Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI use QuickBooks Online (QBO). Be forewarned, I have NO accounting background other than my experience with QBO, Google searches, and YouTube videos. I have only recently achieved a slight understanding of Debits and Credits (thanks to YouTube). My tax entries on all of my rental income invoices are automatically recorded into my Tax Center and are located in liability account named "State of Texas Accounts Payable in my Chart of Accounts. When I originally set up the Auto Tax feature in QuickBooks Online I did not understand how it was supposed to work. I did not know I was supposed to use the Tax Center to record PAYMENT of those taxes. Instead, I set up an expense account for the State under the "Taxes Paid" category and recorded each tax payment as an expense. Now, three years later, I have a large Accounts Payable balance on my balance sheet. So, I HAVE paid ALL of the taxes owed but the Tax Center and my balance sheet shows they have NOT been paid. My balance in the Tax Center and balance sheet needs to be zero. I have so many questions about how to make that happen and I am deathly afraid of screwing up my books. I need the Community's help in fixing this problem. Here are my questions and concerns:

A. Can I delete every tax payment expense I made for the last three years, and then go into the Tax Center and record them as paid?

B. Will the Tax Center then automatically make the proper expense entries in QBO?

C. When I do the deletions, I assume my checking account balance would increase incrementally with the deletion of each tax expense and then would return back to its original value after I record all the tax payments through the Tax Center?

D. FYI, I previously tried to change the category of the tax expense payments to the State Tax payable account but QBO would not allow it. I got an error message.

E. What about the auto-tax connection to my invoices?

F. Would I first have to delete all my invoices, and that would automatically remove the tax entries from the Tax Center? In other words, after deleting all my invoices, would the Tax Center then show there is no tax to be paid?

G. All the invoices are marked as paid. Do they have to be changed to unpaid before I'm allowed to delete them? Will I be allowed to delete them?

H. What ever needs to be done to correct the issue, the bottom line is the values in all my accounts need to be the same after the fix as they were before the fix. With the obvious exception of the State Tax Payable account.

H. This whole thing is so convoluted and interconnected it makes my head spin. I hope the QuickBooks Community has an answer. There HAS to be a solution to this problem. HELP!

I deeply appreciate your hard work seeking guidance and solutions through Google searches, YouTube, and engaging with the Community, @TXFlipo. I understand that you're in the process of learning the features of QuickBooks accounting, and facing challenges is part of that journey. Yet, I'm here to assist you as you deserve support from the Community. Let’s go through your questions one at a time to help you get everything organized.

To begin with, yes, we can delete all tax payments made outside the Tax Center as the problem occurs when you create an expense account instead of using the appropriate way. After deleting them, let's record them properly in the Tax Center and mark them as paid.

Second, the Tax Center does not automatically create proper expense entries in QBO. That's why you'll need to record each tax payment in the Tax Center from the oldest to the newest.

The third is yes, when you delete the tax payment expenses, your account balance will increase by the amount of each deleted expense. After you record the payments through the Tax Center, your account balance will decrease by the total amount of the tax payments you record.

Fourth, the error message is expected as it's not the right process. You just need to delete the tax payments or expenses and record them correctly through the Tax Center.

Fifth, there's nothing to worry about the auto-tax connection feature as it will continue to work as long as tax payment records are corrected.

The Sixth and seventh options could complicate your records further, it's better to avoid touching invoices and invoice payments. You should focus on correcting the tax payments.

Lastly, values in all of your accounts must align perfectly after we have deleted any inaccuracies and made the necessary corrections through the Tax Center. This process ensures that the tax payments is accurate and reliable.

Additionally, consider consulting with a certified accountant or accounting professional. They can provide personalized assistance and ensure that your books are accurate.

Moreover, QBO simplifies taxes with Automated Sales Tax Envelopes. Envelopes help you save for emergencies or to get ahead financially.

