Hi @nduke ,I understand this process has been challenging for you. Rest assured, we're here to help resolve any issues and ensure your payroll taxes are handled efficiently.

Keeping your payroll taxes accurate is crucial to avoid compliance issues, and staying updated with platform and regulation changes is beneficial.

You can follow these steps to Address Issues:

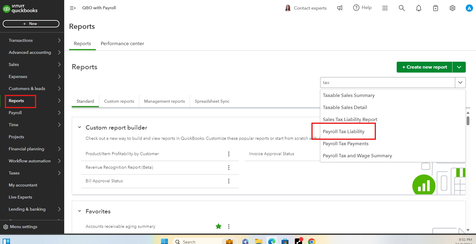

- Run reports use Payroll Tax Liability Report to cross-verify data and understand discrepancies.

- Navigate to the payment tax history to check if the payment was made on the specific date indicated when exporting the data and use the This Year option to search for any overdue unpaid taxes.

See the screenshot below on how to locate the tax liability report:

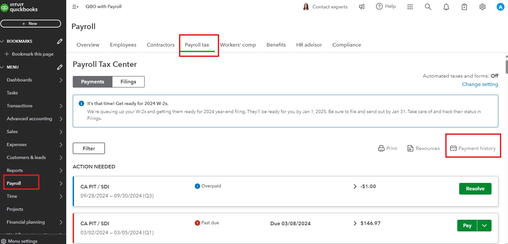

Here's how to locate the Payment history:

- Go to Payroll.

- Select Payroll tax.

- Click on Payment History on the right side.

- Use the This Year to filter to check for any overdue unpaid tax.

If issues persist after your checks, contact QuickBooks Online payroll support for a detailed review.

I've included some articles to assist you with accessing and managing your tax payments.

If you have any further questions or need more help, feel free to reach out. We're here to ensure you manage your payroll taxes efficiently in QuickBooks Online. Have a great day.