Limited time. 50% OFF QuickBooks for 3 months.

Buy now & saveAnnouncements

Get unlimited expert tax help and powerful accounting in one place. Check out QuickBooks Online + Live Expert Tax.

- US QuickBooks Community

- :

- QuickBooks Q & A

- :

- Payments

- :

- Re: Double Payment & Refund

- :

- Reply to message

Reply to message

Replying to:

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Reply to message

Handling unexpected payments and refunds can be tricky, but we got this, Vero. Together, we'll ensure everything is recorded correctly in QuickBooks so you can maintain seamless financial records.

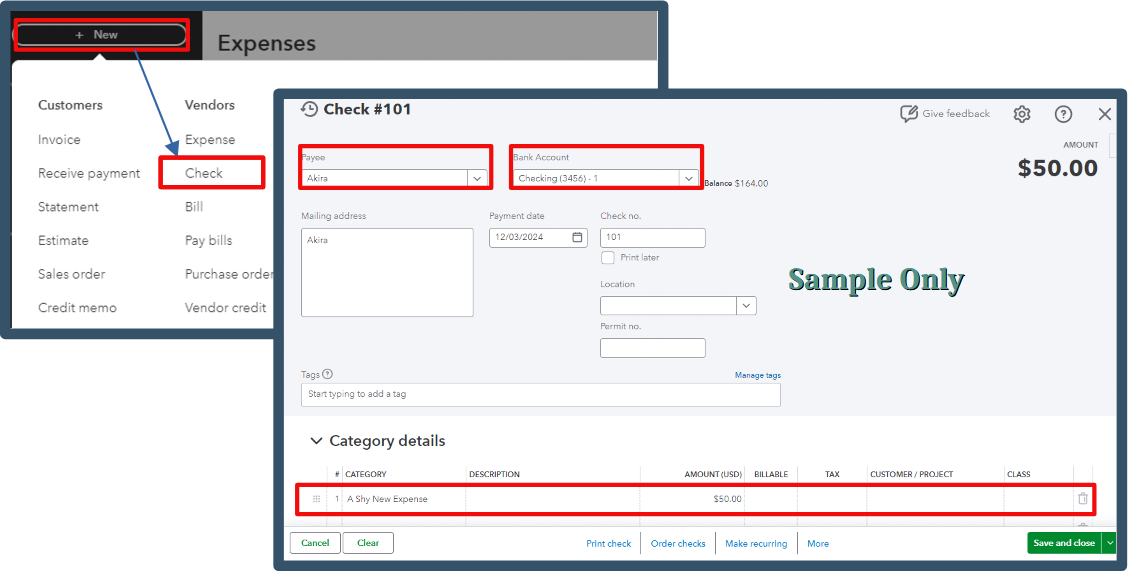

Before anything else, let's create a check to record the payment your vendor took from your checking account. Here's how:

- Go to +New, then select Check.

- From the Payee dropdown, pick your preferred vendor.

- Choose the account you want the money from in the Bank Account dropdown.

- Select the correct expense account, then enter the amount.

- Hit Save and close.

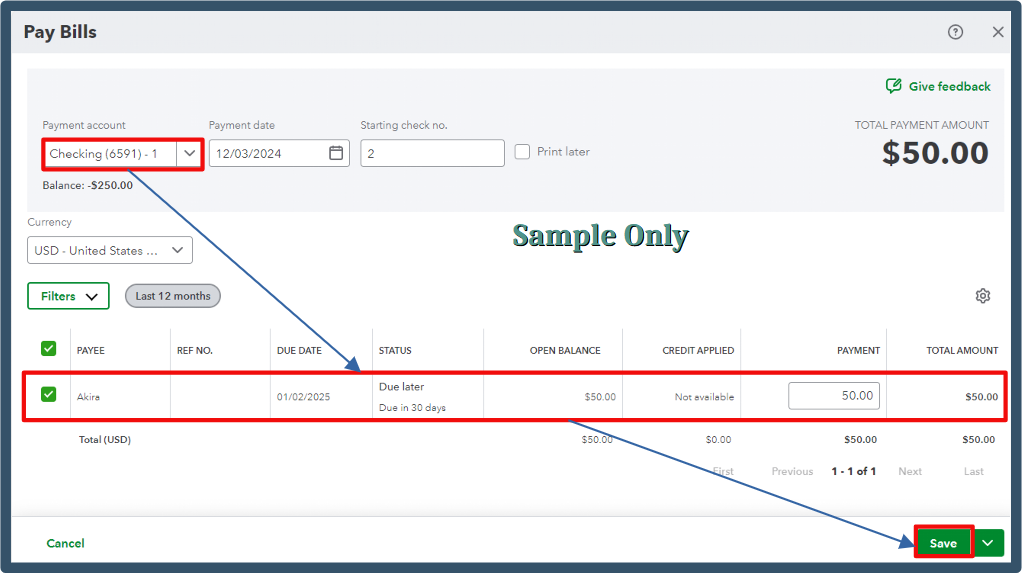

Now, let's use the Pay Bills feature to close your bill.

- Click +New, then select Pay Bills.

- On the Payment Account, choose the account used to pay the bills.

- Tick the corresponding transaction.

- Once done, hit Save.

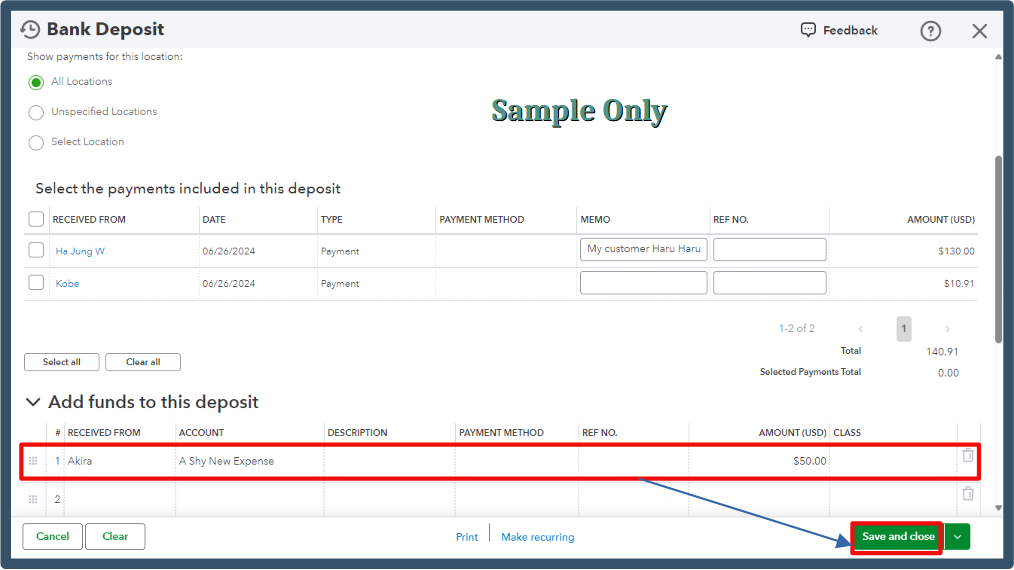

Afterward, let's create a bank deposit to account for the refund.

- Navigate to +New, then click Bank Deposit.

- Head to the Add funds to this deposit area.

- On the Received From column, select your vendor.

- Choose the same expense account and enter the correct amount.

- Save and close.

Moreover, you can run a report to generate a detailed overview of all payments made to your vendors.

Following the suggested steps above will help you clear the transaction effectively. If there's anything else you need assistance with or any new questions arise, let me know instantly. Let's keep your financial management accurate, Vero.