Limited time. 50% OFF QuickBooks for 3 months.

Buy now & saveAnnouncements

Get unlimited expert tax help and powerful accounting in one place. Check out QuickBooks Online + Live Expert Tax.

- US QuickBooks Community

- :

- QuickBooks Q & A

- :

- Other questions

- :

- Re: Construction company vendor refund

- :

- Reply to message

Reply to message

Replying to:

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Reply to message

Thanks for getting back to us, @LeahC.

I appreciate you trying the solution provided by my colleague. Allow me to join the conversation and add steps for recording the transaction.

If the vendor’s profile shows a negative balance, create a bank deposit and link the credit to offset the amount. Here’s how:

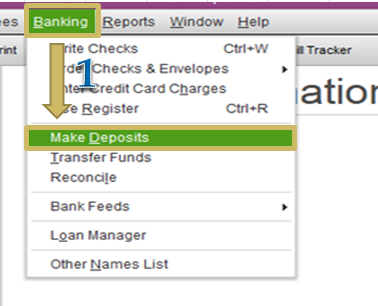

- Go to Banking menu at the top and select Make Deposits.

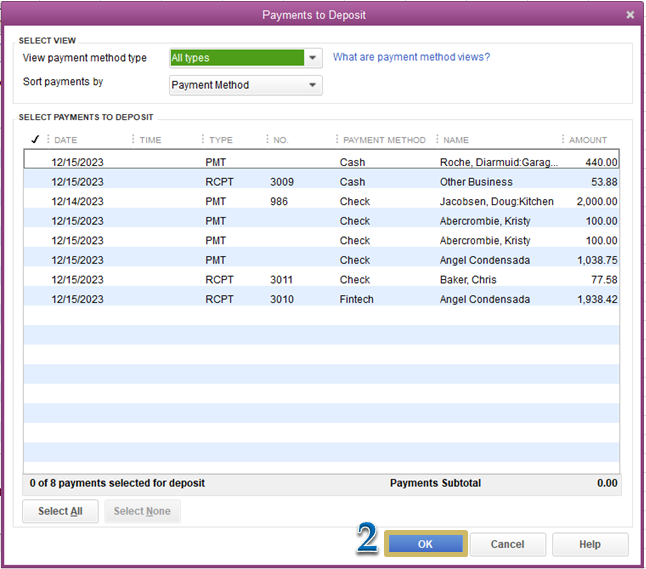

- If the Payments to Deposit window appears, click OK.

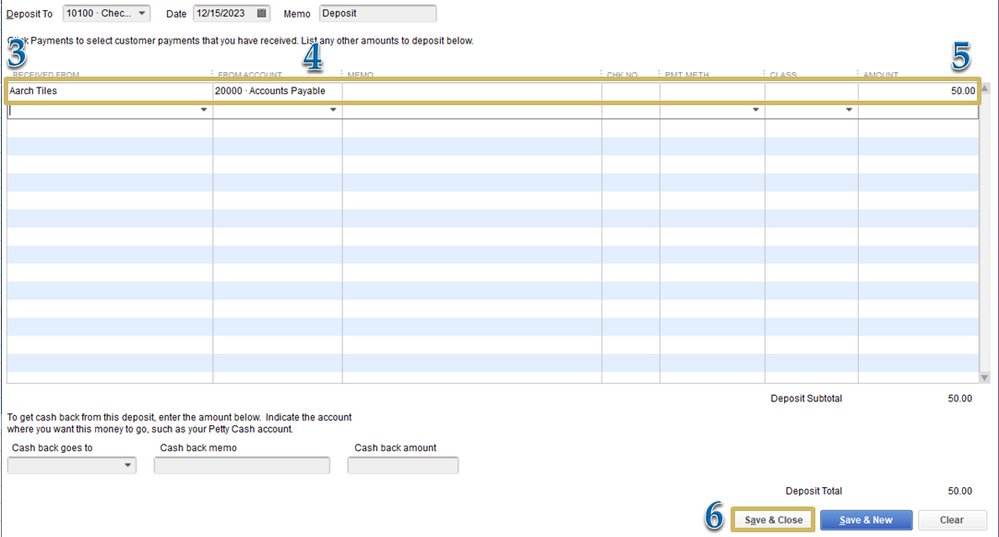

- Select the vendor on the Received from field.

