Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello there, @colleen-heinrich.

If you wanted to set all of your sales items as a default to non-taxable, there’s no need to set up sales tax in your QuickBooks Online. However, if there is a specific sales item that you wanted to add a tax, it will depend on what kind of product you sell and where you sell it.

To add a sales tax to a specific item/product, here’s how.

Click this article for additional reading on adding sales tax item. Add sales tax categories to your products and services.

For your future references, you can also use custom rates to manually calculate taxes on invoices or receipts.

Feel free to fill me in if you have any other questions. Take care and keep safe.

Is there a way to set ALL items to non-taxable, a one-click default?

the items have already been entered as taxable.

There are over 100 items, which is why looking for a one-click default change.

Thanks!

Hello, I have the same question as colleen-heinrich. I don't think you answered her question regarding setting a default sales tax category for products and services. We do sell both taxable and non-taxable items but would like to set the default of Sales tax category to non-taxable when setting up the product. Is this something that can be done in QB Online?

Yes, you can definitely set an item as nontaxable, Reyva1.

Once you have set up your Sales tax, you have the option to set a sales tax category for each item. Every time you use it when creating a transaction, it'll automatically be nontaxable.

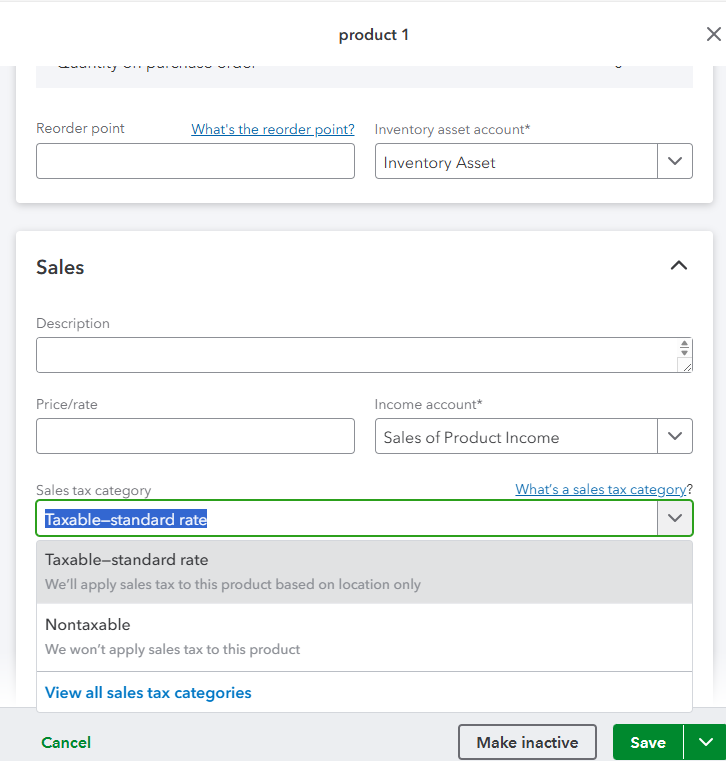

I'll show you how to edit an existing item and selecting the sales tax category:

Changes to the item's information will only affect future transactions. You can do the same process when creating new products.

For more details on managing your sales tax and how we calculate it, you can check out this article: Set up and use automated sales tax in QuickBooks Online.

The Community is always available to help you with any questions you have with QuickBooks. You take care and have a great day ahead!

You may prepare the data with the following template

| Name | Type | UnitPrice | SKU | QtyOnHand | InvStartDate | InvAssetAccount | SalesDescription | Taxable | PurchaseDescription | PurchaseCost | IncomeAccount | ExpenseAccount |

| Gift Certificate | NonInventory | 25 | $50 Gift Certificate | Y | $50 Gift Certificate | 15 | Product Sales | Purchases | ||||

| Music Titles | NonInventory | 20 | Artist CDs | Y | Artist CDs | 12.5 | Product Sales | Purchases | ||||

| Handhelds | NonInventory | 100 | Portable Game Player | Y | Portable Game Player | 50 | Product Sales | Purchases

|

then utilize the trial period of TPImporter

https:// transactionpro.grsm.io/qbo

THANK PABZ... WILL KEEP SAFE OPERATING THIS KEYBOARD. HUGS (VIRTUAL/SAFE)

We have already migrated on QB desktop to online, but the list items (over 3000) all say taxable. Is there any way to change them without having to go into each item?

Yes, there is an alternative way to modify them in QuickBooks Online (QBO), @toolroom.

You can export the Item list to an Excel file to indicate whether it is taxable or non-taxable. After making changes, you can save the file and import it back into QBO.

Here's how to export the list:

After that, import the file to QBO:

You can also consider checking a third-party app that can modify these lists by batch by going to the App menu and then selecting Find Apps or visiting this link: Marketplace.

If you'd like to run another report to pull up your data, check this article to guide you further: Run reports in QuickBooks Online.

I'm always here to help if you have other questions about your item list. Have a good day ahead.

This still does not answer the OP's question which is whether there is a way to set the default status of a *new* product that is added to be non-taxable, so that every new item added does not have to be manually changed from taxable to non-taxable.

Assigning a default status, whether a non-taxable or taxable to a newly added products is unavailable, goodbrew.

You'll have to adjust the tax settings under the Sales tax category manually. I've added screenshot for your visual reference:

I would also suggest considering a third-party application that works with our system to simplify your workflow and automatically set the correct tax status for new products. You can find the Apps menu in the left navigation panel, or visit our Apps center to explore more options.

I'm adding this article that will help generate a report that displays your non-taxable and taxable sales: Sales Tax Liability report.

If you have additional concerns about managing taxes, add them in the comments, so I can address them promptly.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here