Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI inadvertently applied sales tax to an invoice from the first quarter of this year for an exempt corporate client. The client has not paid the invoice because they want me to send an invoice that doesn't include the sales tax. Since I have already submitted sales tax to the state for that quarter, I cannot simply remove the sales tax from the existing invoice. The only thing I can think of is to create a credit memo for the sales tax, but I don't know how to set up the service item. Can anyone help me resolve my problem?

FYI... I am not a bookkeeper or an accountant. I am a small business owner and I do my own bookkeeping.

Thank you for the detailed explanation, Carol.

A credit memo is issued to a customer when they have overpaid an invoice, allowing the overpaid amount to be deducted from their next order. However, in your case, since the customer hasn't paid the invoice yet, you'll need to edit the invoice to remove the tax, as the customer is not subject to taxation.

While you could create a sales tax adjustment, the original invoice would still show as taxable. To ensure your records are accurate and to correct your previous sales tax calculation in QuickBooks, unchecking the sales tax is the best option. This would also let you resend the original invoice without the tax.

Since you've already submitted the sales tax to the state for that quarter, it's best to contact the tax agency directly to inform them of the overpayment and ask whether you need to amend your previous tax filing. This way, they can authorize either a refund or apply it as a credit against future tax filings.

If you have any additional questions, please feel free to revisit this thread.

@Jessavell_A I understand all that you've explained, but, to me, this is an unacceptable solution. Editing an invoice from a previous quarter, in my opinion, just creates havoc with the sales tax.

~ The QBO sales tax platform is challenging & not completely trustworthy. I don't want to risk complicating things unnecessarily.

~ Past experience with requesting a refund or amending a previous filing with my tax agency has also been challenging. I prefer to avoid that frustration.

Your link to "create a sales tax adjustment" adjusts the sales tax due in the reporting process. It does not adjust the sales tax on a specific client's invoice.

I am thinking my only option is to fully credit the invoice from first quarter & create a new invoice without sales tax. Doing so will be accurately reflected in the sales tax due at the end of this quarter. The downside is the new invoice will have a current date & not reflect the original date. That's a detail I can live with if it means my client will finally issue payment.

I have a similar issue - a client that, after invoices were issued (months ago), now is indicating they are tax exempt. They have paid the invoice less the tax.

I agree with OP that the sales tax module in QB is not one to mess with, and I don't believe that the current liability would correctly adjust if I were to modify the invoice, and modifying an invoice that already has payment data attached is not really viable.

I need to generate a credit that can be applied to the balance of the invoice, that will also reduce our current month's tax liability. How do we do that?

Thanks for getting involved with this thread, dLearned.

You can consider creating and applying a credit memo to your customer's paid invoices.

Here's how to create one:

