Limited time. 50% OFF QuickBooks for 3 months.

Buy now & saveAnnouncements

Get unlimited expert tax help and powerful accounting in one place. Check out QuickBooks Online + Live Expert Tax.

- US QuickBooks Community

- :

- QuickBooks Q & A

- :

- Payments

- :

- Re: On the receive payment screen, enter the full amount of t...

- :

- Reply to message

Reply to message

Replying to:

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Reply to message

I'll help you correct this transaction so you can continue to run your business, @SuzanaH.

Allow me to share some information first on how to manage payment in QuickBooks Online.

There are two options to record sales transactions in QuickBooks, and it depends on when you receive the payment. You can use the Invoice and then Receive Payment for a deferred. However, you’ll want to use the Sales receipt once it’s immediate.

When you used the Received payment option in QuickBooks, you should match it directly to your bank transactions. This way, we can avoid double-counted income. You can delete the deposit and Sales receipt you made to correct it. Here’s how:

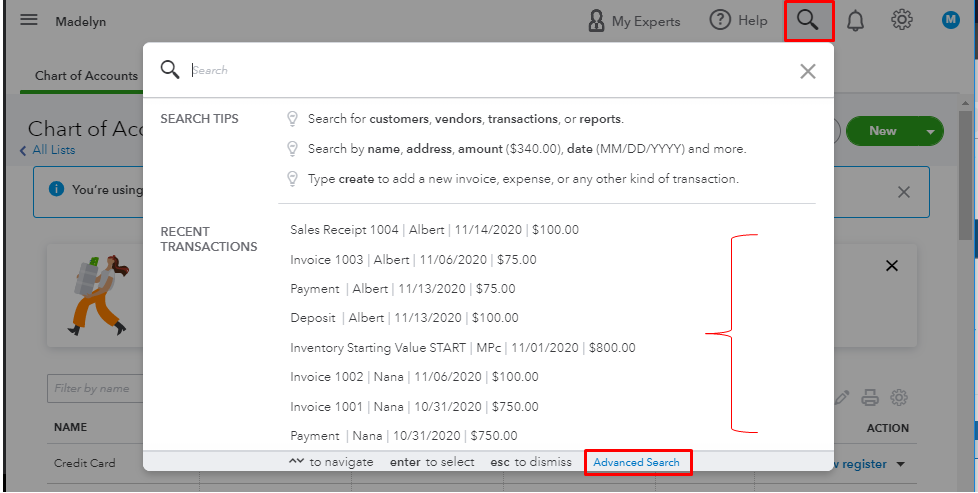

- Go to the Magnifying icon and select the deposit. You can select the Advanced Search to locate the event easily.

- Click More at the bottom and choose Delete.

- Press Yes after.

Once done, go back to the Banking page then used the Find match option to match them in the program. You can check this article on how to add and match downloaded banking transactions for your reference.

Feel free to drop a comment below if you have any other questions about payments in QuickBooks. I'd be happy to help you out. Have a great day.