Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

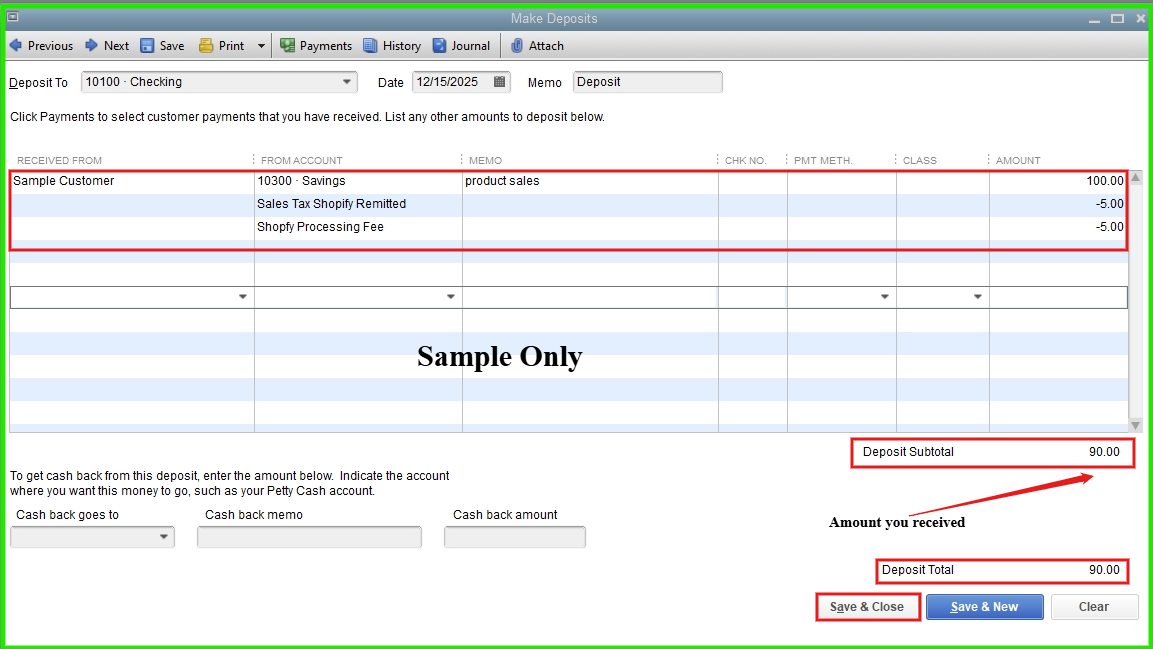

Buy nowYou can use the Bank Deposits feature in QuickBooks Desktop (QBDT) to manually record your revenue, sales tax remitted, and Shopify processing fees, Bray3214.

I recommend consulting your accountant to ensure proper recording methods, account classifications, and the use of appropriate accounts for deposits and processing fees.

If you have any additional concerns, please don’t hesitate to let us know.