Need help choosing?

Speak to a QuickBooks expert to find the right product for your business

Talk to sales: 0808 304 6205

9.00am - 5.30pm Monday - Friday

Get product support

Contact support Visit support page Making Tax Digital compliance checker*

46% of businesses wrongly believe they’re MTD-compliant. Answer up to five simple questions to understand if you’re ready for MTD.

Is your business VAT-registered?

What is your annual turnover?

Have you signed up for Making Tax Digital for VAT?

Have you signed up for Making Tax Digital for VAT?

How do you submit your VAT returns?

It looks like you're not affected by Making Tax Digital yet

As your business isn’t registered for VAT, you won’t need to comply with Making Tax Digital until April 2024. That's when MTD for Self Assessment Income Tax will be introduced for the self-employed and landlords with annual income of £10,000 or more. But the earlier you get used to keeping digital records, the better.

QuickBooks helps your business get ready to comply with the upcoming government regulations – and makes managing your business finances a whole lot easier. Find out more about our HMRC-recognised

You could be fined for not complying with Making Tax Digital

From April 2019, almost all VAT-registered businesses with an annual taxable turnover above the VAT threshold of £85k have been required to submit their VAT returns following Making Tax Digital rules.

So if you haven’t registered for Making Tax Digital yet (and

) you might be risking a fine.Here's

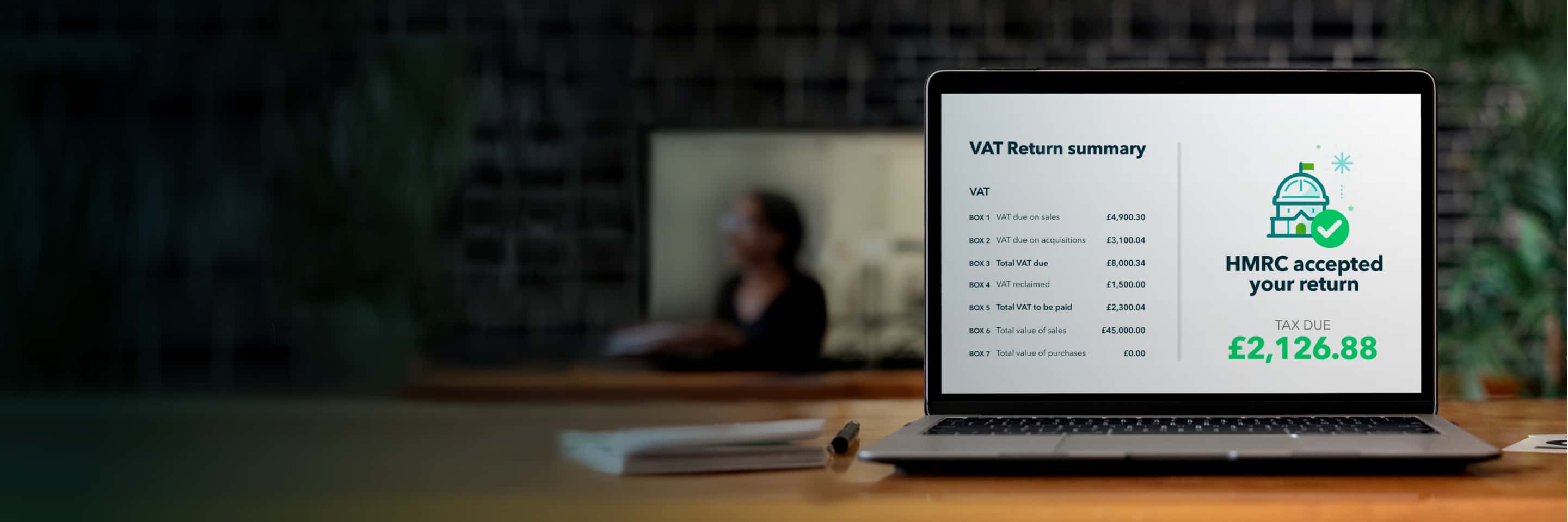

You'll also need to sign up to MTD-compatible accounting software such as QuickBooks and authorise your accounting software to connect with HMRC.QuickBooks makes it easy to stay on the right side of HMRC. You should also save around 8 hours a month managing your business finances.

Not sure if you already signed up for Making Tax Digital?

These guides might jog your memory.

From April 2019, almost all VAT-registered businesses with an annual taxable turnover above the VAT threshold of £85k have been required to submit their VAT returns following Making Tax Digital rules.

So if you haven’t registered for Making Tax Digital yet (and

) you might be risking a fine.Still stuck? Call our MTD Hotline on 0808 168 9533

Get up to speed with Making Tax Digital as soon as possible

Unless

, you’ll need to comply by April 2022. That means signing up for MTD and using a compatible software package (such as QuickBooks) that connects to HMRC systems.Take the pressure off by getting up to speed well ahead of the deadline and start saving hours of admin time every month.

How to make sure you're complying with MTD

To make sure you’re compliant with MTD for VAT, please check that:

- you're transferring VAT records into your accounting or bridging software without using 'cut & paste' or another manual method

- your accounting software is uled on the HMRC website as MTD-compatible

Need help?

or speak to one of our experts on 0808 168 9533.With QuickBooks’ free data import tools you could soon be saving around 8 hours a month with smart tools like the VAT error checker.

A few things to check with your accountant

To make sure you're MTD compliant, check that your accountant has:

- been using

- or

to submit your VAT return.

Ask your accountant about QuickBooks’ HMRC-recognised Making Tax Digital software. With our free data import tools you can be set up in a matter of minutes.

Need help?

or speak to one of our experts on 0808 168 9533.*The results provided are only indicative of whether you are compliant with Making Tax Digital. MTD eligibility and compliance is ultimately decided by HMRC. For more information about MTD requirements please check the HMRC website. Independent research conducted on behalf of Intuit QuickBooks by Opinium of 500 VAT registered UK small businesses with 0-49 employees, April 2019..

Stay informed and inspired

Subscribe to get our latest insights, promotions, and product releases straight to your inbox.