Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWhen generating a W-2 State E-File for submitting to Oregon in QB Desktop (Employees, Payroll Tax Forms & W-2's, Create State W-2 E-File) 90% of the time the information wont populate, when it does transfer the information, the STT Wages & STT tax information does not populate. The information is on the W-2 when i printed them, and is correct but it wont appear on the state E-file .txt file.

Microsoft Office, Payroll, & QB's have all be updated and programs restarted. I was told the payroll update being released today 1-12-23 would fix the issue. It only made things worse because now the e-file will only occasionally work where it always worked before (except with the exclusion of the STT info).

Is this issue being fixed?

Hello there, Wmatsu.

We appreciate your time and work in attempting to fix the state W-2 (Oregon) filing issue. Let's go over some troubleshooting methods so you can E-file your state W-2 smoothly.

To begin, make sure that your Excel version is up to date. This way, you can use the program seamlessly. If it's the updated one, open your QuickBooks and download the most recent maintenance release to get the latest features, and product improvements, as well as fix bugs in older versions.

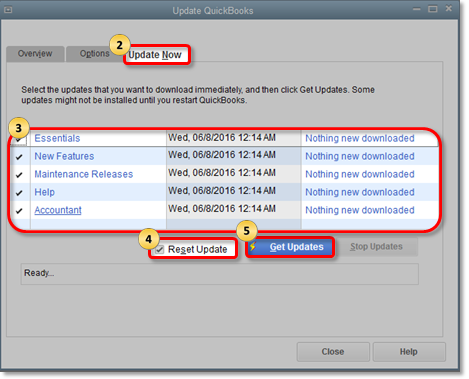

Here's how:

Next, create and file your state W-2. For detailed instructions, check out the following reference: File your state W-2s with Quickbooks Desktop Payroll Enhanced.

If the solutions don't work, I recommend contacting Payroll Support Team again. Then, provide the case number from your previous chat or call. They can go through the notes and carry on with troubleshooting steps where they left off.

To obtain the contact information:

I've included some resources below to help you process your W-2s and get answers to frequently asked questions regarding the tax form:

Also, the following link contains a list of topics that tackles managing your workers' information, processing tax forms, handling tax notices, and other payroll-related activities: QBDT guide.

Feel free to visit the Community again if you need assistance while working in QuickBooks or have other tax forms concerns. I'll jump right back in to make sure you're taken care of, Wmatsu.

Thank you for your reply.

I have tried this multiple times with all 9 of the QB support agents. Nothing has fixed the STT issue not populating into the State E-File workbook in excel. In fact, the payroll update that was supposed to fix the issue made my excel workbook not work most of the time. VBA error kept occurring after the payroll update. Never had that issue before. When i do manage to get the State E-file to populate, the STT info is STILL not there.

Things are worse than before contacting QB Support and downloading the payroll update.

Hello matsu,

I appreciate you for contacting our phone agents, and the team is here to ensure the issue about the STT. Upon checking, this issue has been resolved. I'd suggest refreshing the page to ensure that the STT populates.

If you have other concerns, feel free to post again. I'm here to make sure everything's good on your end.

Thank you for your response. I just ran a new State E-File report and the STT information is still NOT there.

Hi there, @matsu.

Let me help you fix your issue today. I'll recommend running a payroll report if there's a deduction for STT for all employees. We'll need to update your tax table.

If there's none, we'll need to create a liability adjustment.

Here's how:

You can also read this article for the complete details: Adjust payroll liabilities in QuickBooks Desktop Payroll.

Don't hesitate to reply to this thread if you have additional questions about a state e-file report or any related issues. I'll be willing to assist. Take care and have a good one!

Same here! Most of the time it won't generate the e-file workbook. When it did (once) the workbook was missing STT wages and STT withheld. I may have to manually enter W-2s on iWire if Intuit does not fix this! What a nightmare.

Thanks for joining this thread, c0ntrary.

Updating your payroll tax table is a good place to start to ensure that the STT wages and withhold flow on the Tax form Worksheet. Please ensure to get the latest Payroll updates released last January 12, 2023.

Here's how:

If the problem persists, you can run the Verify and Rebuild data procedures. This will scan the company file for data issues and resolve them.

To verify the data:

To rebuild the data:

If none of these work, I'd recommend calling our Payroll Support Team. They have the necessary tools to investigate the cause. It will also enable them to send a ticket to our engineering team to alert them of the problem if necessary.

In addition, I've included an article that will assist you in managing payroll and keeping track of employee expenses. This guarantees that your record is correct: Run and Customize Reports.

