Limited time. 50% OFF QuickBooks for 3 months.

Buy now & saveAnnouncements

Work smarter and get more done with advanced tools that save you time. Discover QuickBooks Online Advanced.

Reply to message

Replying to:

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Reply to message

Hello there, annette23.

You've got it right. You'll need to make a new account to record a payback to a shareholder in QuickBooks Online. You can set up a liability account for this one. Let me show you how:

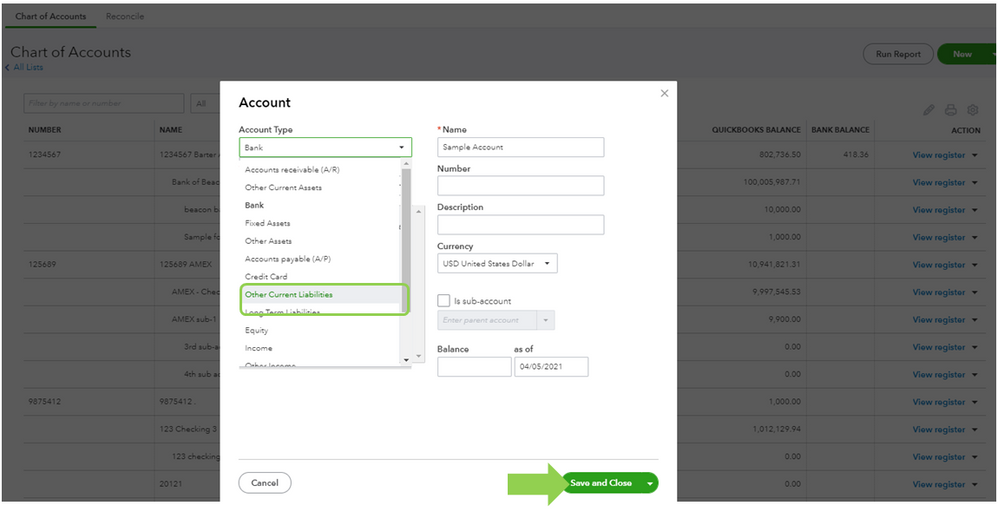

- Go to Accounting on the left panel.

- Within the Chart of Accounts tab, click New at the upper-right corner.

- In the Account dialog, select either Other Current Liabilities or Long Term Liabilities from the Account Type drop-down list, depending on the type of loan and its repayment time frame.

- In the Detail Type drop-down list, select either Other Current Liabilities or Long Term Liabilities.

- Enter a name for the account in the Name field.

- Once done, click Save and close.

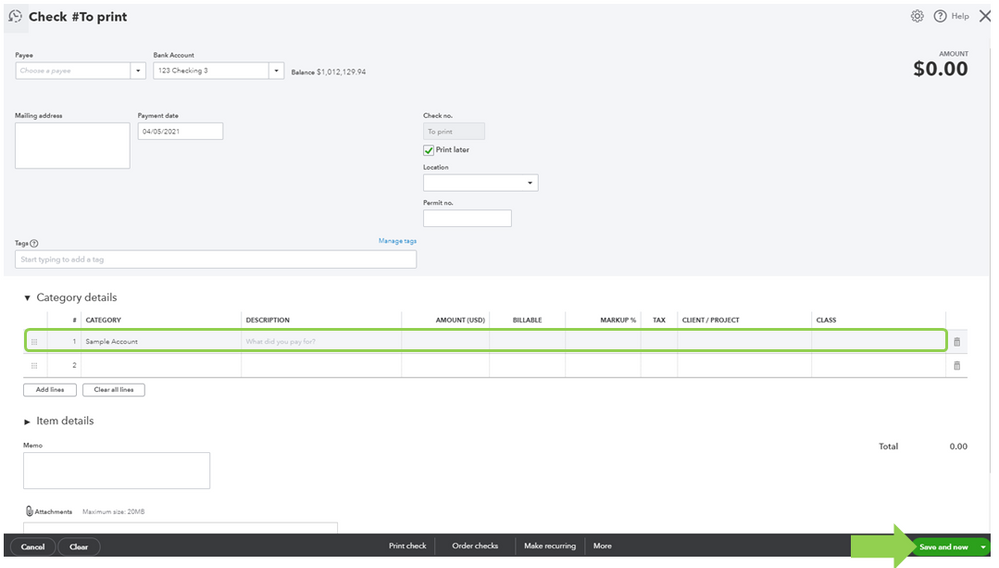

The next step is to create a journal entry for the loan. Make sure to enter the amount of the loan and add it to the appropriate expense accounts. Once done, record the loan payments using a check. Here's how:

- Go to the + New.

- Under Vendors, select Check.

- From the Account drop-down list, select the liability account you created for this loan.

- Enter the amount of the payment. Then, add all the necessary information.

- Then, hit Save and close.

For further guidance, I'd recommend reaching out to your accountant to make sure everything is properly set up. They'll ensure to use the correct account when recording a payback to a shareholder. This way, your data won't mess up.

Check this article for more details: Record a company loan from a company officer or owner.

Please let me know if you still need my help. I'd be glad to help you further. Stay safe and have a great day!