Of course, I can assist you with that, jane1170. Properly managing these taxes within QuickBooks Online ensures compliance with legal requirements, helping you avoid penalties and fines.

To start, we can review your state tax settings within QuickBooks Online to ensure everything is set up correctly. This includes verifying your SUI and SDI rates. Here’s a step-by-step guide to check these settings:

- Log in to your QuickBooks account.

- Go to the Gear icon settings, and select Payroll settings.

- Click the Edit icon of the appropriate state.

- Enter the correct rates and other necessary information.

- Hit Save, then Done.

Please note that the zero amount can also be attributed to the employee having already reached the SUI wage base limit. I recommend reading this article to learn more: Understand payroll tax wage bases and limits.

Furthermore, state income tax calculation varies by state. It may sometimes show as zero if your employee’s gross wage is too low or if they claimed exempt status. To understand the minimum thresholds for state withholding, check out your state withholding agency website.

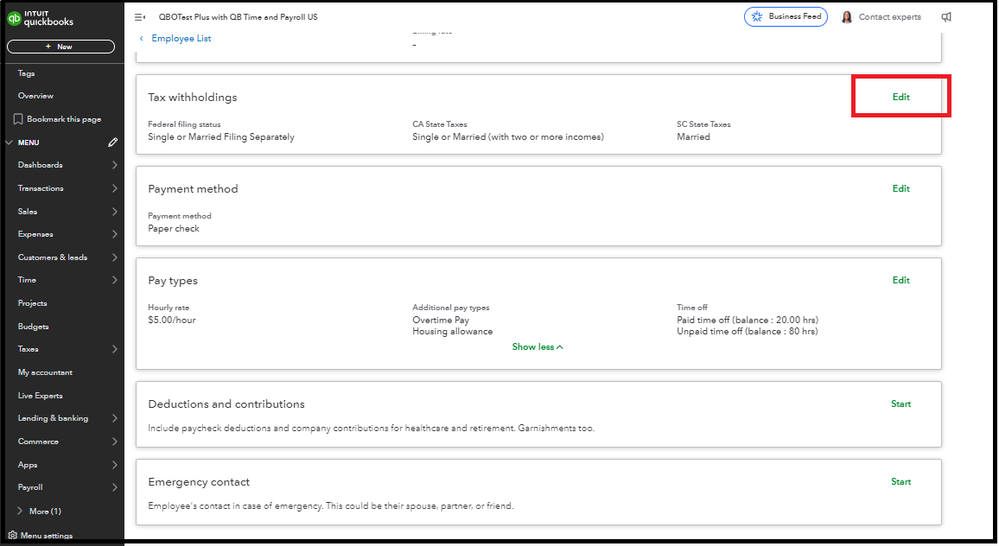

To verify your employee's filing and exempt status in QBO, follow these steps:

- Go to Payroll, then Employees.

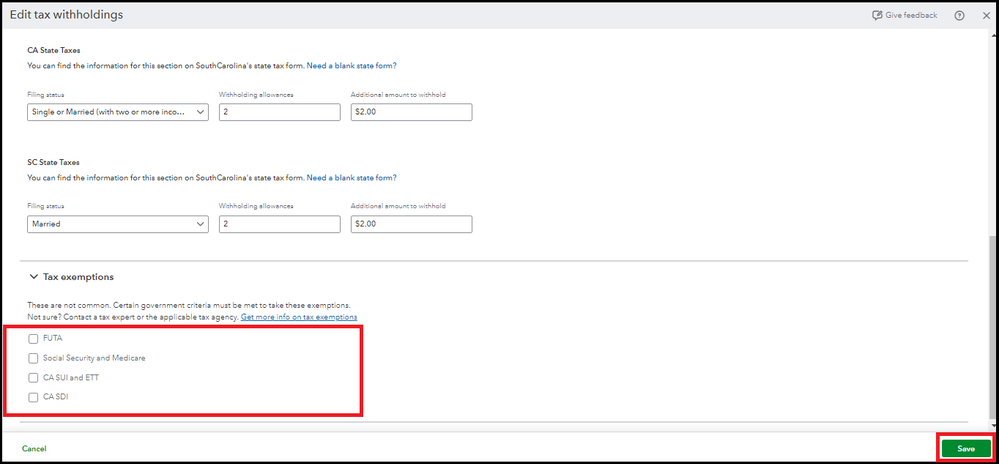

- Select the employee, then head to the Tax withholdings section

- Under State withholding, fill out the necessary details.

- Make sure to uncheck the boxes in the Tax exemptions section.

- When finished, select Save.

Additionally, you can check this article on how features move to QuickBooks Online. It provides a valuable understanding of how various functionalities transition and how you can effectively manage this migration for a smoother experience.

Moreover, you may refer to this article to view the steps to several payroll reports. It outlines the payroll reports you can generate to gain valuable insights into your business operations and employee data.

If there's anything else you want to know or need further clarification about state payroll taxes in QuickBooks Online. I'm here to help and provide you with the information you need in the comments below.