Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI noticed that QBO is not calculating sales tax for items correctly.

Items are all set up as non-taxable. This is because I only collect sales tax in certain states. So, at the invoice level I mark items as taxable that I need to. Always worked fine in the past up until Q1 of 2025.

On invoices where I collect sales tax, I mark the line item as taxable. For some items, it includes it on the calculation. For other items it does not. There is no difference in the setup for each of these items.

I would expect that when I check "Taxable" on the invoice that the item would be taxed, whether it's an item, discount, etc. But it's not.

This was working fine. I only found it now because I was reporting my quarterly sales tax and noticed that it was all wrong.

As you can see by the attached documents, the items are marked as taxable, the taxable subtotal is correct, but it's only calculating tax for the one item (MAILTOOLP). It is NOT calculating tax for the SPLTOOLSUITE item or the discount (HA).

Fix your program or let me know what I'm doing wrong. As I said, this wasn't a problem in the previous quarters, only the first quarter of 2025 and the problem still exists today

This could get people in trouble with state sales tax agencies. Thank you.

For informational purposes, this was set up for taxing Arcadia, WI [removed].

There are several factors contributing to why your sales tax isn't calculating correctly on your invoices, @bvstone.

First, let me share how QuickBooks Online determines the total tax rate for each sale. Here are the factors:

The tax status of your customer or the state where you sell and ship the product or perform the services may be the reason why the sales tax is not being calculated on the invoice. Check out this article to determine: Understand and set up sales tax-exemptions in QuickBooks Online.

If it is verified that the customer and items are not set as tax-exempt, I suggest getting in touch with our Live Support Team. They can securely investigate and resolve the issue with your sales tax calculations on the invoice.

Here's how:

Additionally, you can check out this article for future reference: File your sales tax return and record sales tax payments in QuickBooks Online.

Feel free to post if you need more help managing sales taxes in QuickBooks.

Did you even read the question before answering, or look at the screenshots? It seems clear that none of your possible excuses apply.

Obviously not. In my searching I've seen the exact same answer copy and pasted.

That's AI for you... such a wonder.... not.

Why is it so hard for QB to just recreate the issue and fix it? Instead I have to spend hours on the phone with support and get no where.

So I did Intuit's job and dug deep into the item differences.

The item that WAS being taxed correctly was marked "I purchase this item from a vendor". The others were not marked that way.

I removed that checkmark from the item that was properly being taxed and now nothing is getting sales tax on it.

That makes ZERO sense. I'm not even sure where that setting came from, but it would be nice to get a list of items with that marked. I supposed I'll need to do that myself as well.

Another update.

I changed an item from "non-inventory item" to "service" and it's now taxed properly.

Something changed in Q1... that doesn't seem correct at all. These are software license keys I'm selling. Not a service, not a tangible item, not inventoried. So now I need to go and change all my items. Aye Caramba.

I take that back. I changed the item back to non-inventory item and it still is charging tax correctly.

So, it was non-inventory. Sales tax not being charged.

Changed it to service. Sales tax being charged.

Changed it back to non-inventory. Sales tax still being charge.

This makes NO sense whatsoever, Intuit.

So I dug into the JSON data for the items to compare items. For the item I was playing with somehow QBO decided to change it to taxable (I did NOT change this setting, it was always non taxable).

Once I removed that, it no longer was taxed as a line item even if i had marked it on the invoice as taxable.

Intuit/QBO... your logic is flawed for sales tax. You need to fix it.

When you are creating an invoice if the Invoice line item is marked as taxable, no matter when the item taxable setting is, you SHOULD be calculating taxes for it. Just like it worked for years up until Q1 of 2025.

The funny part is, the "Taxable Subtotal" IS correct... but whoever wrote the code (and recently updated it) to calculate the actual sales tax must have missed a meeting or something.

Well, I just spent 40 minutes with support showing them how to recreate the issue. They said yes, it's a bug and that there is an "active investigation" out there on it. Well, after a bunch of messing around and trying to quick fix the issue.

But, it took 30 minutes to get to that point. They had me make sure the customer wasn't marked as tax exempt (they weren't). They had me change the item itself to taxable. I humored them and showed that yes, that will make it work. But, it took a lot of explaining to them to understand that companies in the US don't charge the same sales tax to every customer, only those states we have nexus in. So, changing all my items to taxable is NOT a solution.

He then wanted me to set up a custom tax rate in the invoice and I finally said "no... this is not a solution. It is a bug and needs to be fixed... either that or you need to make users of QBO aware that since Jan 2025 you now need to mark items as taxable at the item level, AND mark it as taxable on the invoice for it to work, which never was the case before."

I even offered to log on for free. I bet I could find the code in 30 minutes... an AND instead of an OR most likely... logic errors. Coders these days.. lol

So frustrating. and it probably messed up the sales tax for a lot of QBO users and they won't know it until they do their quarterly sales tax reports/payments and find out they didn't collect enough sales tax from customers, but still have to pay the right amount into each state.

I got a message about the issue saying:

"We appreciate your patience while we looked into your issue. After investigating the issue, we found that we did not receive enough information to complete an in-depth investigation to your concern.

If you have any more information about your case (screen shots, video, etc) , contact us with case number 15135668091 for further review."

How incompetent is the IT team for QBO? I literally worked with a support member for almost an hour showing him the issue! He recreated it himself. He admitted it was a bug.

How could you need any more information?

Just ignore your customers. That's the best way to do things.

RE: How incompetent is the IT team for QBO?

You've used QBO, right? Which should be all you need to answer that question.

