Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Solved! Go to Solution.

I'll guide you on how we can set up and manage payroll for your employees who work at a different location every day, faith.

QuickBooks doesn't have a direct way of handling payroll for a roaming employee since having multiple state unemployment and local withholding on a single paycheck or tax filings may cause issues with state tax forms. For now, I suggest sending feedback about this. Here's how:

Moreover, I can share a workaround on how you can track and run payroll for these types of employees. Refer to the list below:

Please check out this link to help you create, manage, assign and update your pay period: Set up and manage payroll schedules.

Comment below if you have additional questions about managing your payroll set up, and I'll circle back to assist you. Take care!

It's a pleasure to have you here today, @faithelectricaloffice. We'll help you get through this and have your employee set their specific address inside the program.

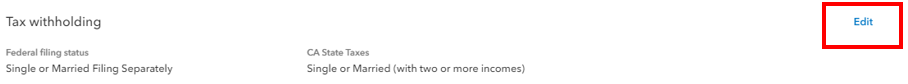

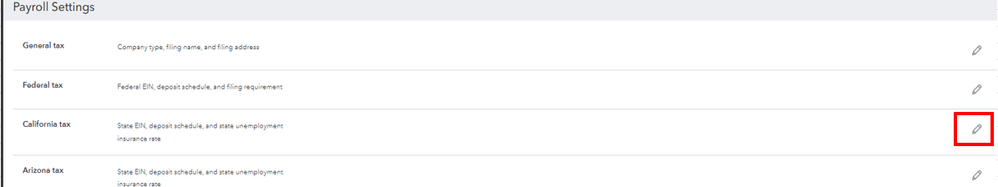

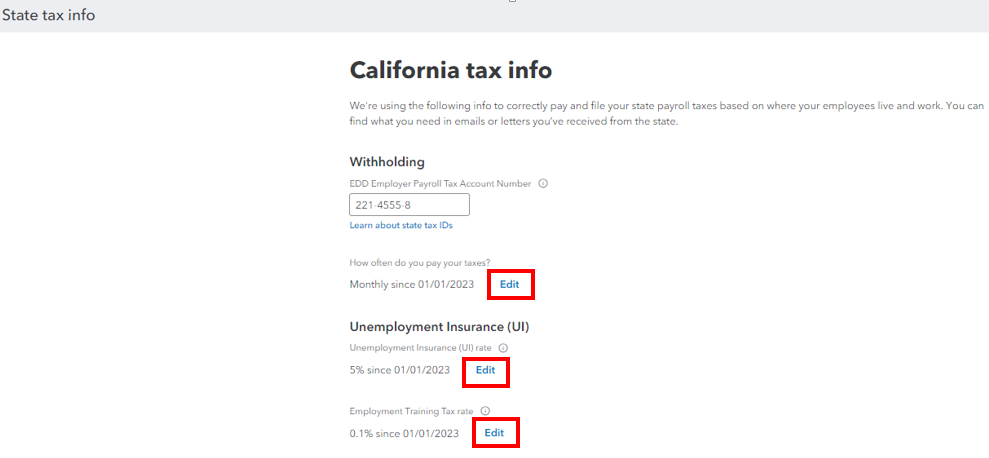

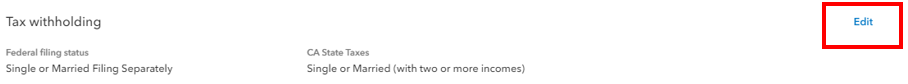

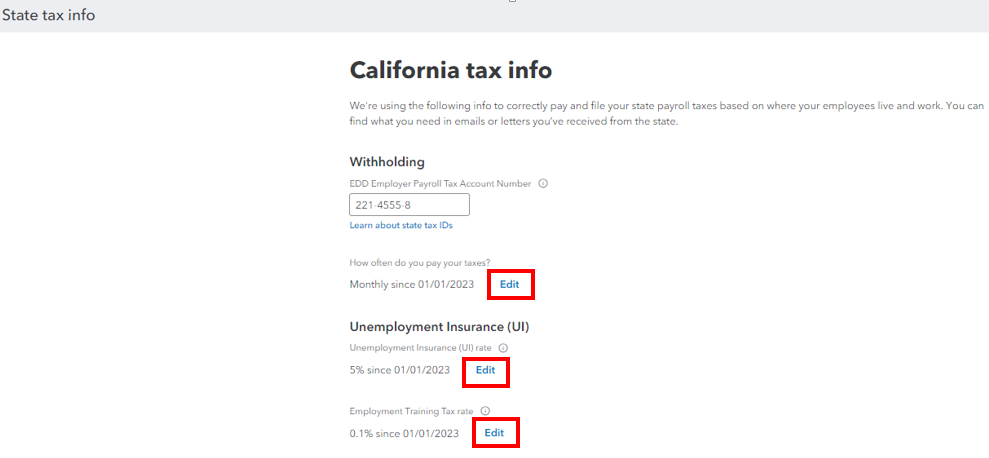

In QuickBooks Online (QBO) Payroll, It's possible to have employees work in more than one state for the same employer. It could be an employee who works in multiple states within the same pay period. Your employee may be subject to different state unemployment and local tax withholdings depending on which state(s) they work in and if they're a resident or non-resident of those states. We'll input the steps below to help you modify their current address:

We recommend checking this page for more information: Set up and manage work locations in QuickBooks Online Payroll.

Moreover, you can visit these handy articles to help you manage pay schedules, and prepare to wrap up this year's payroll in QBO:

@faithelectricaloffice, we'll be happy to have you here again in case you have any additional questions or tasks you'd like to perform inside QuickBooks. Keep safe.

I understand setting their work location, but they work at a different location every day.

I'll guide you on how we can set up and manage payroll for your employees who work at a different location every day, faith.

