Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI ended my sole propritor business (personal household) in January. Let qb payroll file 941 for q1 for me. Found out that I should have used part 3 on that form to indicate the close of my business. Can I amend that filing? I looked on IRS but didn't see anything that indicated I can amend it. Or should I file a $0 q2 941 with part 3 filled out?

thanks

The requirement to submit a corrected tax form largely depends on the specific information that needs to be amended, thermophile.

The Instructions for Form 941 state that "If you permanently go out of business or stop paying wages to your employees, you must file a final return. To tell the IRS that Form 941 for a particular quarter is your final return, check the box on line 17 and enter the final date you paid wages."

However, the 941-X or Adjusted Employer's Quarterly Federal Tax Return does not have a specific section to indicate business closures. I'd also like to inform you that amending Form 941 is currently not supported in QuickBooks Online.

In this case, it's best to directly reach out to the IRS. They can advise whether filing an amended Form 941 is still necessary in your situation, or if you should file a $0 report for the second quarter. For more comprehensive guidance on correcting employment taxes and submitting Form 941-X, please refer to these resources on their website:

Although you may no longer be processing payroll, you might find these articles helpful for completing year-end tasks for the current calendar year:

Navigating tax forms and procedures can be complex, especially when dealing with business closures or significant changes. Please don't hesitate to reach out again if you have any further questions or need additional clarification from the QuickBooks Team.

Can I file a $0 q2 941 in qb payroll? I tried to follow these directions but do not have a run payroll option. I marked my only employee terminated in q1 2024. I can't see what tax forms qb has prepared for me and I can't turn autofiling tax forms off.

I commend your commitment to meet the tax report requirements, thermophile.

At this moment, you won't be able to change the Automate taxes and forms settings because of the ongoing tax filing season. You will be able to change it starting February 01.

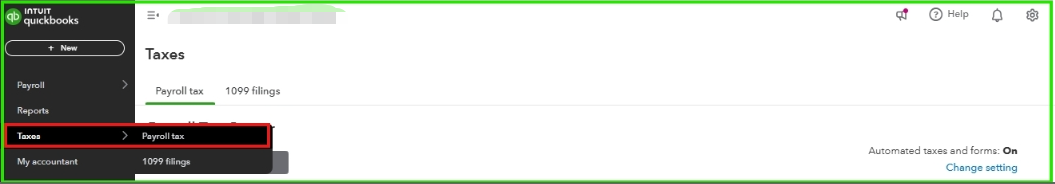

If you're having trouble filing your 941 forms, it might be because the Automate Taxes and Forms feature is turned on. This function allows QuickBooks to handle the filings for you. Please take a moment to check if this setting is enabled. If it is enabled, you can still view the forms and check if it was filed in the Taxes tab. Let me outline the process to you.

Here's how you can view your tax forms.

If you still can't view the forms, I suggest contacting our live expert support. They have the tools to investigate this issue and provide you with assistance throughout the process.

This article offers comprehensive details to access your tax forms and payments: View your previously filed tax forms and payments.

For additional inquiries, don't hesitate to hit the Reply button and leave us a comment.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here