Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

After we processed some returns, in the Pay Sales Tax, under the State Tax, we have a Negative Amount Due.

How do we Zero it out?

If we go to Company > Chart of Account > Sale Tax Payable > you will see the ending balance -xxxx.00. What accounts should we use to zero this out on? Please advise, thank you!

Let's zero out the negative tax amount due, @Erss.

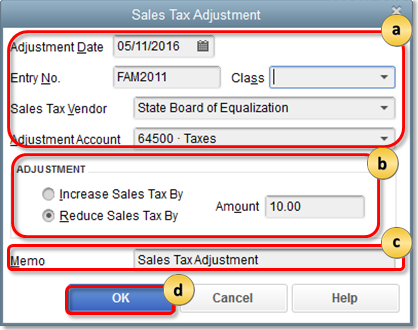

To maintain tax adjustments accurate, I suggest using the Adjust Sales Tax Due tool from the Vendors menu.

Let me show you how:

For more information about the steps above, you can refer to this article: Process Sales tax adjustment.

On the other hand, you can do a journal entry to post this to another account and I recommend consulting an accountant near you to keep your books accurate. You may find this thread handy, too, from the help given by one of our QuickBooks Community experts.

Anytime you can post a comment if you have additional questions about adjusting the sales tax amount due. I'll make sure to help you out. Enjoy the rest of the day!

We did that. That did not zero out the account. It just added another line with the +/- amount.

Maybe the issue is this.

That We have both a Local Tax, and a State Tax. Both falls under the Same "vendor" (state tax organization).

In Local, we need to take away amount due, and in state we need to add amount due to zero out. Does that make sense?

How do we resolve the situation because it is adding a new line?

Hi there, Erss.

We recommend two ways to remove the amounts. Make sure to consult your accounting professional before trying any of these options.

Option 1: Create a General Journal Entry to write off the amount.

Option 2: Use Credit Memo to enter a negative adjustment or a decrease in sales tax.

Please see the attached articles for more information and step by step process:

We'll be right here if you have more queries about the process. Have a great day!

How to zero out beginning balance for Sale Tax Payable to zero for the new fiscal year. When I run report to look for sales tax for Jan - March it show larger amount than it is because it include the beginning balance that not begin with zero. how do I fix this?

I'm using quickbook online.

Thank you.

Hello there, @CK9889.

I can see the urgency of getting your Sales Tax Payable sorted out as soon as possible. One of the possible reasons why the Sales Tax Payable shows a large amount is that there could be some payments that weren't recorded in QuickBooks Online (QBO).

To ensure that this gets sorted out, let's make sure that you have recorded all sales tax payments in QBO. On the other hand, if you were able to record all of them but still produce the same result, you can create an adjustment to fix the balance. Let me guide you on how:

First, let's set up an account for sales tax adjustment. Here's how:

Once done, you can then add an adjustment. Here's how:

For detailed information, kindly visit: Create or delete a sales tax adjustment in QuickBooks Online.

Moreover, for guidance in the process, I recommend consulting your accountant to ensure that this gets treated accurately.

Additionally, I'll also share this link where you can search for articles that can serve as your reference to guide you manage sales taxes in QuickBooks: Help Articles for Sales Tax in QuickBooks Online.

I'm looking forward to getting this sorted out. Feel free to leave a reply if you require further assistance with sales tax in QuickBooks. The Community team always has your back. Have a good one.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here