Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I know this issue may be simple but I cannot find anything online about it and my chat session with QBSE was unhelpful.

In short, I'm self-employed, my wife is not. I filled out the QBSE profile and entered my wife's information including her W2 income. However, QBSE never asks how much is being withheld from my wife's annual salary. And what I think QBSE is doing, is assuming her income is additional income that needs to be added to mine to calculate quarterly taxes. So, on 120K annual income, I end up paying a little more than 42K at the end of the year (around 10K per month). That's a 35% tax bracket ... it doesn't even make sense even if she didn't pay taxes but she has a normal job with taxes, insurance, etc. withheld each month.

For the last 2 years I get this incredible refund around April 15 but I'd rather get a much more accurate quarterly tax schedule. Honestly, my work is very simple ... no employees, some mileage reports, routine invoices for services only (no products being sold) ... it doesn't seem like it should be this convoluted. Has anyone else seen this issue?

Thanks for letting us know, drchance.

I know this wasn't easy for you since you've contacted our support about your tax obligation as a self-employed person. QuickBooks Self-Employed is design to help you record your self-employed income and expenses, track mileage, and prepare your Schedule C. The software calculate the estimated taxes depend on the tax information entered in the system.

There isn't a need for you to enter your wife annual W2 income if you filed your taxes separately. You'll have to update your tax information to get the exact taxes.

Here's how:

This set up will give you an accurate estimated amount to pay the IRS. Check out this link for more details: Review your tax profile in QuickBooks Self-Employed.

Additionally, always check the IRS website for the updated tax payment schedule to prevent tax penalties.

If you have further questions or concerns, let me know. I'll be around to help you.

Giovann_G,

We actually file "married filing jointly".

It seems like QBSE assumes that if you are married filing jointly, your spouse must be self-employed as well and thus, all of their income is subject to quarterly taxes. I just find it difficult to believe that this kind of arrangement (one spouse self employed and the other works for a company) isn't easily handled QBSE.

I'm not expecting QBSE to be 100% accurate on the quarterly taxes but it seems to me that the application would need some additional data to get relatively close. For example, Are you married? Yes. Are you filing jointly? Yes. What is your spouses income? 100K. What is their average monthly tax withholding? 3K.

I appreciate you reaching back to us regarding your tax filing concern, @drchance,

Since you're using QuickBooks Self-Employed (QBSE), we wanted to ensure that the appropriate department could assist you further. By this, I recommend posting your concern to our TurboTax Support forum.

They are our partner support for issues relating to self-employment tax filing. They can give you advice on how to file jointly with your spouse. You can post your inquiries here.

Feel free to leave a reply if you require further assistance with tax filing in QBSE. The Community team is here to help anytime. Have a nice day!

The problem I have pointed out with QBSE (not Turbo Tax) has not been resolved. The problem I have identified makes it impossible for me to send accurate quarterly tax estimates to the IRS. This is a fundamental flaw in QBSE or I'm not getting the right person to show me how to get more accurate estimates. Not only is this a severe shortcoming, I cannot seem to get someone at QBSE to acknowledge the problem. I keep getting passed around. On 9/14, "Vanessa" at QBSE, abruptly ended our chat session with "I'd recommend consulting an accountant". This isn't a unique situation, it's not a misunderstanding of IRS tax rules, it's not even a complicated problem. I pay 320.00 for this software and cannot get someone to look at a basic problem and respond with something that shows they're actually trying to resolve the issue.

I've had two events in my list two filings (2020 and 2021 taxes).

1. I get a huge tax refund (last year 6,389.00).

2. I pay a penalty with interest for underestimating quarterly payments (last year 9.00)

How is this possible and why won't anyone at QB respond with something other than "post on another forum" or "go get an accountant" ? This is your software, does it simply not work?

And for the record, I did post the question on a Turbo Tax support forum. The first response was "Why did QBSE tell you to post this question on a Turbo Tax forum".

Hello there, @drchance. I appreciate you getting back to this thread and for the detailed information.

If your QuickBooks Self-Employed (QBSE) account is associated with TurboTax, all tax-related filing concerns are handled by the TurboTax support team. With this, I'd suggest contacting them to get accurate quarterly tax estimates and other issues relating to self-employment tax filing.

Here's how:

If you still need help, contact them at (800) 446-8848.

Otherwise, if you're only recording entries in QBSE for reporting purposes, manually entering transactions should be fine.

Furthermore, you can check out this article to help you prepare filing taxes with TurboTax: Send QuickBooks Self-Employed tax info to TurboTax Self-Employed.

Thanks for visiting us today. Let me know if you have other concerns about QuickBooks Self-Employed. I'm here to help. Take care!

My estimated taxes are done within QBSE. I will not use Turbo Tax until April of 2023. I use QBSE from January through December. In includes categorizing business expenses, inputting mileage, and printing my quarterly estimated taxes. I do not use Turbo Tax or login to Turbo Tax during the course of a year ... I only use QBSE. QBSE is the only software that estimates my quarterly taxes. Why would I talk to Turbo Tax support for a problem I'm having with QBSE?

