Limited time. 50% OFF QuickBooks for 3 months.

Buy now & saveAnnouncements

Get unlimited expert tax help and powerful accounting in one place. Check out QuickBooks Online + Live Expert Tax.

Reply to message

Replying to:

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Reply to message

Thanks for joining this thread, @DebGer. I'm here to help you fix and match your old transactions without any further delay!

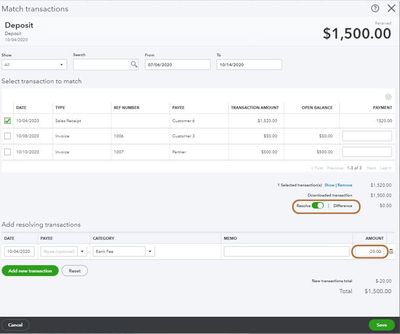

You have two options on how to handle merchant fees. You can use the Resolve Difference option to fix your payment difference. This helps match your transaction through its difference until it will be equal to zero.

- On the left pane, click Banking.

- Select the For Review tab.

- Choose the transactions to open.

- Select the Find other records or Find match button to open the Match transactions window.

- By default, the Match transactions window lists All transactions within the date range, but you can narrow the results.

- Use options on the Show drop-down menu to specify the type of transaction you're looking for.

- If the transaction you're looking for is outside the default date range, select the From and To date fields to change the dates.

- If the amounts are different, you can locate additional matched transactions, or select Resolve Difference to open the Add resolving transaction fields to add the Category and Amount (and, optionally, Payee) of a resolving transaction until the difference equals zero.

- If necessary, you can use the Add new transaction button to add multiple resolving transactions.

- Click Save.

As another option, you can create a bank deposit for the merchant fee less than the amount of the invoice or sales receipt. This way, you can match this transaction to the downloaded bank transaction. You'll have to enter the merchant fee as a line item in the "Adds fund to this deposit" section. Then, select your new merchant fee expense account and enter a negative value that reflects the bank fee amount. For more detailed instruction, go to the What about recording Bank Fees? section in this article: Bank Deposits.

Once done, you can reconcile your account to make sure your books are accurate. Just go to the Accounting menu from the left pane and select Reconcile.

For more insights about this process, please refer to these articles:

- Add and Match Downloaded Banking Transactions

- Why Do I Occasionally Notice Penny Rounding Differences?

Drop me a comment below if you have any other questions. I'll be happy to help you further. Have a great day.