QuickBooks doesn't have a direct way of handling payroll for a roaming employee since having multiple state unemployment and local withholding on a single paycheck or tax filings may cause issues with state tax forms. For now, I suggest sending feedback about this. Here's how:

Moreover, I can share a workaround on how you can track and run payroll for these types of employees. Refer to the list below:

Please check out this link to help you create, manage, assign and update your pay period: Set up and manage payroll schedules.

Comment below if you have additional questions about managing your payroll set up, and I'll circle back to assist you. Take care!

I need help setting up city payroll tax withholding. My employees worked at different locations within a pay period but all in the same state. How can I set up the payroll item to be taxed by the city? And only the city that relates to that payroll item. Example - (payroll item) Regular - Smith and is only subject to City of Cinti tax, no other payroll item is in the City of Cinti (like salary). I am using QB Enhanced payroll desktop

Thank you for joining this thread, @Maximum Homecare.

Currently, our payroll products don't support roaming employees. Since you're using QuickBooks Desktop, you can use location tracking to track your employees in 2 locations and file the taxes manually as a workaround.

First, we need to set up your preferences to track payroll expenses by class. Here's how:

9. Select OK.

Next, we can add a class to your paychecks or employee profile.

When you generate and process payroll, you must access your employees' paycheck information. If you choose to assign one class per earnings item in preferences, you should then allocate a class to each earning item.

If you choose to assign one class to an Entire paycheck:

Afterward, you can manually file their taxes. You can check this article for more details: Pay and file payroll taxes and forms manually in QuickBooks Desktop Payroll.

Additionally, you can check this article to help you create, manage, assign, and update your pay period: Set up and manage payroll schedules.

Keep in touch if you have other questions besides your taxes. I'll be around to assist further. Stay safe!

This does not fix the issue. I cannot set a work location for an individual when they work multiple job sites in a day. We have project Superintendents, these guys visit 1-5 jobs per day, some are within city boundaries and others are not. I cannot tax their wages for work performed outside of the city limit.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here