Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I have a discrepancy in reports. If I choose the "view return" button on the new sales tax section where it shows your sales tax due I get a different gross sales figure than if I go to reports and print a sales tax liability report for the same period.

I'm here to help check the discrepancy of your sales tax due, @ALM555.

I can think of one reason that causes the off amount when opening the Sales Tax Liability report and when clicking the View Return button. It's the report's accounting method. You can switch the report from cash to accrual basis and vice versa to get the exact result.

Here's how:

Once done, compare the figures to the Sales Tax section.

For additional reference about running and customizing reports in QBO, feel free to open this link: Run reports in QuickBooks Online.

You can as well read these articles as your guide while managing sales taxes in QBO:

Please post again on the Community page if you have additional concerns. I'm here to keep helping. Take care!

I already checked that. When I run the report out of the reports section there is only about a $200 difference in cash vs. accrual gross sales. When I view the tax liability report in the new auto view tab there is a HUGE difference in the gross sales report on there vs the report in run in the report section.

Hi there, ALM555.

I'm here to provide additional steps on how we can fix the sales tax discrepancy.

If not the reporting period or accounting method, another possible reason is due to a browser error. Let's pull the Sales Tax Liability report and view the data through the Taxes using an incognito window. From there, compare the two and check if everything looks good.

These are the incognito keyboard shortcuts:

Also, let's clear the cache since it causes errors in QuickBooks Online. You'll want to make sure that your browser is updated or use a different one.

If it gives you the same result, please reach out to our Customer Support so they can conduct an investigation on this matter.

Here are some of the articles you'll want to check:

Post again here if you have more questions. I'm looking forward to assisting you again.

Sorry to see you are dragging yet another user through the "how you fix your own report" steps, when in fact the report is flawed - see my complaint last April.

The sales tax liability report does not pull information from any invoices/receipts that do not contain at least one taxable line item.. one of my clients has a sales and service business. Service is not taxable and any sales receipts entered where only service is provided (non-taxable) are 'ignored' by the Sales Tax Liability Report.

Please fix the report, properly, on the back end.

Thanks

Plum

the report isn't right.

Do you have sales receipts that sometimes don't have any taxable line items? or do you have sales to any tax exempt customers? both of these will throw off the STLR.

Thanks for getting back to us, PlumBookkeeperCO.

As of now, we have an ongoing investigation (INV-52368) about having an issue in the Sales Tax Liability report. We recommend contacting our QuickBooks Support Team so you'll be added as one of the affected users.

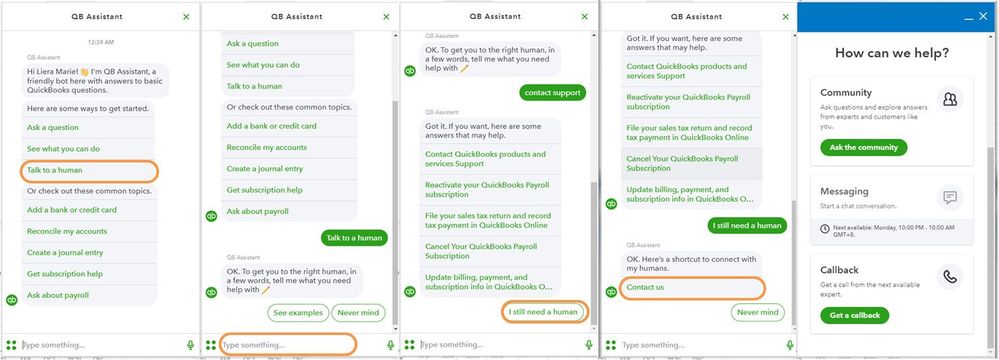

Here's how:

For the old Help menu interface:

For the new Help menu:

After that, you'll receive an email update once the issue is already resolved.

You can also check out this article to learn how to handle sales tax payments in QuickBooks Online: Manage Sales Tax Payments.

Additionally, I've added an article that'll help learn more about sales tax: FAQs about Sales Tax.

