You're on the right track in categorizing your customer payments in QuickBooks Self-Employed (QBSE), Tomtim. Getting a clearer picture of your business earnings is crucial, and I'm here to provide you with additional guidance to keep your yearly taxes accurate.

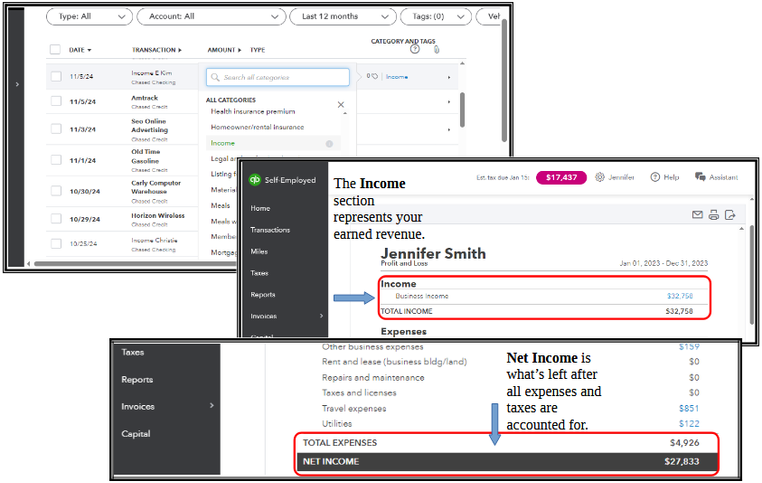

When receiving customer payments, they should be classified as Income to recognize them as revenue. This way, they'll show up as Business Income in the Income section of your Profit and Loss (P&L) report. Then, once all business expenses and taxes are accounted for, the Net income (or simply income) will be displayed at the bottom of the report. I've included a screenshot for visual reference:

You're correct that when categorizing customer payments on the Transactions page, such as those paid via Zelle, they should be classified as revenue. Since these payments may have been automatically assigned to an incorrect category, it may be because of an automatically added bank rule. Here's how you can correct it:

- Go to the Gear icon in your QBSE. Then, choose Create rule.

- Locate the rule related to categorizing your customer payments.

- Select the dropdown arrow and click on the Delete option.

- Alternatively, choose Edit to retain the rule and automatically assign the transactions to the correct category.

As an additional reference, I'm adding this article about matching your categorized self-employed income and expenses to your Schedule C in QBSE: Schedule C and expense categories in QuickBooks Solopreneur and QuickBooks Self-Employed.

Please know that categorizing your business income and revenue doesn't have to be a task you tackle alone. Keep us updated on your progress with categorizing your income in QBSE, and we're here to respond quickly to any questions you may have. We're committed to supporting you every step of the way in the Community. Take care and have a great day!