Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Don't bother, tech support does not have the knowledge or capability to help you! I have spent HOURS on the phone with tech support and NO ONE has yet to come up with a solution! I am based in Florida. We are in the service industry business at a FIXED location. My customers come to ME!!!!!! It does not matter what my customers address is PERIOD! I pay taxes on where my services were performed (which is a fixed location), so the "based on location" addition has thrown a major wrench in my tax liability report! The report is ALWAYS wrong! One technician suggested I hire an Accountant (SMH), another tech said it must be "user error" (LOL) and another tech blamed the software engineer (BINGO)! That's why QB can't help us, becuase they refuse to go back to the drawing board and REALIZE that not EVERY business "ships" things or offers a "mobile" service! I am BEYOND frustrated and have yet to see a change! I tried to change every customers tax rate manually (THOUSANDS) to a custom rate that I created in my Tax agency located in QB, but htat didn't work. Doing my sales tax used to take me minutes to do, now it takes over an hour! I have to run a profit and loss report and 1 by 1 go through each line to see which things I need to pay tax on! This isn't easy since in FL some labor is taxable and some aren't (according to whether a part was involved). If QB doesn't fix this I will be changing to another accounting software. This sucks since I have been a faithful customer since the 1990's!

QuickBooks Online does NOT go by shipping address for the state of TX. QuickBooks needs to fix this.

It does NOT go by the shipping address, quickbooks needs to fix this!

Texas is NOT complicated, it's very simple...charge based on where you ship / deliver to and Cash or Accrual basis. It's not rocket science.

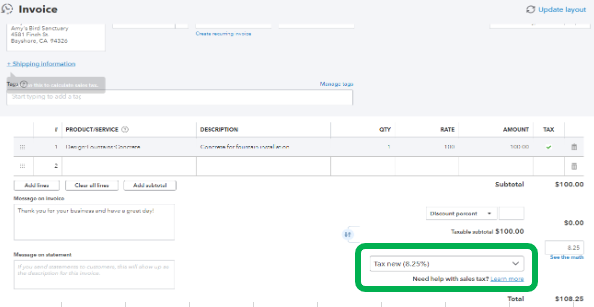

I have a workaround that I figured out...

Find your "Standard" Custom Form Style

Steps to do this...

1. Gear Icon

2. Click on Custom form styles

3. Click on Edit under Action of your Standard form

4. Click on Content

5. On the mockup of the form on the right click on the Pencil icon and Edit the header information

6. Under the heading Display, uncheck Shipping

7. Click on Done

Now when you create a new invoice QuickBooks will use the address of your business as the Based on location default tax for All the new invoices that you create or import. If you need to have a shipping address for the invoice, click on Shipping Information under the Billing Address Quickbooks will calculate tax on the Shipping information.

Hello @Fixer32,

I have reviewed the workaround you’ve shared and it also works. Thank you for sharing your input to help address the issue.

Users also have the ability to create sales tax adjustments in the system. For additional reference. I've attached an article about the process and how to set up the account in QuickBooks: Create or delete a sales tax adjustment.

We love to see members supporting one another! Have a great day.

( edit )

I am replying to this comment: "Texas is NOT complicated, it's very simple...charge based on where you ship / deliver to and Cash or Accrual basis. It's not rocket science." ( end edit)

This is not accurate...for shipped goods, sales tax in Texas is NOT based on where items are shipped to. Construction jobs ARE based on the location of the job. Some taxable services, such as lawn care, are NOT based on the location of the job.

It certainly isn't rocket science, but it definitely not a one-size-fits-all situation.

Important question for all of you with Texas clients....The amount may be so miniscule that it is easily becoming an oversight, but since updating to our new Enterprise account, all Texas clients we run payroll for are being charged sales tax on Direct Deposit. You can see it in the view direct deposit status screen how it breaks it down. Does anyone know why this is happening or are you also seeing this?

Hi there, @guitarguy989.

Thank you for bringing this matter to our attention. I have yet to identify the reason why such an amount of sales tax is charged when processing direct deposit payroll in QuickBooks.

However, taking deeper research and I found out it has been happening for customers with payroll processed for employees in Texas. Most of them also do not know the reason other than it is a new requirement by the state.

Therefore, I recommend contacting your local agency and letting one of the phone specialists know about these charges. Kindly read and use this article to learn more about your local agency and the contact information: Access State Agency Websites for Payroll in QuickBooks.

I'm adding this reference for tips and the important dates to remember in preparation for the coming year-end: Complete Certain Tasks in QuickBooks Online Payroll to Prepare for the New Fiscal or Calendar Year.

Let me know in the comments below if you've got questions about your payroll processing in QuickBooks. I'll surely be around ready to lend a hand. Take care always!

Oh my goodness - YES. We are in the same boat and in the Dallas "Area". Our office is outside of Dallas city limits but the work we do almost always has to be taxed at our customers' addresses (Dallas, Plano, Richardson etc...) which all have either a 2% city tax or a 1% city tax and a 1% Dallas MTA tax etc... Why cant this get solved.

You just need to map your products or services to the following tax category and sales tax will be calculated at the ship-to address that you put in your invoice >> you need to tell QBO that you want to calculate tax at the ship-to for your business transaction, since more sales are sourced at the ship-from in Texas. It's set up at the ship-from by default.

The name of the category you want to use is >> Apply sales tax at ship-to address where permitted under state law

Once you do this, you will see the sales tax rate at the ship-to address calculated. Hope this helps!

Unless you are supposed to charge 6.25% only and QBO decides that your address is in an additional taxing district when it isn't. If you use the Texas Comptroller's tax rate tool, we're 6.25 only. The Intuit lookup tool has us at 7.25%.

Did you ever find out how to automate the taxes? I spent 2 hours on chat and she did not understand the county tax of 2 percent.

I need invoices to auto populate the 8.25 not just the state tax.

Only for state tax not county tax. Even then you can’t create an invoice and it auto populate the correct tax. You have to go in click on detailed charges and change it there, which is nonsense. Seems to me where they have the tax tied to our state that it would have multiple options if you have multiple taxes.

It's March 2024 now but I will respond with what I know after having seen a client through a major Texas sales tax audit. For most purposes Texas is origin based, where your office is....where you take the sale. It would be destination based in things like setting up a market booth as that would be your origin for those sales. My client is an oil and gas contractor performing work in varied locations and via said audit it was confirmed as origin based, taxable from the office location where sales are made originally and not from the plant locations they travel to to work.

Just my two cents.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here