Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWelcome to this thread, neetab.

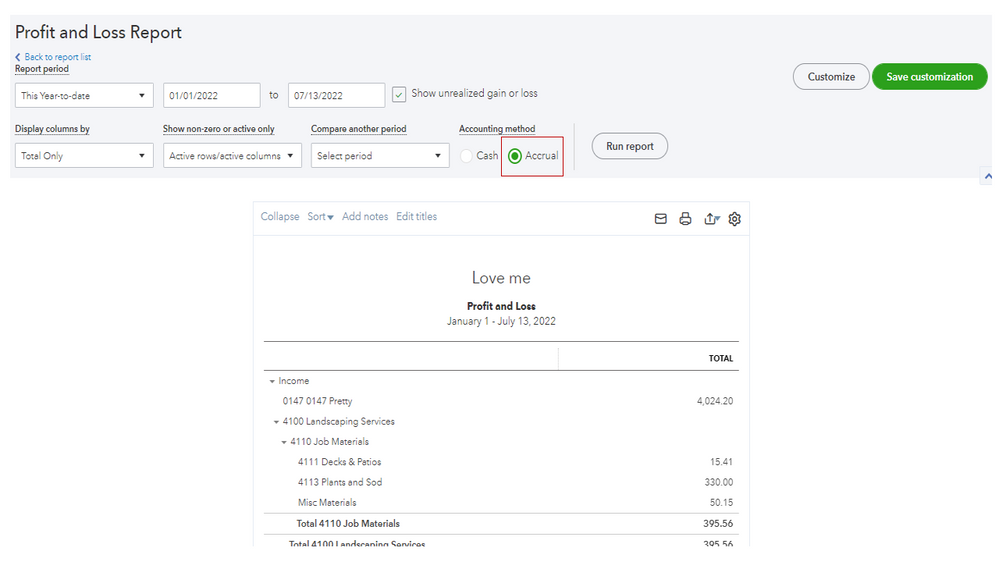

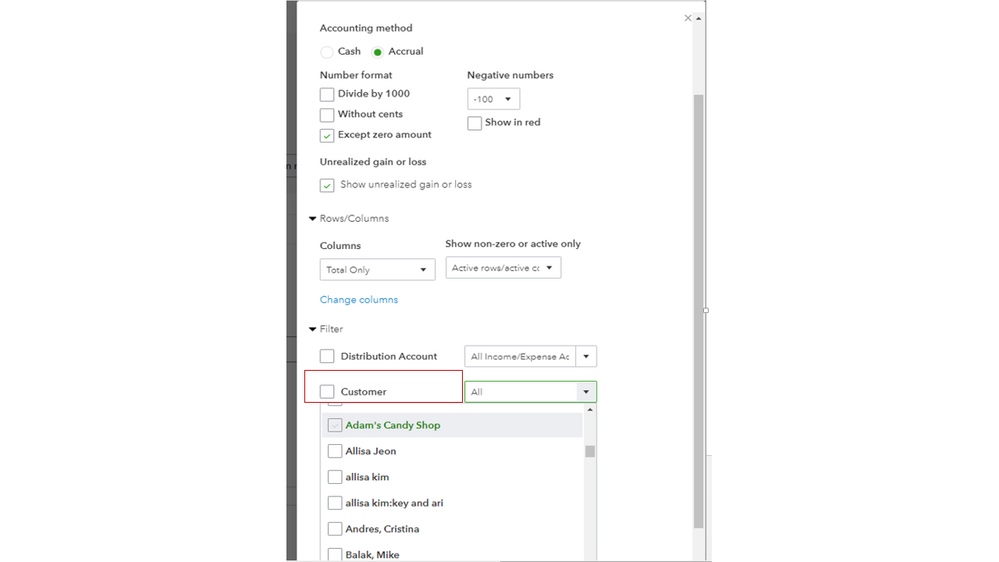

Allow me to chime in and help you find the accrual entries for your customer in QuickBooks Online (QBO). Let’s run the Profit and Loss report and customize it to see the data you need.

When you move from the desktop version to QBO, compare your financial reports to make sure your information was copied successfully. You’ll have to open the Profit and Loss or Balance Sheet statements. Then, set the accounting method to accrual basis to check the data.

You can go over this resource for additional information: What to do after you move from QuickBooks Desktop for Windows or Mac to QuickBooks Online.

When you’re ready, follow these steps to build the report:

This reference will walk you through the process of how to tailor the information on your statements: Customize reports in QuickBooks Online. You’ll learn about automating a custom report, exporting your statement to Excel, and so on.

To get around any accounting activities easily, you can browse our online resources. They contain topics about inventory, taxes, payroll, banking, etc. to help with your future tasks.

Thank you for giving me the opportunity to help, neetab. Should you have other QuickBooks concerns or additional questions about your customer’s transactions, let me know in the comment section below. I’ll get back to answer them for you.