We appreciate your patience in this matter. Rest assured our engineers are currently working on an immediate fix.

Thanks for the quick reply. I'll follow those steps and once again, add myself to an "ongoing" case.

Forgive my sarcasm however - it's pretty clear that nothing much (and I'm being generous) is being done to fix what should be a staple report, reliable, accurate and with only a few columns.

I will also continue to be a pain your butt until it gets fixed as there seems to be little recognition around the 'halls' of Intuit that people are erroneously filing their sales tax based on your report.

Received an email stating this complaint is now closed as engineers were unable to replicate the issue.

SO... what now? too many people are seeing the problem as described.

Plum

Here's a thread from February this year you replied to with a ticket number. As you can see, I responded afterwards letting you know that ticket had been "closed" without an issue found and yet, CLEARLY there's still an issue.

So, please no "we're working on this" and "can see your concern" or "the engineers are working urgently" because obviously none of those statements about the STLR report issue are true.

I've developed a set of steps that I perform (at no charge to my clients, so it's costing ME money) that work around the bugs in the STLR. Meantime I can do nothing to help a brand new client who wishes to get a single bill for bookkeeping from me that includes their QBO plus subscription and I get the same platitudes of "not the experience we want you to have..." "rest assured we're working urgently to fix it". Please... can we get some actual engineers to work on some actual problems and get actual resolutions?

I'm at a point where it's much less effort to go research an alternative to QB and then convert all my clients to that solution than spend any more hours chasing down "known issues" that QB clearly doesn't plan on working on any time soon.

This is also happening to me. I went online to chat and did a screen-share. They failed to recognize the issue, insisting that the Liability report is correct. I showed the representative that it isn't correct, because my total sales were not being reported on my sales tax liability report.

She just couldn't recognize the issue, continuing to insist I just needed to run reports over and over again.

I went incognito and ran it as cash basis. It is underreporting by $32,000.

I found this issue and showed it to the rep through the screen share. She told me that this issue has been resolved. (Clearly not, since I'm having the EXACT same issue.)

I will now have to also get creative with my sales tax report to the state. I spent an hour begging this representative to take me seriously, and it feels like I was arguing with a brick wall.

Quickbooks, fix this problem!

What is your work around for this issue, if I may ask? Thank you for your time.

Run a "Sales by Product/Service Summary" report for the month needed.

This should give you, your total gross sales for the month.

Run a "Sales Tax Liability Report" for the month needed.

This should show you your taxable sales and sales tax collected.

I am using my Total Gross Sales from the first report.

And then figuring my tax exempt sales, after deducting my taxable sales (from the STLR).

This is the only way I know to go about it since the STLR won't pull all the sales for the month.

Also, double check it against your P/L - Income accounts.

Do you have a different accounting software to recommend? I am sick and tired of having this issue, no help from QB and they refuse to even acknowledge the obvious issue. I will gladly give my money to another company to keep from this circus every quarter.

How is this investigation going. To this day it is still a problem. My company invoices 70% of sales without taxes and 30% with tax. The Gross sales ammount in the STLR is usually rally off. I am just hoping that the Taxable Sales Values are correct because thats what we use to file the taxes.

Joining the thread to assist you, @sigfriii. I wanted to make sure your concern about your report is addressed completely.

Our engineering team has already released the updates about the investigation concerning your Sales Tax Liability report. And it is said that that issue has been closed as resolved.

Since you still have the problem while using the said report, I'd highly suggest contacting our Customer Care Support. With the tools available for our team online, a specialist can pull up your account, securely, and perform the steps needed to fix your report.

To do so, you can connect with our specialist online using the steps outlined by my colleague, @CharleneMaeF, above. Here's a link you can use for the best way to contact them online: QuickBooks Online Support Hours to Back your Business.

I'm adding this reference for the articles you can use to get a better understanding while working with your sales with us: Use the Automated Sales Tax in QuickBooks Online.