I pulled my tax report for the month of May and the numbers were way low. QBO did an update( not sure when) and changed all taxes for invoices to automatic tax calculations. I have been manually changing the tax to the % I needed. None of the manually tax changes invoices showed on the sales tax report. Does anyone else have this issue?

We haven't received any other reports about this issue, @Bosco115.

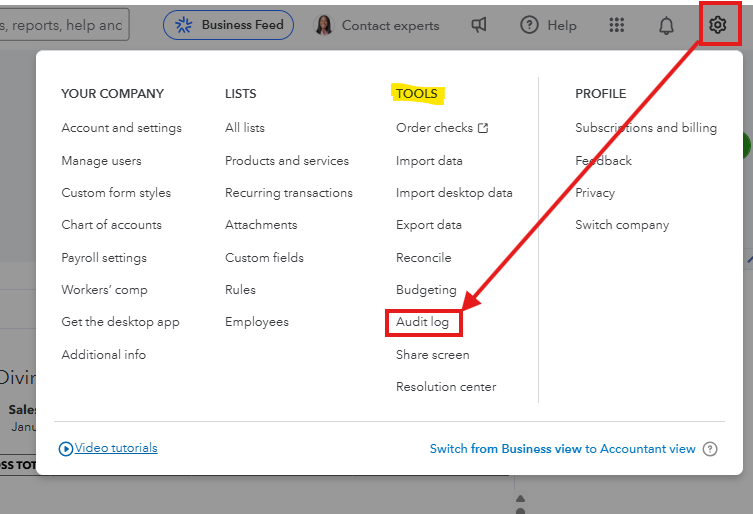

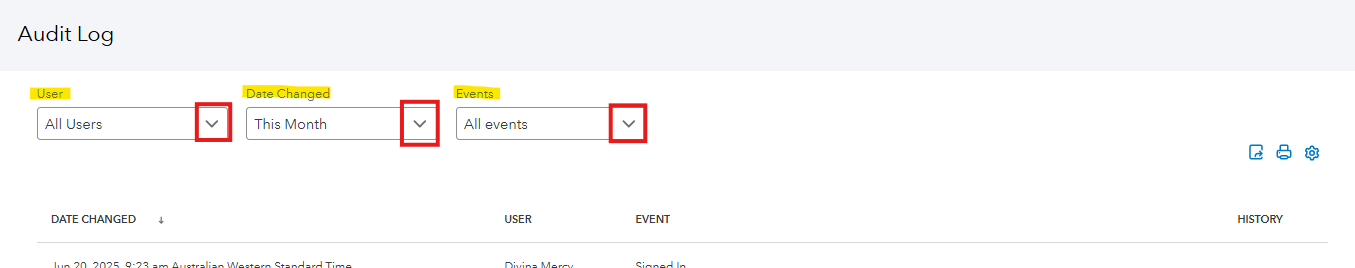

To see if any changes were made to the taxes on your invoices, let’s use the Audit Log.

Here’s how you can do that:

For more information on the changes made automatically by QuickBooks Online, you can check this resource: Use the audit log in QuickBooks Online. Proceed to Learn about users created by QuickBooks section.

Regarding the sales tax report not showing the tax on invoices you've manually changed, ensure all your filters are set correctly.

If everything looks good but the issue continues, clear your browser's cache and Intuit-specific cookies. Corrupted data can cause this issue. You might also want to use a different supported browser.

If you're looking to improve your invoice payment process, check out this guide: Record Invoice Payments for actionable tips and best practices.

Please let me know if you need any further assistance.

We have the same problem, but better yet, items setup identically are pulling tax rates from DIFFERENT counties on the same invoice!

Both items are service items setup with all the same parameters. Nothing different other than the part number. Yet, one gets tax from the county in which we are located and the other gets tax from the customer's county! Ohio is a destination-based tax state for services! Customers call and we look like idiots for trying to explain the problem. Also, people are not too fond of being charged the wrong amounts. It's flat out embarrassing.

Intuit and QBO are a joke. Support is non-existent and the software does weird crap on its own without explanation or logic. We are actively searching for a replacement, but the pain of switching might be the only thing keeping us using this steaming pile of crap.

This is not the impression we wish to leave you with, @jtmillican.

I wanted to clarify if you have you tried contacting our support team to get this issue escalated? If not, I recommend reaching out. This way, one of our agents can start a new investigation to have it further reviewed by our engineers. You can use the steps I'm including below to connect with our team directly:

Please don't hesitate to let me know if there is anything else I can assist you with. I'm always happy to help. Take care!

Tori-

Thanks, but when I do as you suggest I have no option to "Contact Us". Intuit does everything in its power to keep us users (who pay monthly without fail) from contacting PEOPLE. I don't give a rat's backside about AI. I want a PERSON.

I've tried for four days this week to call someone. Can't find a number. I've tried for three days to figure out how to successfully log onto this community forum thing and finally figured it out. My accountant who is a "QBO Expert" blah blah blah can't get an answer.

This flaw is so ridiculous and unacceptable that after I get done swearing at the wall of my office, I laugh my backside off. It's a darn joke. It's a FUNDAMENTAL function of an ACCOUNTING app. IT DOES IT WRONG. The alarm bells and claxons should be ringing all over Intuit that they might have some serious tax liability issues that THEY created on their hands! Wait till the state comes after me for sales tax issues. I'll sue Intuit for the fines, fees, and penalties, and my attorney fees.

IT'S A MAJOR PROBLEM WITH A FUNDAMENTAL FUNCTION. FIX IT!

This is squarely aimed at your dev, app, and QA people, not you. Pass it on.

Jim

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here