- Choose Accounts Payable for the From Account.

- Enter the amount of credit in the Amount column.

- Click Save & Close.

Right after, you can link the deposit to the credit. Follow the steps below:

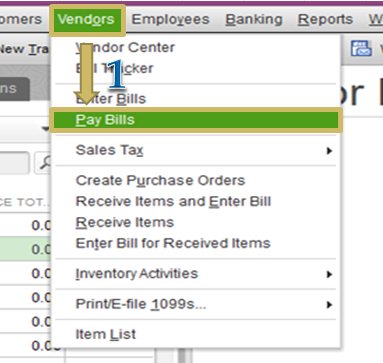

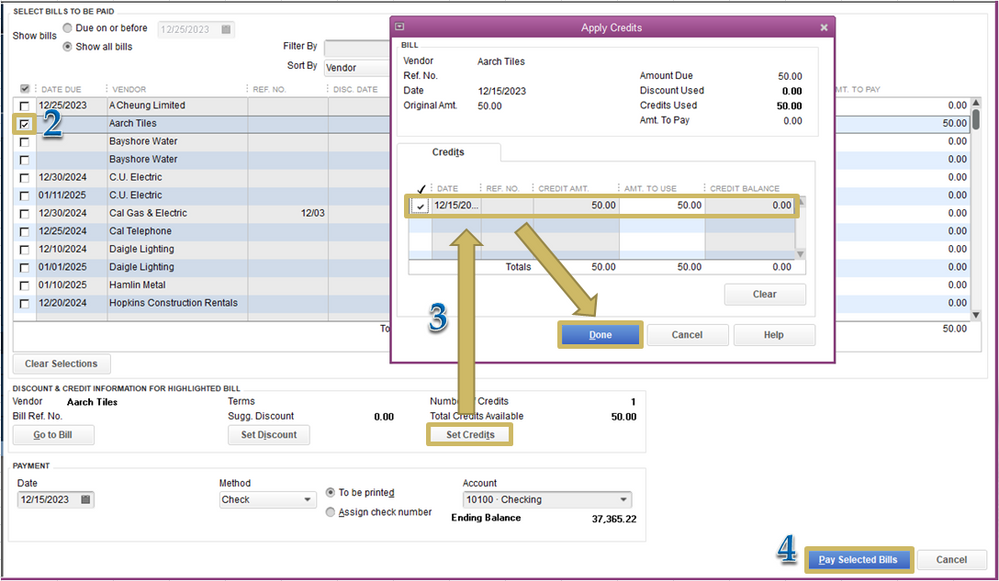

- Go to Vendors menu at the top and select Pay Bills.

- Put a checkmark on the Deposit that matches the credit amount.

- Click Set Credits and apply the Credit, then choose Done.

- Hit Pay Selected Bills.

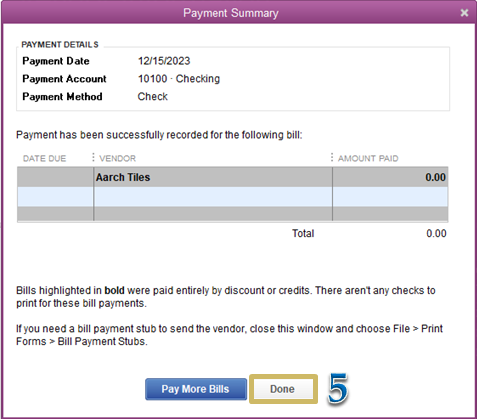

- Choose Done.

These steps should record the transaction correctly. For more information, check out this article: Record a vendor refund in QuickBooks Desktop.

Hit the Reply button below should you need further assistance working with QuickBooks. I’m more than happy to help. Have a great day!