Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWe filed our 2024 1099NEC in January electronically via QBO.

We have 2 contractors with misspelled names and I need to file a corrected 1099 for them.

Per the 2024-25 update: Per IRS regulations, you must file corrections the same way the original forms were filed. If you e-filed your original form, you must e-file your corrected form.

We waited the 2+ weeks for corrections to be enabled. It has been active now for over a week... But at this time you get another flag saying that changing contractor Name or EIN is not available and is being worked on.

We have angry contractors trying to do their taxes and cannot finish as they are waiting on our corrected documents...

Any ideas? Help? Do we just mail in the changes and hope they are accepted/updated?

@MBodyTherapy As far as actually correcting them, well. There are definitely ways to do it through government websites, but after the implementation of IRIS, I'm not sure there are any you'd get approved for within a reasonable amount of time.

There are some websites that can electronically transmit various forms for you (1099s, W2-Gs, etc), but I can't recommend any particular one myself.

All that being said: Which part of their name is misspelled?

If it is the first name, it won't actually matter; the IRS verifies identities using the last name and the tax ID, not the first name.

I appreciate your patience and know the urgency of getting your 1099 NEC form corrected @MBodyTherapy.

The feature to correct the Recipient Name or EIN will be available very soon. It's best not to mail changes to the IRS because you can only make corrections on the platform where you first submitted the forms. If you want your contractors to have a copy then mailing is fine.