Hi drchance,

I understand that you've been working with our QBSE agents to resolve your issue. However, I'm going to let you contact them again so this will be investigated further. We're unable to check records or filings from here.

Thank you for your patience and understanding.

"I'm going to let you contact them again so this will be investigated further.We're unable to check records or filings from here "

Sorry, I really do not know what your last response is saying. Maybe you're asking me to do something?

Hi there, @drchance.

Yes, my colleague would like to let you know you'll be needing to contact our specialists online. As the Community is a platform addressing all technicalities about QuickBooks products, our tools do not include the ability to review customer information, like yours.

I want to include that reaching out to our Customer Care Support is best during business hours from 5 AM-5 PM PT Mondays-Fridays. Use this article to learn more: How do I connect with a tax expert in TurboTax Live?

I'm a post away if you have any other QuickBooks concerns. I wish you continued success in all of your business ventures. Take care!

@JonpriL ... The last time I talked to QBSE's "specialists online", they told me I may need to hire an accountant. Why am I getting the run around on this basic question. QBSE keeps passing me off to different groups and now I'm being asked to go back to the tech support I started with ... phone support.

You said "our tools do not include the ability to review customer information" but you really do not need any of my customer information for this problem. This issue is not specific to me and is not unique to any of my data. Simply use generic data ... pretend you make 50K a year ... and tell QBSE your married filing jointly and your wife also makes 50k ... but she works for a company that witholds taxes on her monthly check. QBSE will calculate your estimated taxes on 100K which is not accurate.

I'm trying to find out if there's a solution to this. If not, just say that QBSE cannot estimate quarterly tax based on that scenario. Maybe say something like ... the best we can do is just tell QBSE you're married filing separately ... your quarterly taxes will still be inaccurate ... but they'll be less inaccurate.

We have the exact same situation.

You are correct - their tax estimator assumes if filing jointly your spouse is also self-employed and thus gives you a huge tax liability estimate.

The quarterly tax calculator - which is a big part of why we use this - becomes useless.

Please post if you get a straight answer or fix!

I am having a similar issue. There must have been a change recently in QBSE as I didn't have any estimated due this quarter and then all of sudden I checked today and it has a huge number. You are right that I believe it is adding my spouse's W2 income to my total and not accounting for the tax withholding she has from her employer. Please let us know if any solution has been provided.

I just noticed the same thing today. Got real worried for a second. I found an old screenshot of the tax profile page that did include spouse withholding. It is not there right now. Doing some basic calculations, I am expecting a $3000 refund, but QBSE is telling me we owe another $5000 in January.

Thanks for joining this thread, boolean0101.

Let me share some information about why estimated taxes aren't showing the expected amounts. There's an ongoing investigation into incorrect calculations in QuickBooks Self-Employed (QBSE).

I suggest contacting our QBSE Live Team so they can add your account to the investigation (INV-81193). Once added, you'll receive updates via email.

To help you get ready to file taxes in QuickBooks Self-Employed, this article will help you prepare: QuickBooks Self-Employed annual tax guide.

Don't hesitate to create a new post here in the Community forum if you have other QuickBooks concerns. We're always open to helping you.

I have the same issue. My wife and I have W2 jobs and both have side gigs that we would like to be able to calculate how much we owe in self-employment taxes for said side gigs. I looked today and it said I owed $30,000 in taxes!

Were you able to get this resolved?

I have the same thing going on, except I attempt to withhold more through my main job in the hopes that I would be able to pay extra taxes to compensate for my side gig.

I thought this system was supposed to calculate the quarterlies correctly?

Frustrating!

I've also experienced my estimate jumping up significantly this December, with no extra income applied. I always save a little extra for quarterly payments, but when the difference is several thousand higher for a quarter, its a bit tough to swallow.

I am having the same issue, and was relieved to find it's not just me. I was on top of my quarterly tax estimates when suddenly in December it told me I owed double what it had been telling me a week or two prior. I am self-employed and my wife is salaried and has her income tax withheld. Being able to track, estimate, and pay taxes is one of the primary reasons I'm paying for this software, and will have to look elsewhere if this function stays how it is now. drchance is correct in that having a field right next to our spouse's W2 income where we can indicate their monthly tax withholding would fix this completely. Indicating we will not be filing jointly is also inaccurate as it puts us in a completely different tax bracket. Please fix this ASAP QBSE!

I am having this exact same problem!

I tried getting help with the live chat QBSE has but they ended the sessions abruptly with 0 help.

QBSE PLEASE add the option for the withheld amount on a W2!!

Hello, gamer1girl.

I know this hasn't been easy for you, as you've already contacted QBSE support about inputting your husband's withheld taxes. I'd still suggest reaching out to our TurboTax support again, as they can take a look into your account and assist you further.

I would also recommend consulting with an accountant or tax advisor about this matter. This way, they can provide options for handling and recording the taxes properly.

I appreciate your patience in this matter. If you have other questions, you can always post them here.

