You can disable the Automated Sales Tax by accessing the Sales Tax Settings, Teresa. Before proceeding, make sure to delete any transactions that include sales tax or mark items as non-taxable. To identify these transactions, run the Sales Tax Liability Report. Let's go through the process below.

When you enable Automated Sales Tax in QuickBooks, it automatically calculates tax using default rates. If this feature is active, QuickBooks will use its rates over any custom rates to ensure compliance with tax regulations.

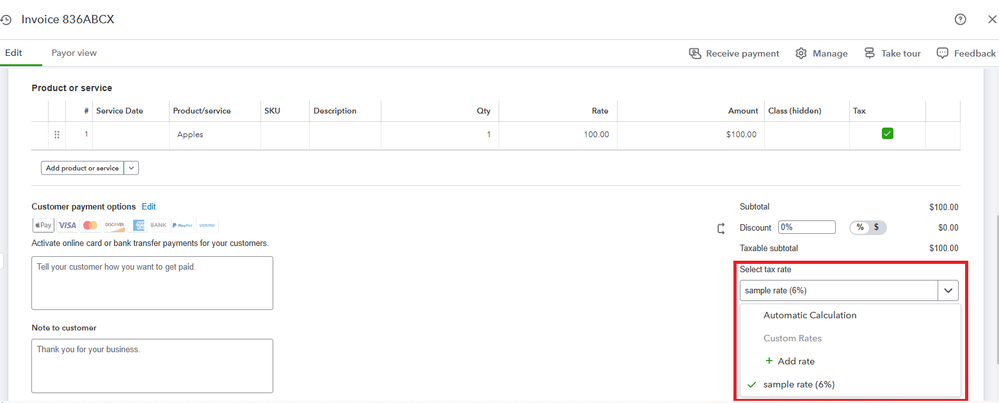

If you need to use the custom rates, just select them in the Automatic Calculation drop-down of your invoice.

Then, you can proceed to these steps to turn off automated sales tax:

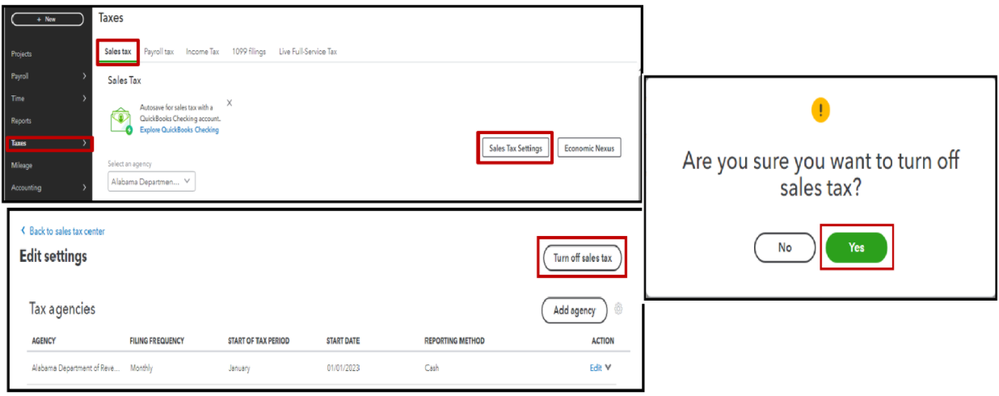

- Go to the Taxes, then choose Sales tax.

- Select Sales Tax Settings, then Turn off sales tax.

- Confirm the action by clicking Yes.

For more details about turning off sales tax, see this article: Turn off sales tax in QuickBooks Online.

Additionally, I'll be sharing these resources that will guide you in personalizing your sales forms and how to record your invoice payments in QuickBooks:

If you need further assistance with turning off the sales tax automation or have questions about QuickBooks Online, please comment below. I’m happy to assist you.