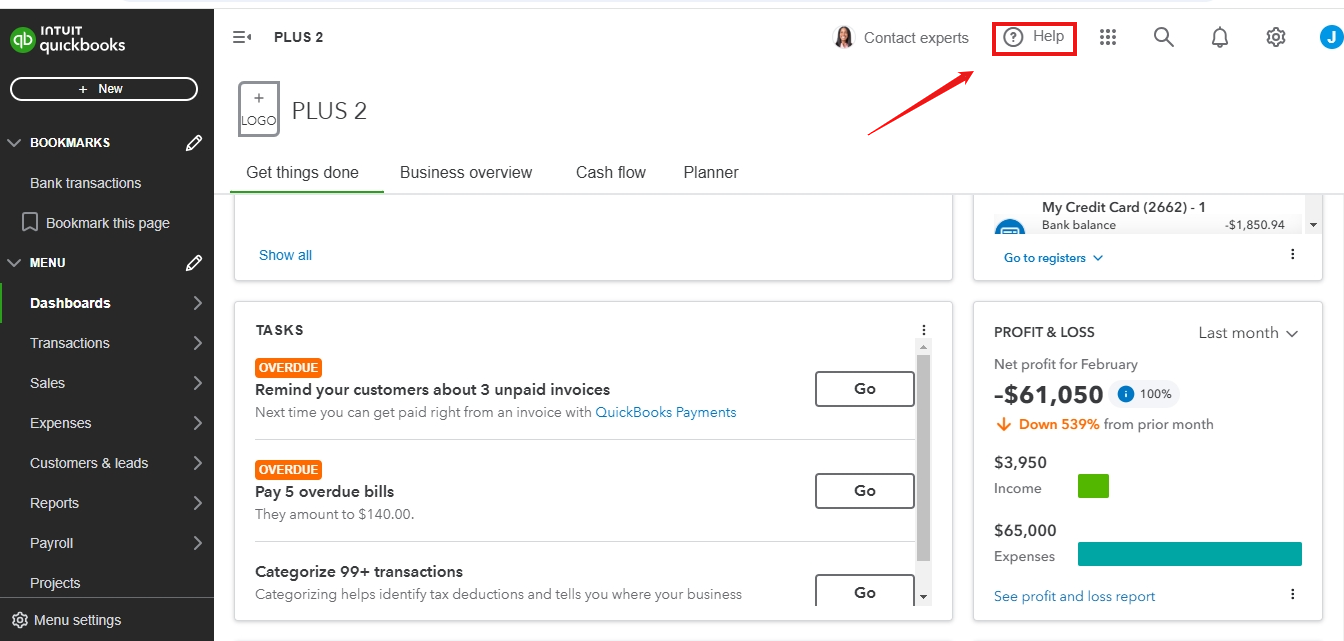

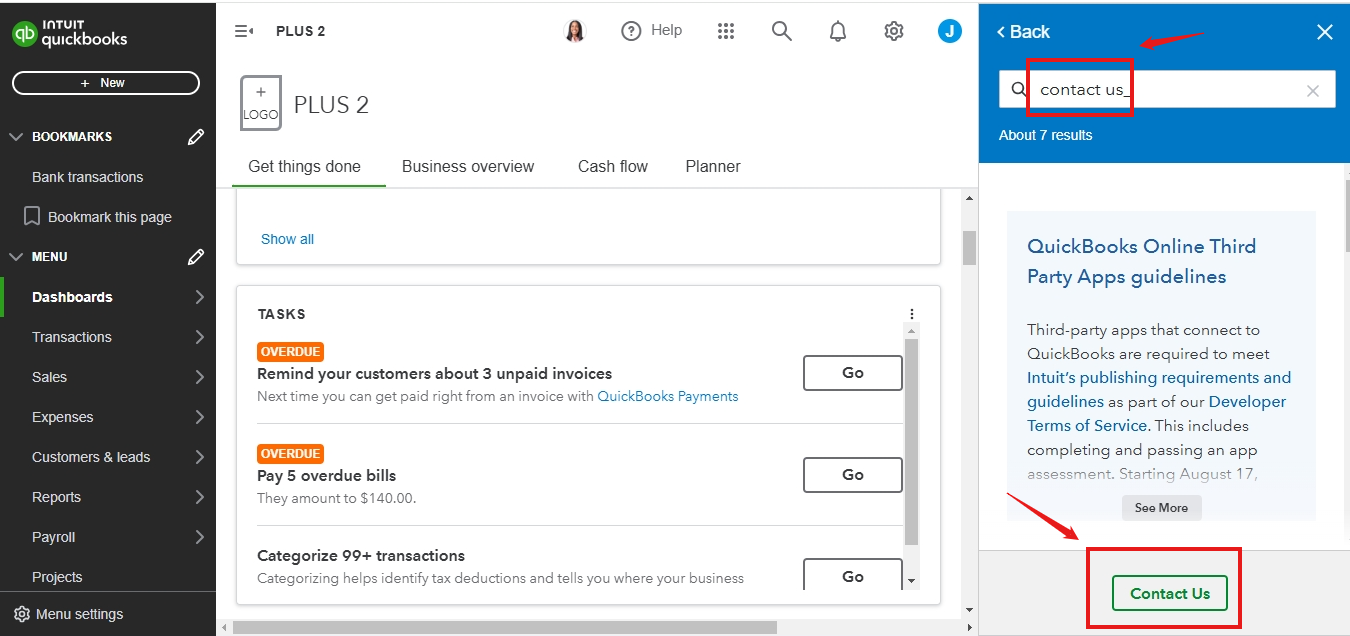

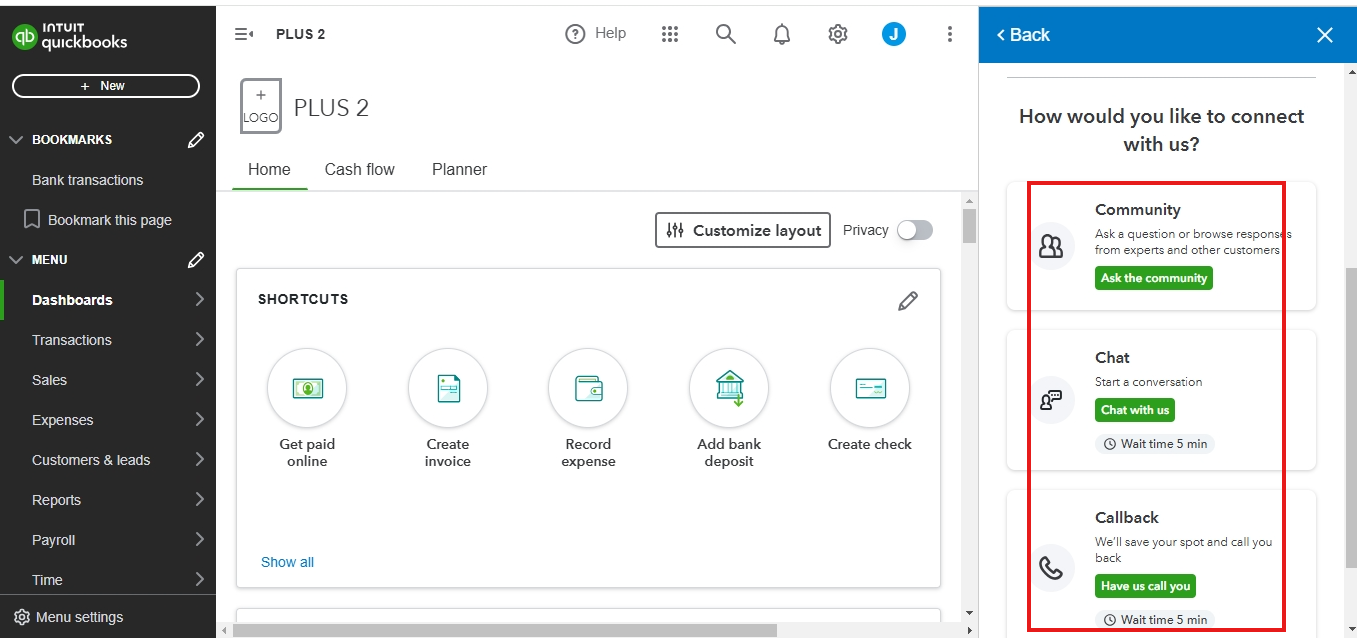

For now, I suggest reaching out to our Live support team to get email updates on this feature. I'll guide you below on how to reach them:

You can refer to this article to check our support hours in QuickBooks Online: Get help with QuickBooks products and services.

Also, keep this article for the future. It's a great guide on IRS regulations for filing 1099 forms and shows you how to file or correct them in QuickBooks: Understand the IRS regulations for filing 1099s and W-2s.

Remember, we're always here to help! If you have any questions about correcting your 1099 form, just reach out to us by getting back to this thread.

Thank you for the feedback. I have been telling the contract workers that as long as the last name and SS# match it will be fine. But they keep asking...

It is simply a confusion on 1st name spelling. Asian contractors. Entered into QB as 1st/Middle/Last, when really their names are 1st and last only. Corrected in QB, but after 1099's were filed.

I had already used the "HELP" feature numerous times prior to coming to the Community page to find further assistance. The original responses were "just wait please". Once the "Correct" feature was released but then not being able to fix the name, I waited another week. Reached out yesterday again before coming here. I received a call back and after much review and them checking on system, the response was to simply mail the changes into the IRS as there was no date given on expected release of ability to do Electronically. Help desk emailed me the information on what is needed to mail in the change. 🤷

Issue is 1st name spelling. Asian contractors. Entered into system with 1st/Middle/Last name and 1099's only brought over 1st/Last. But Middle is actually part of the 1st name. Fixed in system, but not until after the 1099's were submitted.

After numerous calls to the Help Desk they said to just mail in the corrected 1099's as they had no date when to expect the function to work on-line.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here