Inactive or ineligible contractors might cause incorrect reporting in your 1099s, ague. Let's check on that together.

Only contractors you paid above the annual $600 cash threshold get a 1099. It's important to note that credit card payments are not included, as the financial institution will record those payments. Furthermore, QuickBooks uses the expense accounts you mapped to report 1099 transactions when creating 1099s. Since your amounts are off, we'll need to review the contractor payment transactions and associated accounts.

Here are the steps to do so:

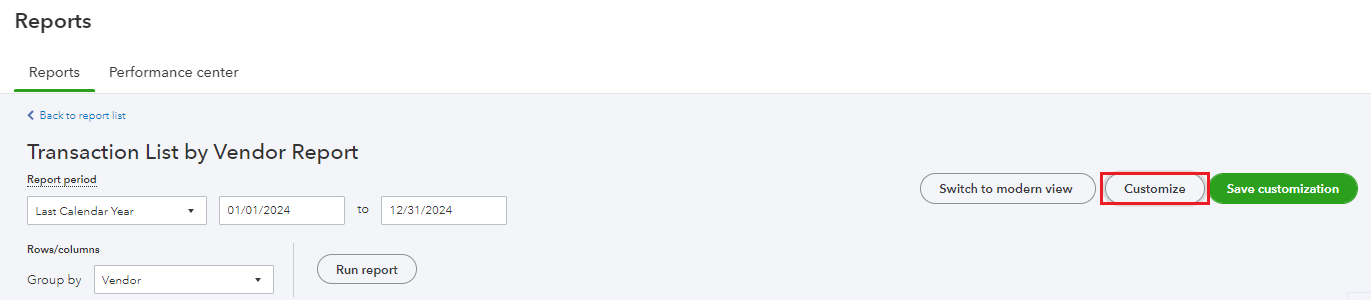

- On the left navigation panel, click Reports.

- Search and open Transaction List by Vendor.

- Click Switch to classic view and then Customize.

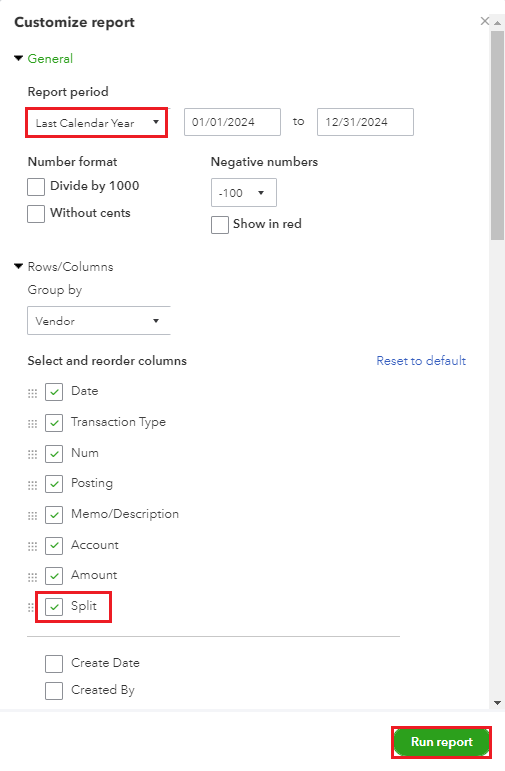

- Set the Report period for Last Calendar Year.

- Go to the Rows/Columns section, and then click Change columns. Put a checkmark on the Split box.

- Navigate to the Filter section.

- Check the Vendor box, and pick 1099 vendors who are in question from the dropdown.

- Click Run report.

- Check the Splits column to identify which accounts are linked to the vendor's transactions. If you see the word "SPLIT," click on the transaction to view the details about the affected accounts. If the transaction is a Bill Payment, access the Bill to see which expense accounts were impacted.

Review the accounts associated with your vendors, and then run 1099 reports to verify that your amounts are summing up correctly. Here's an article to guide you through this process: Create 1099 reports in QuickBooks.

I'll also provide this article for more comprehensive guidance on resolving discrepancies in amounts found on 1099 forms: Troubleshoot missing contractors or wrong amounts on 1099s.

Then, to help you prepare and file your 1099s, check out this article: Create and file 1099s with QuickBooks Online.

Additionally, you might want to Explore QuickBooks Payroll for seamless management of your taxes and forms. With QuickBoks Payroll, our team will automatically handle your paperwork, ensuring you remain in compliance with all regulations.

Feel free to return to this post if you need more assistance or have further questions about 1099s. I'm here to ensure that your QuickBooks experience is smooth and that your financial reporting is precise and compliant. Have a great day!