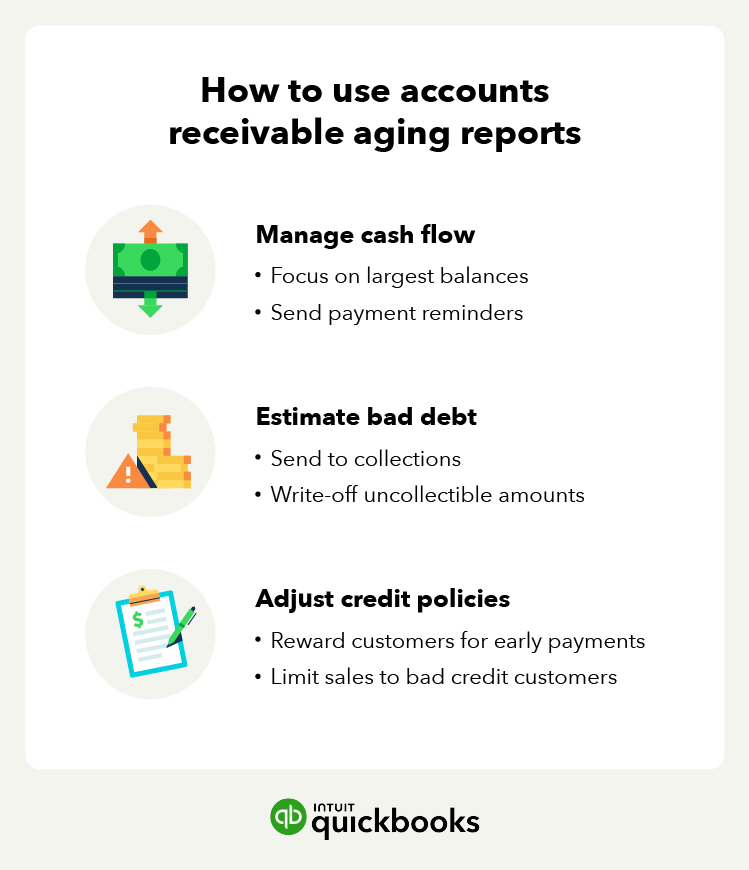

A/R aging reports can tell you a lot about your business, such as how effective your collection payment practices are and how you manage cash flow. You can also use your accounts receivable aging report for a variety of purposes, such as:

Manage cash flow

Adequate cash flow is essential to running a successful business. With an aging report, you can identify problems in your accounts receivables.

Then you can take steps to get clients to pay their invoices faster, which can help prevent future cash flow issues.

Estimate bad debt

An aging report for accounts receivable can help estimate bad debt, which is uncollectible payments. Bad debts typically form when customers receive credit they are unable to pay back. A best practice for businesses is to use an aging report to make an estimate of bad debts for each period.

For example, let’s say a company allows a:

- 1% bad debt allowance for the 0–30 day period

- 5% bad debt allowance for the 31–60 day period

- 10% bad debt allowance for the 61–90 day period

- 15% bad debt allowance for the 91+ day period

Now let’s say the company’s accounts receivable aging report lists:

- $200,000 in the 0–30 day period

- $175,000 in the 31–60 day period

- $100,000 in the 61–90 day period

- $75,000 in the 91+ day period

Using that information, this company will have an allowance for doubtful accounts of $32,000. To find this, use the following formula:

- ($200,000 x 1%) + ($175,000 x 5%) + ($100,000 x 10%) + ($75,000 x 15%)

- 2,000 + 8,750 + $10,000 + $11,250 = $32,000

Estimating bad debts allows a company to revise its allowance for doubtful accounts. Companies usually use previous A/R aging reports to determine the historical percentage of invoice dollar amounts for each date period that resulted in bad debts.

Typically, the longer a debt goes uncollected, the higher the chance it remains uncollected. Businesses must keep this in mind as they manage their finances. This way, they can adjust how much debt they can afford to go uncollected.