If there's anything else that I can help you with besides working with your sales tax, please let me know using the Reply option below. I'll surely be around ready to lend a hand. Take care!

I run a sales summary report detail so I can see sales by service (non-taxable) and sales for products (taxable). I run a taxable sales detail report and look for sales where the tax was 0.00 (shows sales to exempt customers).

*Usually* the STLR taxable sales $ is correct, it's the gross sales and sales to exempt that are off... so by running these other reports I can subtract (or add as the case might be) to arrive at the actual gross sales $, sales $ to exempt and taxable... since most if not all taxing authorities use gross sales and non-taxable sales and exempt to arrive at the taxable amount.

It's particularly egregious in my opinion for a financial package like Quickbooks to have this so very wrong. For what it's worth, I've experience the refusal to accept the issue from reps on the phone in spite of many hours sharing screens etc.. it wasn't until I extracted all the data to Excel that I discovered what was missing (and why) - presented this to them and they still insist I'm the bonkers one.

Two years later I still have this issue that this user has. My Quickbooks is completely up to date. This happens to me on my quickbooks desktop which I use for one company and it happens to me on my quickbooks online that I use for another company. Not only is the total sales different on the sales tax liability report I pull from the reports section to the report I pull from the tax section but then I grab a P&L from the same time period and I get a THIRD number. I have been using quickbooks for over 20 years so NO Im not switching between accrual and cash NO my dates aren't different and no there are no hidden filters that might change the numbers. Exact same report giving totally different numbers.

This is a total disgrace. Both of my versions of quickbooks are 100% up to date.

Hi there, @MeanEmaJean.

Currently, we have an ongoing investigation (INV-74138) about sales tax due not matching with the tax liability report in QuickBooks Online (QBO). Rest assured that our engineers are working diligently to get it resolved.

I recommend contacting our Customer Care Support team so that they'll add you to the list of affected users. Then, you'll receive email updates of the investigation's status once it's been resolved. I've included the steps to contact support below.

After you speak with a QBO representative, you may ask him to transfer you to a QuickBooks Desktop (QBDT) support. This way, they can take a closer look at your issue and raise a ticket to the engineering team if needed.

I appreciate your patience as we work through this. If you have any other concerns, please don't hesitate to drop a comment below. Take care always, @MeanEmaJean.

Hey Plum, maybe relat

@PlumBookkeeperCO wrote:Thanks for the quick reply. I'll follow those steps and once again, add myself to an "ongoing" case.

Forgive my sarcasm however - it's pretty clear that nothing much (and I'm being generous) is being done to fix what should be a staple report, reliable, accurate and with only a few columns.

I will also continue to be a pain your butt until it gets fixed as there seems to be little recognition around the 'halls' of Intuit that people are erroneously filing their sales tax based on your report.

@PlumBookkeeperCO wrote:Thanks for the quick reply. I'll follow those steps and once again, add myself to an "ongoing" case.

Forgive my sarcasm however - it's pretty clear that nothing much (and I'm being generous) is being done to fix what should be a staple report, reliable, accurate and with only a few columns.

I will also continue to be a pain your butt until it gets fixed as there seems to be little recognition around the 'halls' of Intuit that people are erroneously filing their sales tax based on your report.

ed maybe not... When I pull my reports I notice one is showing the bill to and the other is showing the ship to address (of course in the report it only shows "name address" generically with no option to select Bill to or ship to address. Clearly resulting in two different totals for schedule a vs schedule b (California reporting)... Is this part of the same issue? We now have hundreds of thousands of dollars in back payments owed and penalties/interest due between 2019 and now thanks to this issue not being caught 😖 thanks in advance

-B

If you open an invoice double check the address reported because that will change each district you're reporting it for. That's where I found my issue this morning, after weeks of grueling over this (qb desktop user)... Looks like 2 different reports one pulls the bill to address the other pulls the shipped to address and many are in two different tax districts which has totally fkd me on the last 4 years of reporting. Good times (sarcasm)

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here