You can post your reply if you have additional QuickBooks-related concerns. Take care and stay safe.

Hi everyone, and Quick Books Support!

Well good to know I'm not alone here. Curious QuickBooks Support, what is the ETA on you all resolving this software glitch? Manually entering W-2 employee information in order to meet State submission requirements is not a reasonable option. Already, this has been a costly and operational burden for our small business. We pay for this particular service to avoid manual entry and other headaches such as this one. We have tried all of the solutions your team has suggested. Time is of the essence.

Same problem - QB is not worth anything any more.

I am getting tired of Intuit.

I do payroll for multiple clients on their computers with their software. This issue is affecting all of my clients on their computers and seems to have started after the payroll update that corrected the state unemployment wage limit around 1-12-2023. The gross wages for OR STT and the tax amount is not showing up, or the entire excel spreadsheet is blank! I do not have the time to manually create this for all my clients. When we call, we are told it is an error on our side, but it is not. I have printed W-2s and 4th quarter tax statements and all the data is there. Please fix!!

Same issue for AZ! Will not let me generate the Excel workbook per usual, just started happening for about a week now.

Same issue for AZ! Will not let me generate the Excel workbook per usual, just started happening for about a week now.

Same issue for AZ! Will not let me generate the Excel workbook per usual, just started happening for about a week now. Can someone from QB please help???

Hello NicoleBlue and vvnaccountant,

@vvnaccountant, I appreciate you for adding a screenshot for additional reference. I want to ensure you and @NicoleBlue will get accurate data from the entire Excel spreadsheet in QuickBooks Desktop.

Have you tried downloading QuickBooks Tools Hub? This tool helps you fix common errors like the particular error you got when generating the Excel workbook. Let's follow these steps if you haven't tried them yet.

Once done, run a quick repair on your program.

For further guidance, check our repairing tool: Repair your QuickBooks Desktop for Windows. If the issue persists, I recommend contacting Microsoft Support or someone who can guide us in reviewing your Excel version. They can check and help us resolve any incompatibility between Excel and our program.

We can read through these articles. They provide information about fixing Excel issues and importing/exporting QuickBooks data with MS Excel files.

Visit anytime if you have additional concerns about generating the Excel workbook. I'll help you in any way that I can.

Same problem here in Kansas. Did the QB Tool Hub, reinstalled Excel, called the state, had IT work on it . . . Come on QuickBooks you have to fix this for all of us!

Hello there, @ask.

Creating a W-2 file in QuickBooks saves time from the manual process of calculating. Please know I appreciate your effort in sharing with us the steps you've taken to resolve the issue.

I agree with the importance of automatically acquiring a copy of the state W-2s with the correct details. I've also checked, and I can see you've already performed some troubleshooting steps.

If your QuickBooks Desktop isn't up-to-date, I recommend updating the release. Aside from improving the performance of the software, this process also fixes common and unusual behaviors in the program.

Here's how:

After performing the steps above, let's also run a payroll update. It helps ensure all maintenance fixes from our backend are added to your QuickBooks.

Please follow these steps:

Once done, please go back and create the state W-2 again. You should be able to get a copy of your data showing the correct information.

In case all else fails, please proceed with contacting our dedicated Payroll Support Team. They can further check the issue regarding the payroll data.

Our Customer Support Team for Basic and Enhanced is available from 6 AM - 6 PM PT (Monday - Friday). For Assisted Payroll, any time, any day. See the steps to get a hold of a specialist:

We also have the Verify Data and Verify Rebuild tools to fix issues related to the data. Here's an article to learn how these features self-identify data problems within a company file and self-resolve them using Rebuild Data: Verify and Rebuild Data in QuickBooks Desktop.

You can get back anytime you need assistance with e-filing in payroll or navigating QuickBooks. The Community is always available in this public space.

That worked! Thank you so so very much!

@AlcaeusF Can I ask you a specific question regarding another QB issue? Not sure how to do so. Let me know.

Hello there, @ask,

I'm glad to know that my colleague @AlcaeusF has helped you resolve the W-2 issue on your end. Know that the Community team is always here to help you anytime.

Moreover, if you want to start a new post on the Community page, you can follow these steps how:

1. Go to QuickBooks Community.

2. Select Sign In, then QuickBooks Community.

3. In the Community dropdown, choose Ask the Community to start a new discussion.

4. Type in your concern.

5. Once done, click Post.

Feel free to reach us back if you require further assistance with your QuickBooks concern, or you can simply click the "Reply" button on this thread if you want to add more details/comments about your issue. The Community team always has your back. Have a great day ahead!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here