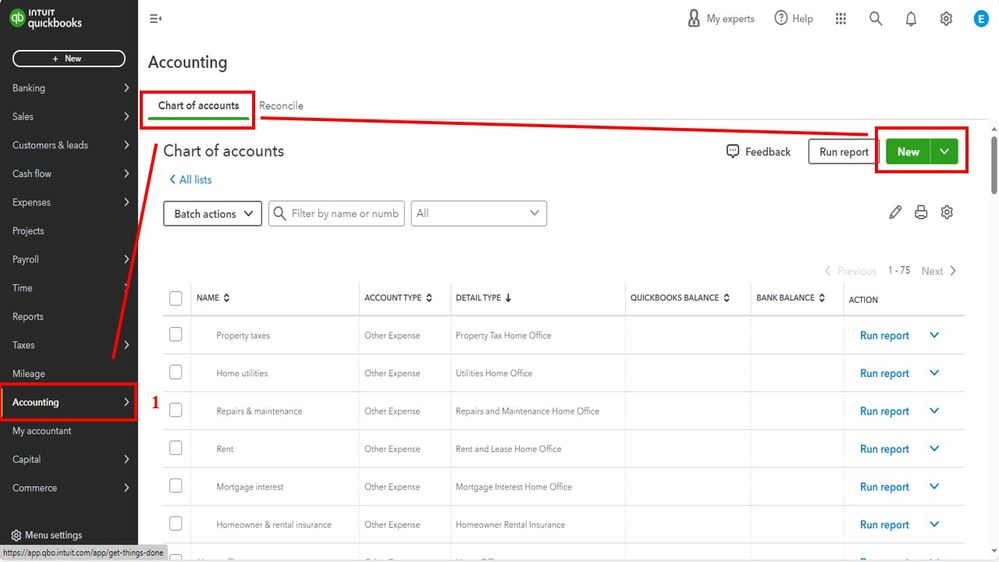

To set up a credit card, we have to:

Here's an article you can visit to learn more about setting up your credit cards in QBO: Connect bank and credit card accounts to QuickBooks Online.

Additionally, I've added this article for future reference about processing your credit card payments in QBO: Record your payments to credit cards in QuickBooks Online. This way, you can keep track of your expenses and maintain accurate financial reports.

If you have any questions regarding how to link your credit cards to QBO, please leave a comment below. Have a wonderful day!

Thank you for that detailed how to with picture, appreciate that. Went ahead and put to credit card which showed up as a liability account. Then I went and created sub accounts for each individual credit card. My understanding is that I will only reconcile the main credit card account, correct?

Thanks for your follow-up, @finance-robbprec. It's good to know that the steps shared by my peer above help you in completing your task.

Yes, you're right. When it's time to reconcile, you only need to reconcile the parent account since all transactions within the subaccounts are consolidated into it.

Check out this article which will help guide you through the process: Reconcile an account in QuickBooks Online. If you're new to this, you can seek help from your accountant to maintain accuracy and balanced accounts.

I'm adding this article in case you encounter discrepancies at the end of the reconciliation and know how to fix them: Fix issues at the end of a reconciliation in QuickBooks Online.

If you have any clarifications with the reconciliation process, please don't hesitate to leave a comment below. The Community is available around the clock to provide support and guidance.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.