Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

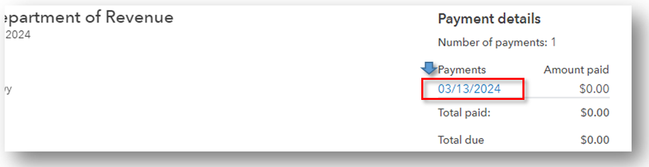

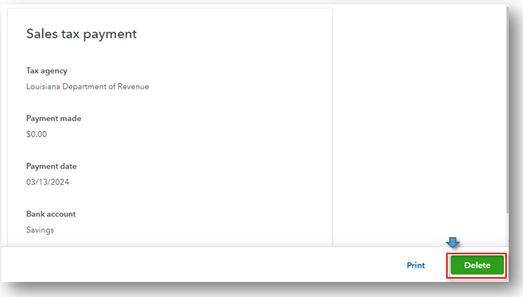

I have entered the credit memos applied to our monthly sales tax, and it results in an amount owing of zero. There seems to be no way to record a payment of zero, and the screen continues to tell me my payment is overdue. How do I either record a zero payment or at least get QB to recognize nothing is due.

Hi, @dLearned.

I'm here to help with the issue of the sales tax showing overdue despite applying the credit memo to your monthly sales tax payment and recording the payment.

Normally, you can record a zero sales tax payment in QuickBooks Online (QBO) after credit memos are applied. Upon checking here on my end, our Product Engineers are working on a fix for Sales Tax Returns showing as overdue despite recording the payment. I recommend contacting our Support Team to add you to the list of affected users and be notified promptly once it's resolved. Here's how:

1. In your QuickBooks Online (QBO) account, go to Help (?).

2. Select either of these tabs:

3. Choose how you want to reach us (phone or chat).

After this, we have a workaround you can perform to resolve this issue. Here are the steps:

Here's an article on how QBO automatically calculates sales taxes for your products or services to use as a reference in the future: Learn how QuickBooks Online calculates sales tax.

You're always welcome in the Community if you have more questions about recording zero sales tax payments in QBO. We're committed to offering ongoing support. Take care.

Thanks for your reply, but you are missing my point. Previously, I was able to record a zero payment, NOW I cannot record it at all.

When I try to, the date field will not populate (no calendar, won't take entries).

To be honest, if there is nothing owing, I should not have to enter a payment at all (it should have a y/n for filing only). But since I can't enter it at all, it still shows as overdue. That is different from what you mention.

Thanks for the clarification, @dLearned.

I recognize that you were able to record zero tax payments before and are now having issues doing so, specifically with the date field not populating. Let me make it up to you.

First, I suggest accessing your QuickBooks Online (QBO) through your browser's incognito mode and recording the zero sales tax payment from there to isolate what's causing the problem. This is because although QBO uses browser cache and cookies to improve the user experience, these stored data can become outdated and cause unexpected behaviors within the software. In your case, these stored data could be interfering with recording the zero sales tax payment. Here's how:

If this works, proceed to clear your browser's cache. This process will remove and fix specific issues and help the program run optimally. Additionally, you can use other devices and supported browsers to ensure everything works as expected.

However, if this doesn't work, it could be that the problem is stemming from the account itself. I'd recommend contacting our Support Team to assist you with this. Rest assured that they have the necessary tools to identify the cause of this problem and be informed of the next steps.

Additionally, should you need to edit sales tax rates in the future, you can refer to this article as a guide: Edit sales tax rate in QuickBooks Online.

Keep us posted if there are details you'd like to add further about the issue of recording zero sales tax payments. We'll do our best to assist.

Juts found this question via googling and having the same experience, I swapped to "desktop view" and it finally worked for me.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here