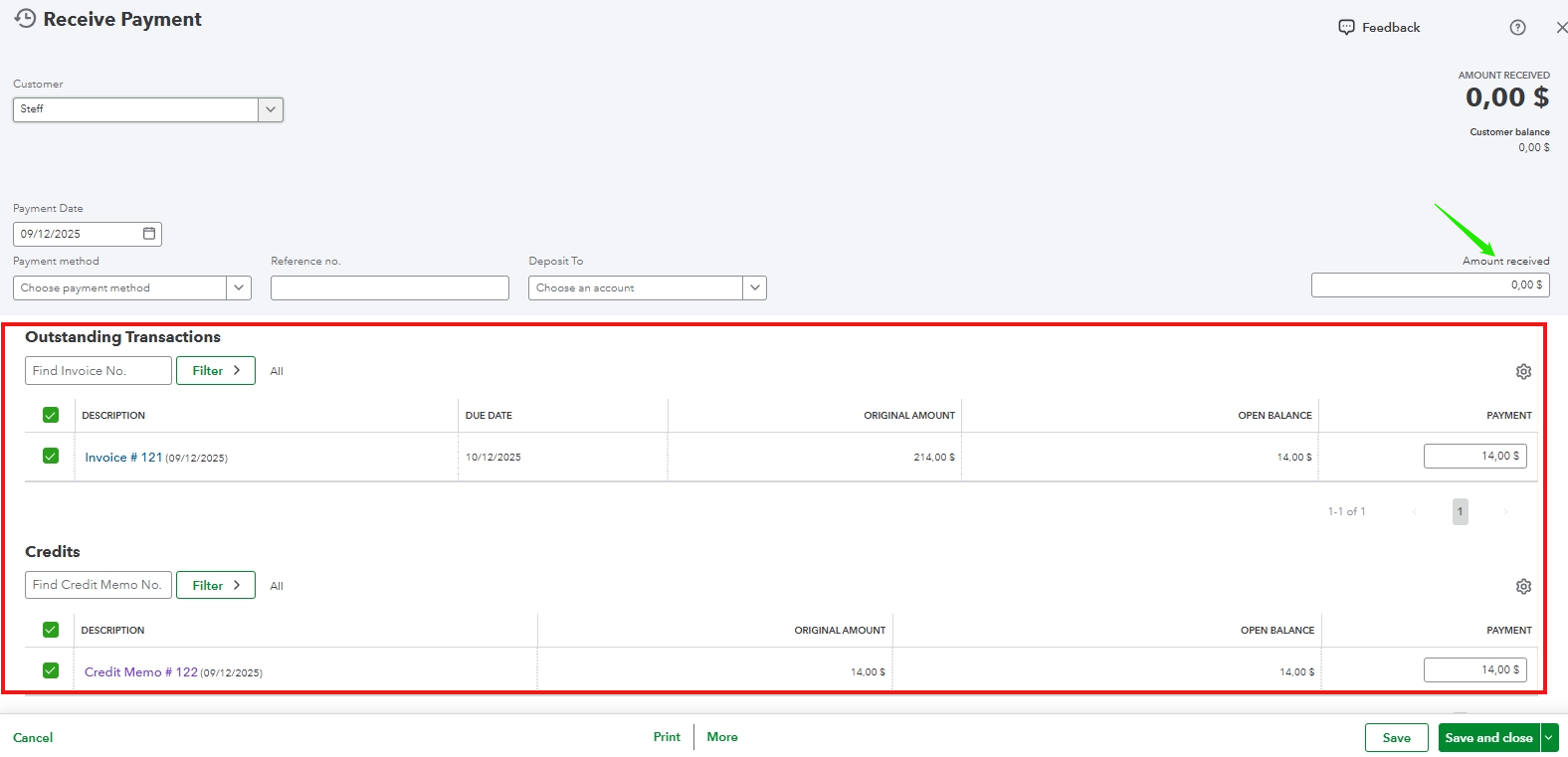

After creating your credit, you can apply it to an invoice.

If you're unsure of what you should do to correct the incorrect sales tax payments, I'd recommend working with an accounting/tax professional. If you're in need of one, there's an awesome tool on our website called Find a ProAdvisor. All ProAdvisors listed there are QuickBooks-certified and able to provide helpful insights for driving your business's success.

You can also consider the recommendations mentioned in Jessavell_A's post if necessary.

I'll be here to help if there's any additional questions. Have an awesome Thursday!

Thanks for the reply, but this is not helpful at all. I do not have a product code for Sales Tax. There is no product credit being issued, purely a sales tax charge.

How to I get it into the Sales Tax account, and have the liability updated?

I appreciate your follow-up, dLearned.

To generate a credit that can be applied to the invoice balance, we'll first need to create a product or service item linked to a non-income account. It will allow you to create a credit memo to offset the sales tax amount and ensure the liability account is accurately reduced.

Here's how:

Now, you will use this new item to create a credit memo. Make sure to enter the total amount of the sales tax.

Once done, let's apply the Credit Memo to the Invoice's remaining balance:

The original invoice will now be marked as "Paid or Deposited," ensuring that your sales tax liability report is accurately adjusted. The client's record will remain clean, and your books will stay accurate.

To avoid this type of situation in the future, it is essential to ensure that your tax-exempt customers are properly marked in QuickBooks Online before you create any invoices.

Let us know if you require further clarification or assistance by leaving a reply below. We'd be happy provide the necessary information.

I find it ironic that you would tell me to "ensure my customers are properly marked tax exempt" when QuickBooks does not use this flag to not charge tax (i.e. if I use a product line that is taxable for a customer that is exempt, tax is still charged). Perhaps suggest the system work to prevent this instead.

In any case, the customer did not notify us of this exemption, but thanks for the rest of the solution, convoluted as it may be.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here