Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowMy client has an account called "Board of Equalization Payable" that really should be called "Sales Tax Payable." I want to have all sales tax items pointing to the "Sales Tax Payable" account. I can't seem to be able to merge the two accounts into "Sales Tax Payable." I can't find where to edit the sales tax items for remapping. It's not like QB desktop and as usual, QBO is incredibly aggrevating. How do I fix this in QBO?

Solved! Go to Solution.

create a new sales tax item and use it - delete/inactivate the old one

When you use pay sales tax with the old agency still having a payable amount, use sales tax adjust as an increase, and use that BOE account as the adjustment account - if that BOE account is not included in sales tax payable

create a new sales tax item and use it - delete/inactivate the old one

When you use pay sales tax with the old agency still having a payable amount, use sales tax adjust as an increase, and use that BOE account as the adjustment account - if that BOE account is not included in sales tax payable

Thanks for this thread! I’m having trouble with a client’s sales tax tracking too. This thread made me feel like less of an idiot, QBO isn’t very intuitive and doesn’t mirror their desktop enough.

Did you ever get an answer to your question? My client is trying and has "sort of" set up a sales tax liability account for several states, but I can't figure out how to track which sales/invoice/customer is set up for a particular liability account. And, the Automated Sales Tax Center has added confusion to my search for an answer. :(

Greetings, @KHMills.

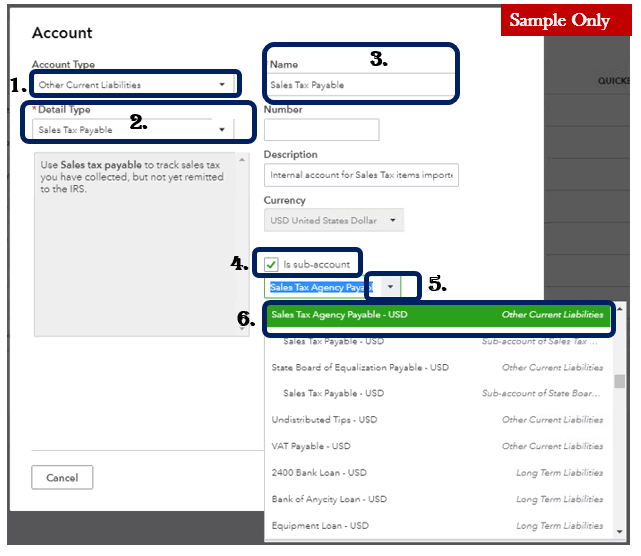

I’d like to have this opportunity to share how you can map your sales tax payments to the Sales Tax Payable account in your Chart of Accounts.

With QuickBooks Online, regardless of how many State Tax agency you will direct your sales tax payments you can connect it to one account in the Chart of Accounts. Since you’re seeing two Sales Tax Payable account, you can modify the accounts listed on your Chart of Accounts by adding, deleting, renaming accounts or merging sub-accounts with parent account.

First, decide which between the two accounts would you set up as the parent account. Once done, you can proceed with merging the sub-accounts.

Here’s how:

That should do it! Once completed, you need not to worry about the Sales tax payments recorded on each accounts since it will be merged. Thus, there's no need to manually re-mapped it.

Fill me in if you have other questions about recording your Sales Tax payments in one account in your Chart of Accounts. I’m always here to help.

But it won't let me merge certain accounts.

When I try to merge a Sales Tax account created by a user with a Sales Tax account created by QBO I get an error message that the the detail type needs to match.

But Sales Tax accounts created by QBO have 2 "Sales Tax Payable" options for the detail type.

If you try to change from one "Sales Tax Payable" to the other, you get an error message that you can't change this for accounts used to track sales tax.

Hello there, @Katerina_.

I'm here to join the thread and help share a little more information about merging accounts in QuickBooks Online (QBO).

Yes, accounts can only be merge if they have the same type. QBO creates some accounts for the company by default and creates other special accounts when certain features are turned on in the settings. You can't modify or delete these accounts.

Since QBO created the Sales Tax account, you can't modify or change the detail type of this account.

For more information about merging accounts, you can check this article: How to merge accounts, customers, and vendors.

