Confidently claim expenses for Self Assessment. We’ll extract the data from piles of paper receipts in a matter of clicks, and do all the calculations.

- Software with you in mindBecome a ProAdvisorJoin our free ProAdvisor Programme and access tools, resources and exclusive discounts to help take your practice to the next level.

- online Accounting for sole traders

- Grow your business

- How can we help you todayInvoices & expensesBanking & Payments

How can we help?

Talk to sales: 0808 304 6205

9.00am - 5.30pm Monday - Friday

Get product support

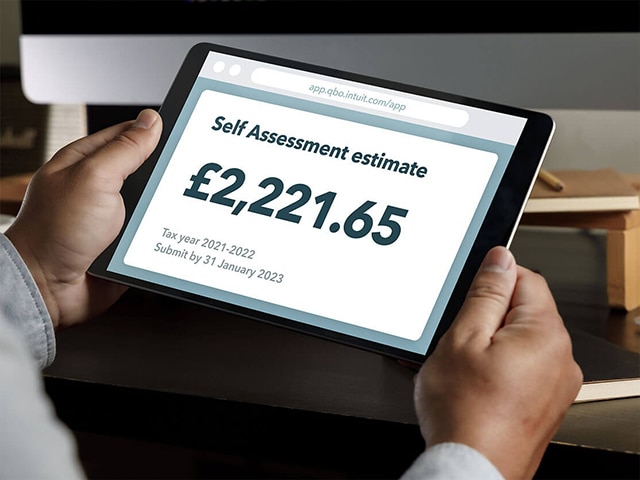

Contact support Visit support pageComplete your Self Assessment with self-employed accounting software

Self Assessment, sorted

Maximise your tax savings

Be ready in record time

Get up and running in a matter of minutes, then organise your income and expenses fast, by connecting your bank and uploading pictures of your receipts. We’ll crunch the numbers and help you prepare your return, ready to file with HMRC.

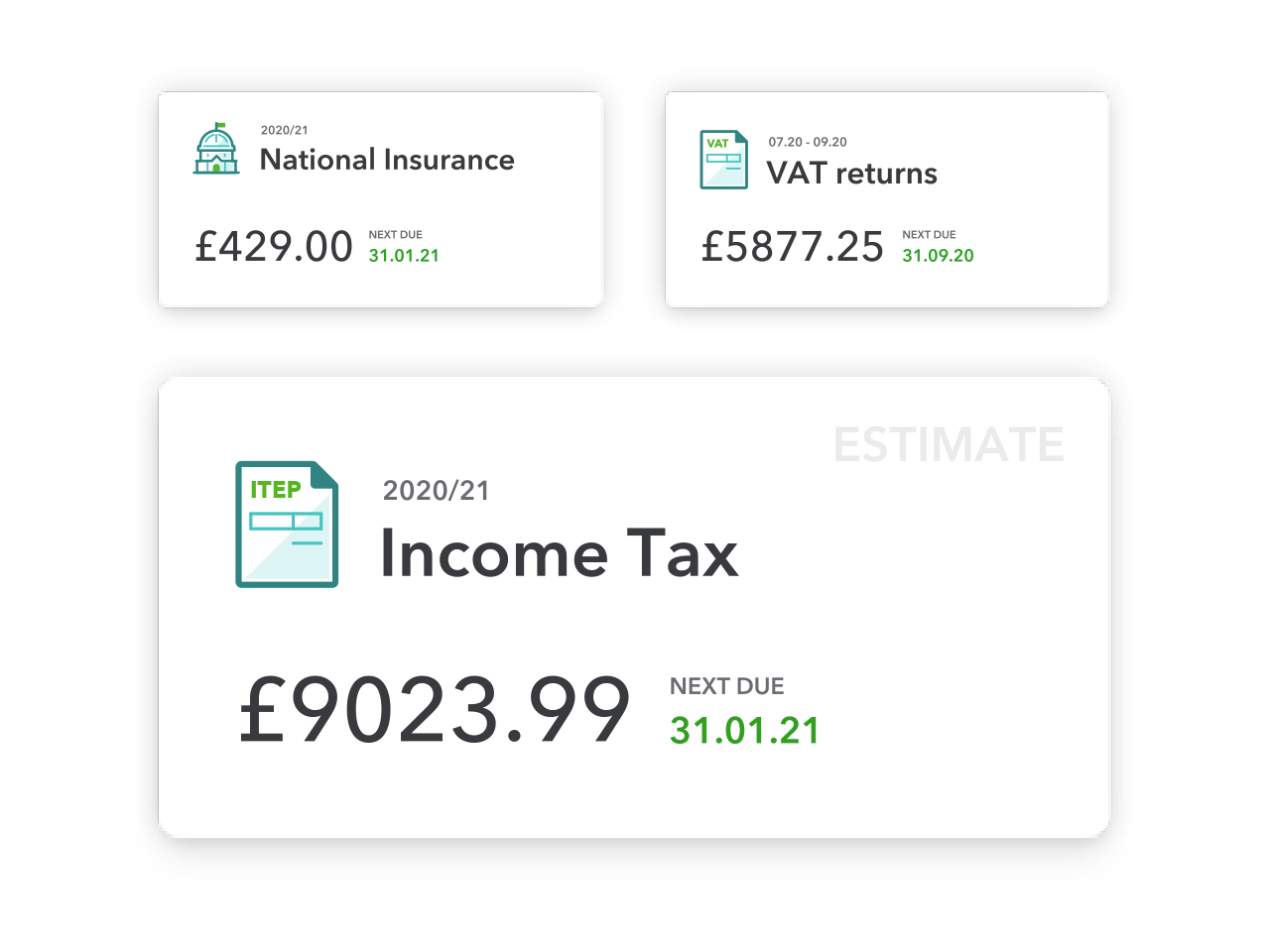

Tackle your tax in one place

Automatically organise, calculate and prepare your Income Tax, VAT and Construction Industry Scheme tax in QuickBooks Online. Not VAT registered? Keep it simple with QuickBooks Self Employed.