Adjust credit policies

One of the main uses of an accounts receivable aging report is to identify customers behind on payments. If you go through your aging report and notice a single client is responsible for most of your late payments, you can proceed with any necessary measures.

However, if you see multiple clients are late on payments, it might be an issue with your customer credit policy. If this is the case, you can compare your credit risk to industry standards to see if you’re taking too much credit risk.

Accounts receivable aging reports allow you to analyze how your collection processes are going. If you have a lot of old accounts receivable balances, especially after 60 or 90 days, your collection processes may need to be revised.

If you notice this trend, you can adjust your collection practices, such as sending invoices right away or working with a debt collection agency. This way, you can ensure clients pay the total amount due in a timely manner and improve your days sales outstanding average.

Run your business with confidence

Once your accounts receivable aging report is ready, you’ll be able to spot which customers are late, how late they are, and how much they owe. You can then take action to get your outstanding payments addressed, such as sending a follow-up invoice or reaching out to a collection agency.

With an accounting solution, you’ll be able to generate accounts receivable aging reports. QuickBooks accounting solution is extremely flexible, allowing you to customize customer settings to send invoices and reminders. This way, you can stay on top of customer payments and take action when needed.

Accounts receivable aging report FAQ

Here are the top accounts receivable aging report questions that business owners have:

What is the purpose of an aging report?

An aging report lists a company's outstanding customer invoices and payment due dates. Aging reports help track how long customers owe money to identify collection issues or determine credit terms. They also help manage cash flow and working capital.

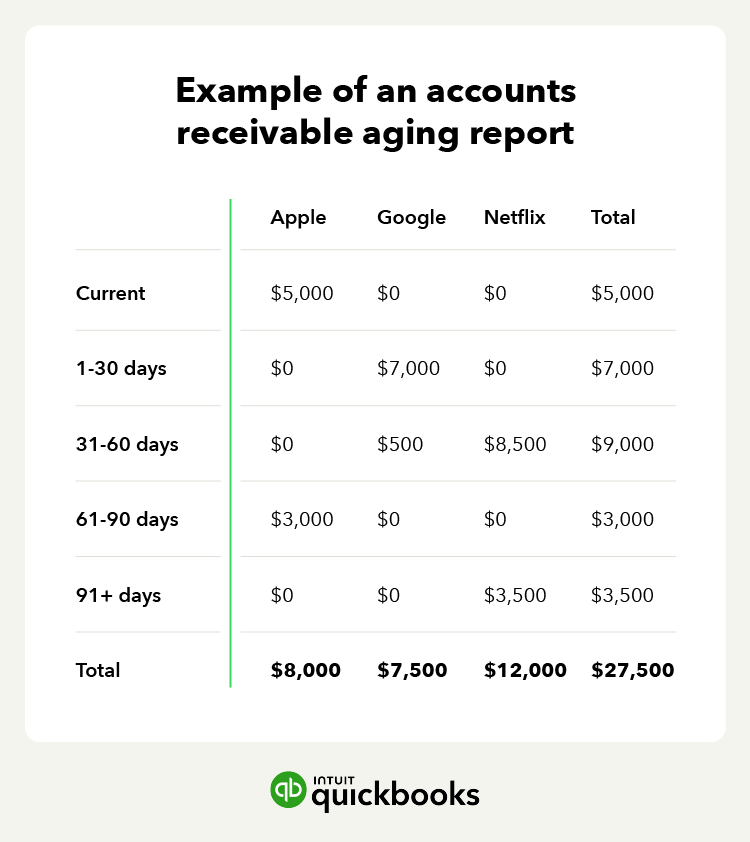

What is an example of aging an accounts receivable?

An example of an accounts receivable aging report is sorting invoices by their outstanding date. For example, the accounts receivable for a customer is $5,000. The amount that is current is $2,500, while the other $2,500 is over 30 days past due.

What is a good AR aging percentage?

A good AR aging percentage will vary by the industry and credit terms the company offers. However, in general, the lower the AR aging percentage, the better. You can find the AR aging percentage by dividing the total amount of receivables that are over 90 days past due by the total amount of receivables outstanding.