Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello Scott,

Thank you for dropping by here in the Community. I'm here to share information about the Maine CSSF rate in QuickBooks Desktop.

QuickBooks provides payroll updates to QuickBooks Desktop Payroll subscribers. These updates include current and accurate rates and calculations for supported state and federal tax tables, payroll tax forms, and e-file and pay options.

I recommend running the payroll update to ensure you have the latest release for the tax table. Here's how:

After performing the update, please review the rate to check if there are changes to the amount. If the problem persists, contact our Payroll Support Team for further assistance. Our Customer Support Team for Basic and Enhanced is available from 6 AM - 6 PM PT (Monday - Friday). For Assisted Payroll, any time, any day.

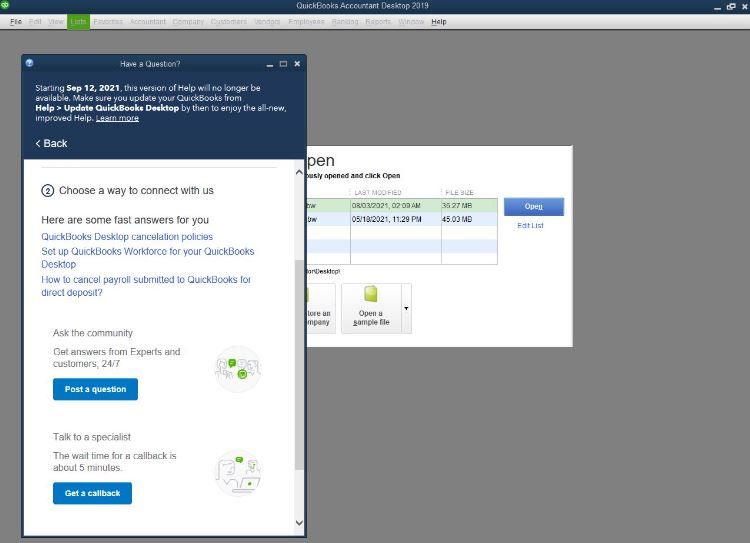

See the steps to get a hold of a specialist:

Also, if you have QuickBooks Payroll and received a tax notice of discrepancy, it is crucial to take care of it promptly to avoid additional tax penalties, interest, or notices. I've included a link you can visit to learn what to do if you receive an IRS or state tax notice of discrepancy: Send in your payroll tax notice.

Drop me a comment below if you have any other questions about payroll tax or updating tax rates. We'll be happy to help you some more.