Yeah everytime I've tried to talk about this specific issue and how to resolve it, I've been intentionally and abruptly disconnected from the live chat etc. TurboTax does not help much as this is specifically a QBSE issue.

Obviously this appears to be a common issue and I'm sure you all here will only be seeing more of these exact questions approaching April. I'm just stunned that with such a simple problem (literally just one little box or section needed!) We are all given the runaround or told to consult an accountant. Calculating quarterly payments is a HUGE pro to QBSE and if that doesn't work because of an extremely common factor that's really sad and you'll be losing customers.

So please I urge for the option to add your spouse's W2 withholding amount to be added or returned as a feature!!

Yeah everytime I've tried to talk about this specific issue and how to resolve it, I've been intentionally and abruptly disconnected from the live chat etc. TurboTax does not help much as this is specifically a QBSE issue.

Obviously this appears to be a common issue and I'm sure you all here will only be seeing more of these exact questions approaching April. I'm just stunned that with such a simple problem (literally just one little box or section needed!) We are all given the runaround or told to consult an accountant. Calculating quarterly payments is a HUGE pro to QBSE and if that doesn't work because of an extremely common factor that's really sad and you'll be losing customers.

So please I urge for the option to add your spouse's W2 withholding amount to be added or returned as a feature!!

@GlinetteC ... "I'd still suggest reaching out to our TurboTax support again" ... I actually gave this a try as mentioned in one of the earlier posts. Turbo Tax support response was "why did QBSE send you over here?". I believe most people would recognize the issue is within QBSE and the support for the Turbo Tax product is simply not in a position to "fix" QBSE. It's like being told to talk to the grocery store manager about the excessive calories in a box of pop-tarts. Well, the grocery store does in fact sell pop-tarts, but they have zero control in how they're made.

"I would also recommend consulting with an accountant or tax advisor" ... I would add to this comment "because, at this time, QBSE is unable to provide an accurate quarterly estimate for married inviduals filing jointly". Be honest, upfront, acknowledge the shortcoming ... and point to something specific that shows QBSE intends to correct problem quickly.

As for me, I've reached out to an accountant so that I can move away from QBSE and focus on running my business instead of chasing bookeeping errors. For my business, it's really not that much more expensive than QBSE's annual subscription costs.

I see where you're coming from, @gamer1girl and @drchance.

Let's send feedback or product recommendations to help improve the features and your experience using QuickBooks Self-Employed (QBSE).

I can see how the benefit of being able to add your spouse's W-2 withholding amount would aid you in keeping your tax return accurate with QBSE. With this, I would encourage you to send suggestions or product recommendations. We'll take them as opportunities to improve the various features of our products.

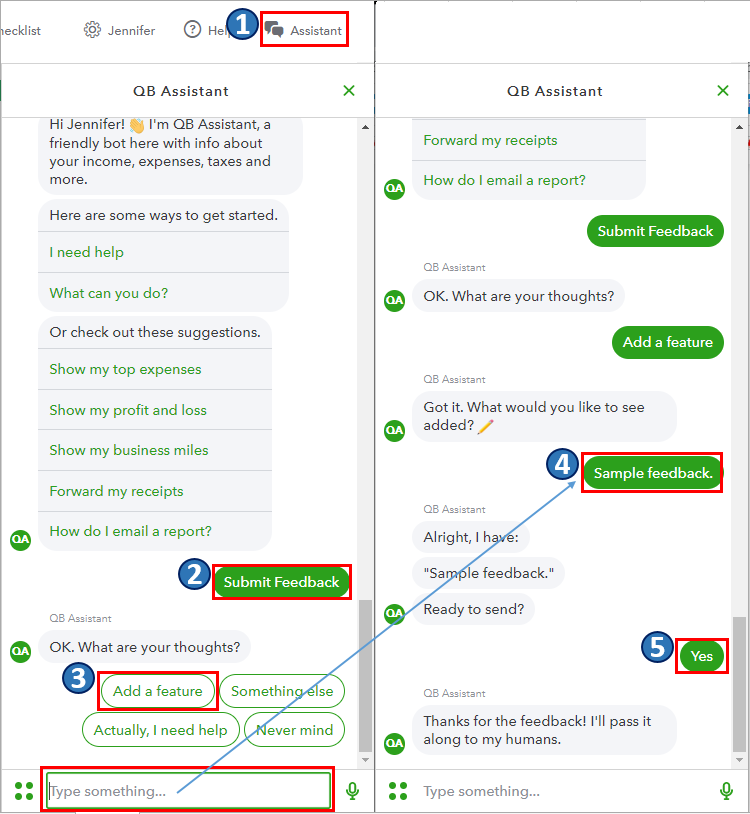

Your valuable feedback will be forwarded and reviewed by our Product Development team and will help improve your experience while using the program. Here's how:

Also, you may want to check out this article as your reference to guide you in getting ready to file your taxes with QBSE: QuickBooks Self-Employed annual tax guide.

I'm all ears if you have other feature concerns or questions about managing transactions in QBSE. You can drop a comment below, and I'll gladly help. Take care, and I wish you both continued success, @gamer1girl and @drchance.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here