If you’re eager to explore the details of QuickBooks reports and enhance your comprehension of your financial situation, think about reaching out to our QuickBooks Live Expert Assisted team. Our knowledgeable experts are ready to provide personalized guidance that is tailored specifically to your unique requirements, ensuring you receive the support you need to make informed financial decisions.

Taking it step by step will help you correct the problem. Also, always remember that the Community is always here to help you whenever you need it. Feel free to come back if there's anything we can assist you. Have a productive day.

CarlSJ, Thanks so much for the quick response. I have a couple of follow up questions.

A. You stated "Second, the Tax Center does not automatically create proper expense entries in QBO. That's why you'll need to record each tax payment in the Tax Center from the oldest to the newest." So are you saying when I do record each tax payment in the Tax Center, a proper expense WILL be created In QBO?

B. If the answer is YES, where will it be created? Which account in my Chart of Accounts will I find that expense record?

I'm sure I'll have additional questions as I sort through this issue. Thanks again!

Hi there, @TXFlipo.

I appreciate you getting back to me for clarification and ensuring that you will be recording your tax payments correctly in QuickBooks Online (QBO). Let me share the information you need for a better understanding of how QuickBooks works with sales taxes.

When the sales tax is taken from your customer's invoice, it will be posted or debited to your Sales Tax Payable and increase your Sales Tax Liability. Therefore, no expense entries will be created in this action, as taxes taken out from the sales transactions aren't considered expenses.

Right after you pay your sales taxes correctly in the Sales Tax Center, this will debit your Bank and credit your Sales Tax Payable and your Sales Tax Liability account. To see these entries, you can view the mentioned accounts above.

Moreover, you can refer to this article specifically to Record a sales tax payment section to correct your book: Manage sales tax payments in QuickBooks Online.

Also, I'd still recommend consulting a professional tax advisor to guide you along the process.

Furthermore, learn how to set up an email schedule for your memorized reports in QuickBooks Online: Set schedule and email information for a memorized report in QuickBooks Online.

Please don't hesitate to reach out if you have further questions managing your taxes, @TXFlipo. I'm here to assist you round the clock with any assistance you may require.

RoseJillB, thanks so much for your response. Let me see if I understand this correctly. First, some background. When I started using the Tax Center, QBO created an account for me called "Texas State Comptroller Payable" (TSCP). This is a liability account and is the account whose balance has increased because I did not record tax payments through the Tax Center. Am I correct there are only two accounts to deal with in handling the receipt and payment of tax money? The TSCP liability account and the Bank account? In your response, I get the impression I would be dealing with three accounts: a "Sales Tax Payable" account, a "Sales Tax Liability" account, and my "Bank" account. My understanding of how it should work is when the tax value is taken from the invoice, the balance of the TSCP liability account balance will increase and because the tax money is deposited (if only temporarily) into my bank account, the bank account balance will increase also. Then, when I pay the tax and record the payment in the Tax Center, the TSCP balance will decrease and the Bank balance will decrease as well. So is it two accounts affected or three? Do I understand the process correctly. Thanks for the help.

When recording tax payments, only two accounts are affected TXFlipo, the bank account, and the sales tax agency payable account. Let me elaborate on the details below.

Sales Tax Payable and Sales Tax Liability are generic accounting terms used to represent tax obligations to state revenue agencies. With this, the Texas State Comptroller Payable (TSCP) account is essentially the same as the Sales Tax Payable account.

QuickBooks also automatically generates the sales tax agency payable accounts (ex. Texas State Comptroller Payable) when sales tax is configured. It calculates tax rates based on transaction locations, tracks sales tax according to state regulations, and prepares accurate tax reporting for each sale.

Then, when you pay sales taxes, QuickBooks simultaneously reduces your bank account balance and the Texas State Comptroller Payable liability account by the exact payment amount.