In addition, you may also check this article for more information about managing default and special accounts in the chart of accounts: How to manage default and special accounts in the Chart of Accounts.

I'll be always here to help you if you have any other questions about managing accounts in the Chart of Accounts, just add a comment below. Wishing you the best!

So there's no real way for me to get rid of multiple and redundant Sales Tax accounts

Hello there, @Katerina_.

Let me help walk you through on how to inactivate the duplicate accounts in your chart of accounts.

Here's how:

You can put a specific symbol or set of letters before the account name. This will denote that the account is inactive.

For additional insights, you may check these articles:

Fill me in if you have other questions about managing your accounts in the Chart of Accounts. I'm just a post away.

Thanks for the reply, but my main problem is that I have balances (from year back, like 2008. They have all been paid, but the prior accountant failed to record this properly) in both these ST accounts, I can't just delete them. I was hoping to merge all them so I would at least have only one "dump" account.

Hello there, Katerina_.

Thank you for giving us feedback with regards to your experience. I want you to know that your voice matters, so rest assured, your thoughts about merging Sales Tax Payable accounts in QuickBooks is heard and appreciated.

Since the option to merge or delete the Sales Tax Payable account is currently unavailable, I recommend editing the name instead. This way you can identify the main and secondary account you'll be using to report sales tax for every transaction.

Here's how:

You can also visit the QuickBooks Blog site to see the latest product enhancements. We send out newsletters each month to keep our customers updated with what’s new about the application, and you’ll also get some tips on how to manage the business using QBO.

Please know that I'm just a post away if you need any additional assistance. I'd be pleased to help you out. Take care and have a good one.

This isn't really helping the main issue but thanks.

So here's what I did. I took the accounts that I wanted to merge and made them sub-accounts of my Sales Tax Payable account. Then I renamed the accounts that I wanted to merge to Sales Tax Payable. I had 8 different accounts and they all merged no problem.

That is exactly how I have my parent sales tax and sub-account for my states set up and I'm getting the same error message. Please help.

This is so frustrating....

I am having the same problem. Quickbooks Online created 3 parent accounts and 2 sub accounts for sales tax tracking and I cannot find a way to combine them into one sales tax payable account. Never had this problem with QuickBooks Desktop.

Thanks for coming in to Community, @BethFL.

I have some information on how to merge a sales tax account. QuickBooks Online (QBO) will automatically create a sales tax account for every state that'll be your default account. Editing or deleting default accounts in QBO is unavailable.

To merge multiple sales tax accounts, you'll have to edit the other account not the default account. Let me walk you through how.

After merging, you can no longer use the account you've replaced. Need more details? Check out this guide: Manage default and special accounts in your chart of accounts.

If you need help in viewing your sales tax info, check this link to go to know how to use the sales tax liability reports.

Tag me along if you still have questions. I'll be happy to answer them for you. Have a great day ahead.

Clearly the QBO people who are trying to tell us how to fix this issue don't do any accounting work, and are telling us to do things that their program can't do, and doesn't fix the problem. QBO is absolutely horrible for sales tax.

I have 3 Sales Tax Payable Accounts plus 2 sub accounts. The Florida Department of Revenue Payable is where all sales tax transactions for the company were recorded when we used Desktop. It also records some of the transactions now. It has a subaccount with no entries. The second account is Sales Tax Agency Payable that started having some of the transactions recorded in June of 2019. It also has a subaccount with no entries. I have tried every suggestion to merge these two accounts. There is a third account Sales Tax Payable that has no entries but when I try to inactivate the account I get a message that it is an internal QuickBooks account and cannot be inactivated. Do you have any suggestions?

Thanks for your input. I am still trying to resolve this issue.

I can share additional information in merging your account, @BethFL.

There are certain accounts in your QuickBooks Online account like the Sales Tax Agency Payable that can't be deleted or make inactive. This account are created automatically when you set up sales tax and reports the sales tax for every transaction.

You can check this article for more information: Manage default and special accounts in your chart of accounts.

Please take note that you can only merge accounts with the same Account Type and Detail Type. You can also use this article for reference: How to Merge Accounts, Customers, and Vendors.

Let me know if there's anything that I can assist in merging your accounts. Take care and have a wonderful day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here