Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I experienced incorrect tax calculated for an invoice with the following items

1. Taxable item $123

2. Nontaxable item $14.00

3. Discount item pre-tax $6.00

Tax is 7.75%

QB Tax calculated $9.11 but it should be $123-$6*7.75% = $9.07

QB calculates taxes correctly for all other situations except when a nontaxable item and a discount line item is in the same invoice. anyone know why? Is this a bug or setting?

Solved! Go to Solution.

Though this is confusing, there is no bug. QuickBooks is working correctly, as designed, and the Intuit agents should know this.

QuickBooks Desktop invoice tables (and other sales forms) support very complicated calculations, way more so than your example, pretty much get it right every time, and have for 20+ years. For example, they support nested subtotals (subtotals on collections of other subtotals), multiple flat and percentage rows both for discount and other types of items, and so on.

Discount Rules:

- A discount using a percentage - where the amount automatically calculates - is applied to the amount on which the percentage is calculated, which is the amount of the first non-discount line item above the discount. If that amount is a subtotal, then the discount is pro-rated and applied to each of the amounts within the subtotal.

- A discount with a flat amount - where it is not calculated on any specific amount and since it is not calculated on any specific amount - is applied to every amount above it in a pro-rated fashion, except for other discount amounts and subtotals.

- Discounts that are taxable, meaning they reduce the taxable amount, can be applied to both taxable and non taxable items. They only impact the taxable sales amount - and so the tax - to the extent they are applied to taxable items. This way you can use one discount item for both taxable and non taxable items.

So, this is what is happening in your case:

Your flat $6 discount is pro-rated between the $123 line and the $14 line.

The pro-rating math in your case works like:

$-6 * 123/(123+14) = -5.39 and

$-6 * 14/(123+14) = -0.61

Since the $123 amount is taxable, your taxable sales amount is $123 - 5.39 = $117.61.

And, your tax is then $117.61 * 7.75% = $9.11

What to do:

If you want the entire $6 discount to be applied to the $123 line item, place the discount directly after that item, and before the $14 item/amount. Then the discount will be applied only to the first amount, your taxable sales will be $117 and your tax will be $9.07:

Taxable $123

Taxable Discount $6

Non Taxable $14

Tax $9.07

OR, use a percentage discount directly below the taxable amount, and then the discount can be listed last:

Non Taxable $14

Taxable $123

Taxable Discount @ 4.88% -> $6

Tax $9.07

OR, setup an Other Charge item for this type of discount and make it taxable, and enter a negative amount. Since only discount type items are "applied" as described above, when using an other charge item as a discount, you can enter the three items in your example in any order. (Note, however, this has implications if you are on a cash basis, because the other charge item will be treated as a return, creating a cash event within the sale, which will impact your cash basis P&L.)

Good day, @TheArk.

Thanks for sharing your concern in the QuickBooks Community.

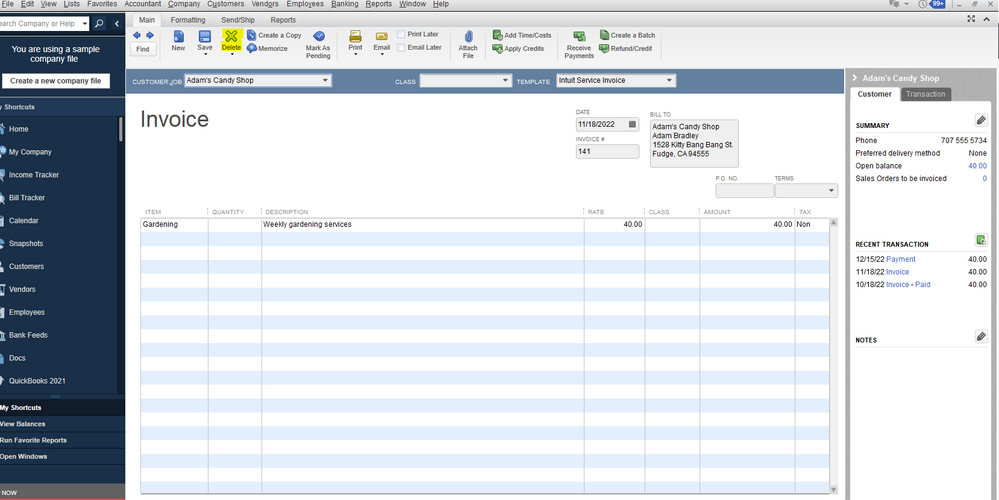

I've replicated the steps you've made and got the correct calculation. You can check out the screenshot below as your reference:

There might be a minor data issue in your company that's causing this behavior. Let me help you clear this out by running these simple troubleshooting steps:

First, update QuickBooks Desktop to its latest release. This can refresh your company data and fix some minor errors in the system. Here's how:

If you're still getting the same result, run the verify and rebuild data tools. Verify Data self-identifies the most commonly known data issues within a company file while Rebuild Data self-resolves most data integrity issues that were verified.

Creating an invoice is part of your usual A/R workflow in QuickBooks Desktop. To know more about the different ways on how to track customer transactions, see the list of our Accounts Receivable workflows.

Let me know how else I can help you with QuickBooks by adding a comment below. I'm more than happy to lend a helping hand. Keep safe!

You need to add another nontaxable line item to match my use case. Mine is a shipping line item with Non Tax. See attached. I also tried a rebuild data and got same results so could it be a bug?

I appreciate you for following my peer's recommendation and for sharing visual reference, @TheArk.