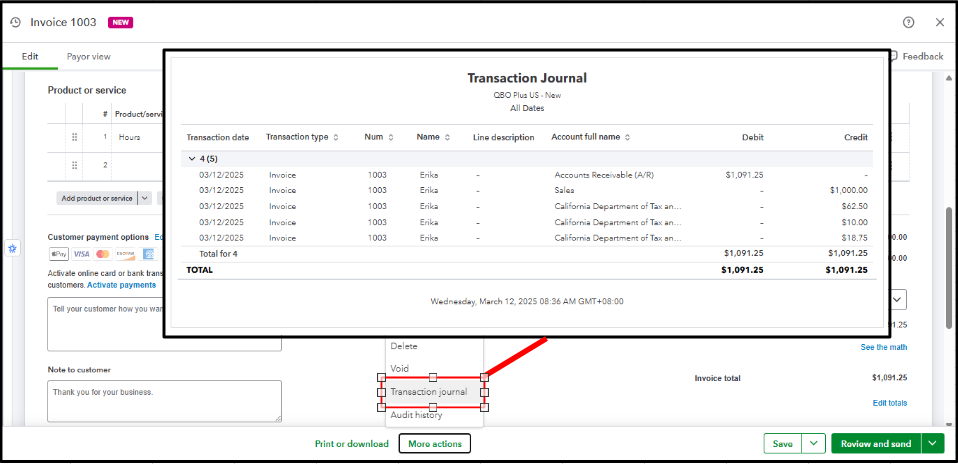

Moreover, when you record an invoice, three accounts are affected by this transaction. The Sales, Accounts Receivable (A/R), and the state agency liability or payable account. In this case, I recommend reviewing the Transaction journal of your invoices to see the affected accounts. I'll add an image for visual reference.

For more guidance on automating sales tax tracking and understanding sales tax adjustments in QuickBooks Online, refer to these helpful articles:

I'll keep this conversation open for any follow-up questions you may have about processing your sales tax payments. We'll be ready to assist you every step of the way.

Hello Erika_K, thanks for the explanation of those accounts. I have a much clearer picture of what happens between the accounts. That will really help me toward correcting the problem I originally mention at the start of all this. I did not know about being able to view the Transaction Journal. I like how you can do that and again, I think that will help me with my problem. And yes, please keep this conversation open as I'm sure I will have more questions in the future. Thanks again.

Thank you for your kind words and for sharing your concerns with us. We are delighted to hear that the information provided has helped clarify things for you, TXFlipo. It's great to know that you found the Transaction Journal useful, and I'm confident it will be a valuable tool in addressing your initial concern.

We're always here to support you, so please don't hesitate to reach out with any further questions. We value your business and look forward to continuing to help you with your QuickBooks needs.

Furthermore, you can explore this article if you need to allocate a transaction between two accounting periods or fix a debit and credit error: Reverse or delete a journal entry in QuickBooks Online.

Keeping the channels of communication open is essential to us, and we are committed to supporting your needs. We look forward to assisting you in the future.

Hello All, I wanted to send this in order to keep this string active. I am working on a plan of attack based on your suggestions and recommendations above. I'm sure while I am planning I will have additional questions and/or concerns. Life gets in the way of me trying to dedicate myself to getting this situation resolved and that's why I haven't posted in a while. I am trying to get back into it again, so please bear with me. Thanks for your understanding.

I have a client that also created an expense to report the sale tax payment, rather than creating a sales tax payment through the sales tax module. If I "undo" the matched expense and create the sales tax payment and match it to the bank feed, will that throw off her bank reconciliations?

Thanks for joining this thread, GingerTexas.

I'm happy to provide some info about the sales tax payment in your client's QuickBooks Online account.

In this particular situation, if the expense is from the most-recent month that has been reconciled, some customers have found it helpful to either un-reconcile the one transaction or the whole month, and then re-reconcile said transaction/month. The likelihood of an issue becomes more likely the older the transaction is, since it would affect the running balance for everything that came after.

Please let me know if you have any other questions. I'll be here to help in any way that I can.

That is the case here...we are trying to help sort out 2024 and she has reconciled the whole year already. I will just leave the balance owed in the sales tax module and do a journal entry to adjust the sales tax liability account.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here