Limited time. 50% OFF QuickBooks for 3 months.

Buy now & saveAnnouncements

Get unlimited expert tax help and powerful accounting in one place. Check out QuickBooks Online + Live Expert Tax.

- US QuickBooks Community

- :

- QuickBooks Q & A

- :

- Other questions

- :

- Re: Vendor refund to credit card (Quickbooks online):

- :

- Reply to message

Reply to message

Replying to:

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Reply to message

Thanks for adding more details about your concern, anonEthos.

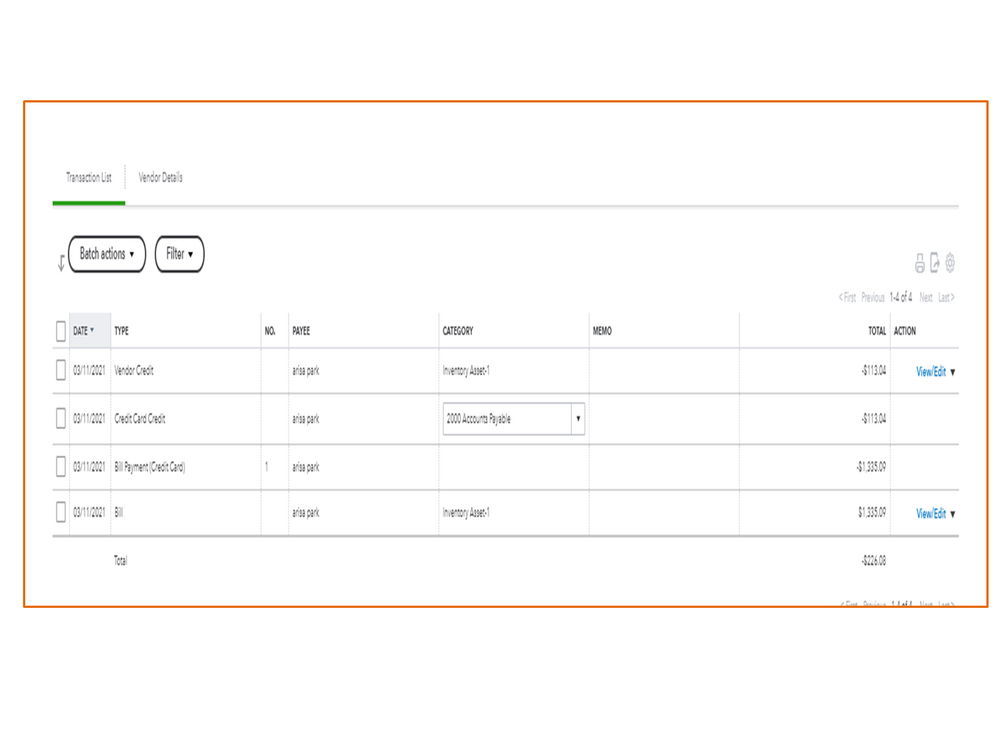

Based on the screenshot shared, the entries are properly recorded in QBO. Also, the amounts will show a negative amount.

The Transaction List page will show all activities or transactions related to the vendor. That’s why it shows a -$226.08 total amount (credits).

When you go to the Vendor’s page, the Open Balance column will show a zero amount. I’ll help show the steps on how to get there.

- In your company, go to the Expenses menu on the left panel to choose Vendors.

- From there list, look for the supplier you’re working on.

- Then, go to the Open Balance column to see the amount.

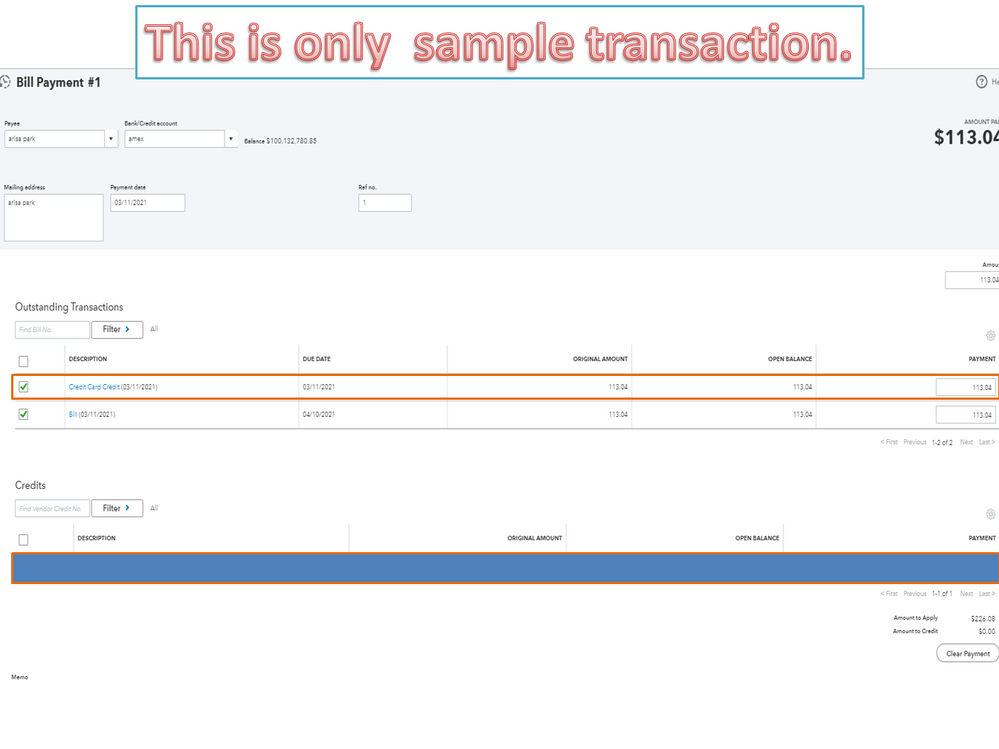

If you’ll create a bill and pay it, the Credit Card Credit will show in the Outstanding Transactions section. Then, the Vendor Credit is recorded in the Credits section.

For additional resources, click here to access our self-help articles. It includes guides on how to handle expenses and vendor transactions.

If you have any clarifications or questions, add a comment below. I’ll get back to answer them for you.