Get software support from a real person

We offer free, award-winning technical support with instant online or video chat with screen sharing. You can call us too if you’re using QuickBooks Online.

Get the answers you need

Wondering what expenses you can claim as a sole trader? Our online guides will set you straight - without the jargon.

Frequently asked questions

It’s a type of income tax paid by:

- sole traders

- people with more than 1 source of income

- company directors who take dividends

- anyone earning more than £100k/year

Details of the year’s earnings from 6 April-5 April need to be submitted to HMRC by 31 January in the following year. The tax is due in two installments: 31 January (in arrears) and 31 July (in advance). You can read more about this in our blog.

There are several parts to the Self Assessment tax return. QuickBooks can give you an estimate of your Income Tax and calculate your income and expenses to help you prepare your SA103 form. The figures don’t include partnerships, property income or capital gains.

QuickBooks can automatically calculate your income, minus expenses based on the information you’ve uploaded to QuickBooks, but right now, VAT and CIS payments aren’t automatically included, so you’ll need to take account of that. If you’re claiming allowances, such as the Married Couples Allowance, you’ll also need to calculate that manually. The same goes for deductions against fixed assets. Check our blog.

If you’re VAT registered and/or use accrual accounting (recording income and expenses when you get a bill or send an invoice) QuickBooks Simple Start is the right product for you. If you’re not VAT registered and use cash accounting (recording income and expenses when you receive or pay money) QuickBooks Self-Employed is probably best for you.

If you need to move from QuickBooks Self-Employed to Simple Start (or vice versa) our friendly team will explain how to migrate your data. Of course, it's easier if you pick the right QuickBooks product from the start, so please call us on 0808 304 6076 if you need any guidance.

Take a look at our blogs for advice about expenses and completing Self Assessment. Our team can give you technical advice about downloading the figures you need from your QuickBooks account, but of other advice, please consult an accountant.

Yes. You can import Customer, Supplier, Items, and Chart of Accounts from an Excel spreadsheet in several ways.

Not with QuickBooks Self-Employed, but you can track your VAT then prepare and submit your return to HMRC using QuickBooks Online.

If you need to manage Construction Industry Scheme obligations (CIS) try QuickBooks Online.

Of course. It’s easy to invite them to access your QuickBooks account. Need to find an accountant? Check out our searchable directory.

You can, but you’ll need to move your data to your new QuickBooks Online product (Simple Start, Essentials or Plus), following step by step instructions here. Our friendly team can help you choose the right product for your needs, so you're less likely to have to switch products. Call us on 0808 304 6076 and we'll be happy to help.

The allowable expenses you can claim under Self Assessment must be for business use only and they vary depending on the business you’re in. You can read more about this in our blog, check out the list of allowable expenses on HMRC’s website or speak to an accountant.

If you’re a sole trader, you need to register for Self Assessment with HMRC so you can pay your Income Tax. Read our handy blog article to find out more.

Offer terms

If you select the Free Trial option the first months subscription to QuickBooks, starting from the date of enrolment, is free. To continue using QuickBooks after your one month trial, you'll be asked to present a valid credit card for authorisation, and you'll be charged the then current fee for the service(s) you've selected. All prices shown exclude VAT. Offer(s) are valid for new QuickBooks customers only. Offer cannot be combined with any other QuickBooks Online offers. Terms, conditions, features, pricing, service and support are subject to change without notice.

QuickBooks Making Tax Digital for VAT software is available to all QuickBooks Simple Start, Essential and Plus subscribers. Use of QuickBooks MTD for VAT software and bridging software must be aligned with HMRC's eligibility requirements and includes additional set up between the small business and HMRC.

QuickBooks MTD software currently supports Standard, Cash and Flat Rate schemes. QuickBooks Bridging Software supports Standard and Cash schemes. Annual submissions are not currently supported but will be coming soon. Businesses whose home currency is not GBP are currently not supported.

All prices shown exclude VAT. Your account will automatically be charged on a monthly basis until you cancel. No limit on the number of subscriptions ordered. You can cancel at any time by calling 0808 168 9533. Any discounts cannot be combined with any other QuickBooks Online or QuickBooks Self Employed offers. Terms, conditions, features, pricing, service and support are subject to change without notice.

60% discount valid until the 7 November 2020.

Call Sales: 0808 168 9533

© 2022 Intuit Inc. All rights reserved.

Registered in England No. 2679414. Address 5th Floor, Cardinal Place, 80 Victoria Street, London, SW1E 5JL, England. Intuit and QuickBooks are registered trademarks of Intuit Inc. Terms and conditions, features, support, pricing, and service options subject to change without notice.