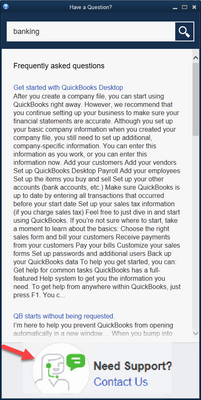

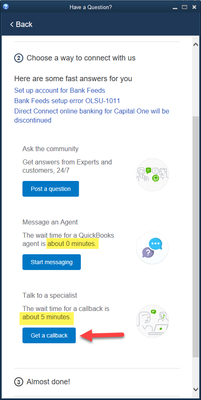

I'll make sure this will get fixed in no time. Since the system is calculating incorrectly after performing the troubleshooting steps, I recommend contacting our Technical Support team. They have advanced tools to pull up your account to resolve it from there. They can also verify your information in a private space.

Let me show you how:

These articles are a good reference when you want to update sales tax codes and add tax agencies:

Let me know how it goes or if you ran into a different QuickBooks concerns by leaving a reply below. I want to make sure your taxes are calculated correctly. Have a nice day!

Do you get the same results when you combine a taxable item, nontaxable item and discount item on the same invoice?

Let me provide you some information about the taxable and non-taxable items and guide you on how to do it, TheArk.

You can definitely combine the items on one invoice provided you have correctly defined them on each line item whether it's taxable or non-taxable. If you're asking if the calculation will still be correct if you combine the items, yes, it will still be correct. I've attached a screenshot so you'll be guided visually:

To keep an accurate record of these taxes, please read this article for more information: Set Up Sales Tax in QuickBooks Desktop. In addition, you can run sales tax reports in QuickBooks Desktop and customize them to get the information you want. Go through this article for the steps: Customize Reports in QuickBooks Desktop.

Let me know if you have any concerns about recording items on the invoice. I'll always be right here to help.

Yes so when you did that, did you see that tax is calculated incorrectly like I saw from my original post?

Went on private chat and the agent pretty much tries to give same resolution as you all instead of verifying my issue. After telling the agent to try it on his QB, he saw same incorrect tax results and verified there's a bug. My advice is to not waste time, please verify the issue first before giving generic resolutions. I chose to post my issues in the community to help others who might experience the same bug and need quick resolution. Going on private chat takes a while.

Let's find out why your sales tax is calculating incorrectly and guide you on how to fix this, TheArk.

You'll want to make sure that you've entered the correct rate and reviewed the tax set up so it will surely give you the correct calculation. If it is still giving an incorrect one, you can update QuickBooks Desktop to the latest release. To do this, follow the steps below:

Once done, you can delete and recreate the invoice to double-check if the same thing happens. To delete the invoice, follow the steps below:

Then, recreate the invoice. Apart from this, after you have gone through the setup, review your sales tax payable to make sure everything is accurate. Check out this reference: Review Sales Tax Reports.

Reach out to us if you have questions about sales tax. Remember, we're here to help you anytime.

Though this is confusing, there is no bug. QuickBooks is working correctly, as designed, and the Intuit agents should know this.

QuickBooks Desktop invoice tables (and other sales forms) support very complicated calculations, way more so than your example, pretty much get it right every time, and have for 20+ years. For example, they support nested subtotals (subtotals on collections of other subtotals), multiple flat and percentage rows both for discount and other types of items, and so on.

Discount Rules:

- A discount using a percentage - where the amount automatically calculates - is applied to the amount on which the percentage is calculated, which is the amount of the first non-discount line item above the discount. If that amount is a subtotal, then the discount is pro-rated and applied to each of the amounts within the subtotal.

- A discount with a flat amount - where it is not calculated on any specific amount and since it is not calculated on any specific amount - is applied to every amount above it in a pro-rated fashion, except for other discount amounts and subtotals.

- Discounts that are taxable, meaning they reduce the taxable amount, can be applied to both taxable and non taxable items. They only impact the taxable sales amount - and so the tax - to the extent they are applied to taxable items. This way you can use one discount item for both taxable and non taxable items.

So, this is what is happening in your case:

Your flat $6 discount is pro-rated between the $123 line and the $14 line.

The pro-rating math in your case works like:

$-6 * 123/(123+14) = -5.39 and

$-6 * 14/(123+14) = -0.61

Since the $123 amount is taxable, your taxable sales amount is $123 - 5.39 = $117.61.

And, your tax is then $117.61 * 7.75% = $9.11

What to do:

If you want the entire $6 discount to be applied to the $123 line item, place the discount directly after that item, and before the $14 item/amount. Then the discount will be applied only to the first amount, your taxable sales will be $117 and your tax will be $9.07:

Taxable $123

Taxable Discount $6

Non Taxable $14

Tax $9.07

OR, use a percentage discount directly below the taxable amount, and then the discount can be listed last:

Non Taxable $14

Taxable $123

Taxable Discount @ 4.88% -> $6

Tax $9.07

OR, setup an Other Charge item for this type of discount and make it taxable, and enter a negative amount. Since only discount type items are "applied" as described above, when using an other charge item as a discount, you can enter the three items in your example in any order. (Note, however, this has implications if you are on a cash basis, because the other charge item will be treated as a return, creating a cash event within the sale, which will impact your cash basis P&L.)

There is no data issue.

There is no calculation issue.

There is no bug.

Nothing will be fixed by engineering.

QuickBooks is working properly, as it always has for the last 25+ years.

@BigRedConsulting is the man! This clearly explains and resolved my problem and only two 2 minutes to read vs. hours with QB agents and only solution is to repair and rebuild. What's interesting is one agent even provided me a case number on the sales tax bug that was currently being fixed.

Thanks for the compliment.

I sure hope they don't "fix" anything, because that could seriously break QuickBooks.

Thanks for the explanation. I was having the same issue and the answer given was explanatory enough for me to fix the way I enter taxable items, then the discount and finally no taxable items.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here