My main goal is for you to submit your 941 form, DBURIC. Allow me to share insights about this matter.

Yes, you're correct. The prompt message you encountered when submitting your 941 taxes is due to the leap year.

To rectify this, let's perform a payroll update on your QuickBooks Desktop Payroll account. Doing so helps you have the latest and most accurate rates and calculations for supported state and federal tax tables, payroll tax forms, and e-file and pay options. It can also ensure you can re-submit the e-payments.

Here's how:

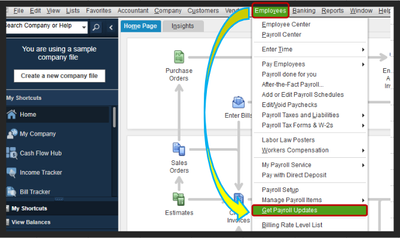

- Go to Employees, then select Get Payroll Updates.

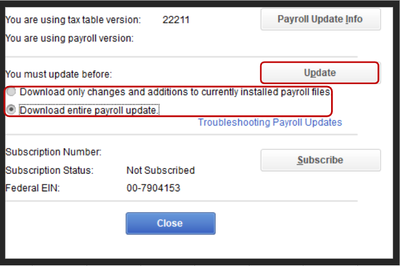

- Choose either Download only changes and additions to currently installed payroll files or Download entire payroll update.

- Click Update. An informational window appears when the download is complete.

For more details, please see this article: Get latest payroll news and updates in QuickBooks Desktop Payroll.

Once done, submit the form again.

Additionally, I've added an article to help you learn more about the status of your payroll tax filings: Check the status of your payroll tax payments or filings sent through QuickBooks Payroll.

You're more than welcome to drop by again if you have other questions about paying your federal taxes and filing the necessary payroll forms. Please let me know, and I'll chime in to help again.