Retained earnings are a vital part of any business. Without it, many companies would have to borrow extensively from banks, or flounder in the market. If you’re starting a business and in need of knowledge surrounding retained earnings, we have you covered.

What are Retained Earnings and How to Calculate Them

What are Retained Earnings?

At the end of an accounting period, whatever is leftover of the net income of a business, after distributing dividends to the owners (sole proprietorship, or partnership), or shareholders (in a corporation), is referred to as retained earnings.

As the name suggests, it is the earnings retained by the company once all other profits have been distributed where they need to go. Retained earnings are one element of an owner’s equity, or a shareholder’s equity, and are classified as such.

Retained earnings are one of the most important and “organic” sources of funding for any business. They can be put to good use through reinvestments such as:

- Financing new projects: you can use your retained earnings productively by using it toward new expansion projects and initiatives. This tactic avoids the need to look for external financing, which, as many business owners know, can create further interests and debts.

- Investing in research and development: another effective way to use those retained earnings is by investing in R&D—it often serves as fuel to maintain competitive advantage.

- Upgrading existing operations and infrastructure: if you want to aim at improving internal processes’ efficiency and productivity, you can use retained earnings to optimize those operations.

Companies may also use their retained earnings to pay off debt. This is a great way to save on compounding interest expenses and improving credit scores.

In other words, the purpose of these earnings is to reinvest the money to pay for further assets of the company, continuing its operation and growth. Thus companies do spend their retained earnings, but on assets and operations that further the running of the business.

Retained Earnings Formula

Businesses calculate their retained earnings at the end of every accounting period- typically on a monthly, quarterly, and yearly basis. The formula is as follows:

Retained Earnings (RE) = Beginning RE + Net income – Dividends

Here’s the breakdown by term: Beginning RE represents the retained earnings from the previous, which will be the starting point for our calculation. Add your net income for the period—the total revenue minus total expenses—and subtract the dividends, which is the amount distributed to shareholders.

Suppose XYZ Inc. wants to calculate their retained earnings for the period based on their financial information below:

- Net Income: $100,000

- Dividends Paid: $20,000

- Beginning Retained Earnings: $300,000

XYZ Inc. must plug the numbers above in the formula Retained Earnings (RE) = Beginning RE + Net income – Dividends

Therefore, RE = $300,000 + $100,000 - $20,000

RE = $380,000

The ending retained earnings for the period is $380,000.

Net Income Vs. Retained Earnings

Net income and retained earnings are not the same things. However, net income, along with net losses and dividends, directly affects retained earnings. Net income is the total amount a company makes after taxes and expenses.

A company is taxed on its net income. Retained earnings are the amount a company gains after the taxation of its net income. Therefore, retained earnings are not taxed, as the amount has already been taxed in income.

Dividends and Shareholders

Dividends refer to the distribution of money from the company to its shareholders. Many corporations keep their dividend policies public so that interested investors can understand how shareholders get paid.

Dividends are typically paid in cash to shareholders- to do this successfully, the company first needs enough cash, as well as high enough retained earnings. Other times, corporations may decide to distribute additional shares of their company’s stock as dividends. This is known as stock dividends, as they issue common shares to existing common stockholders.

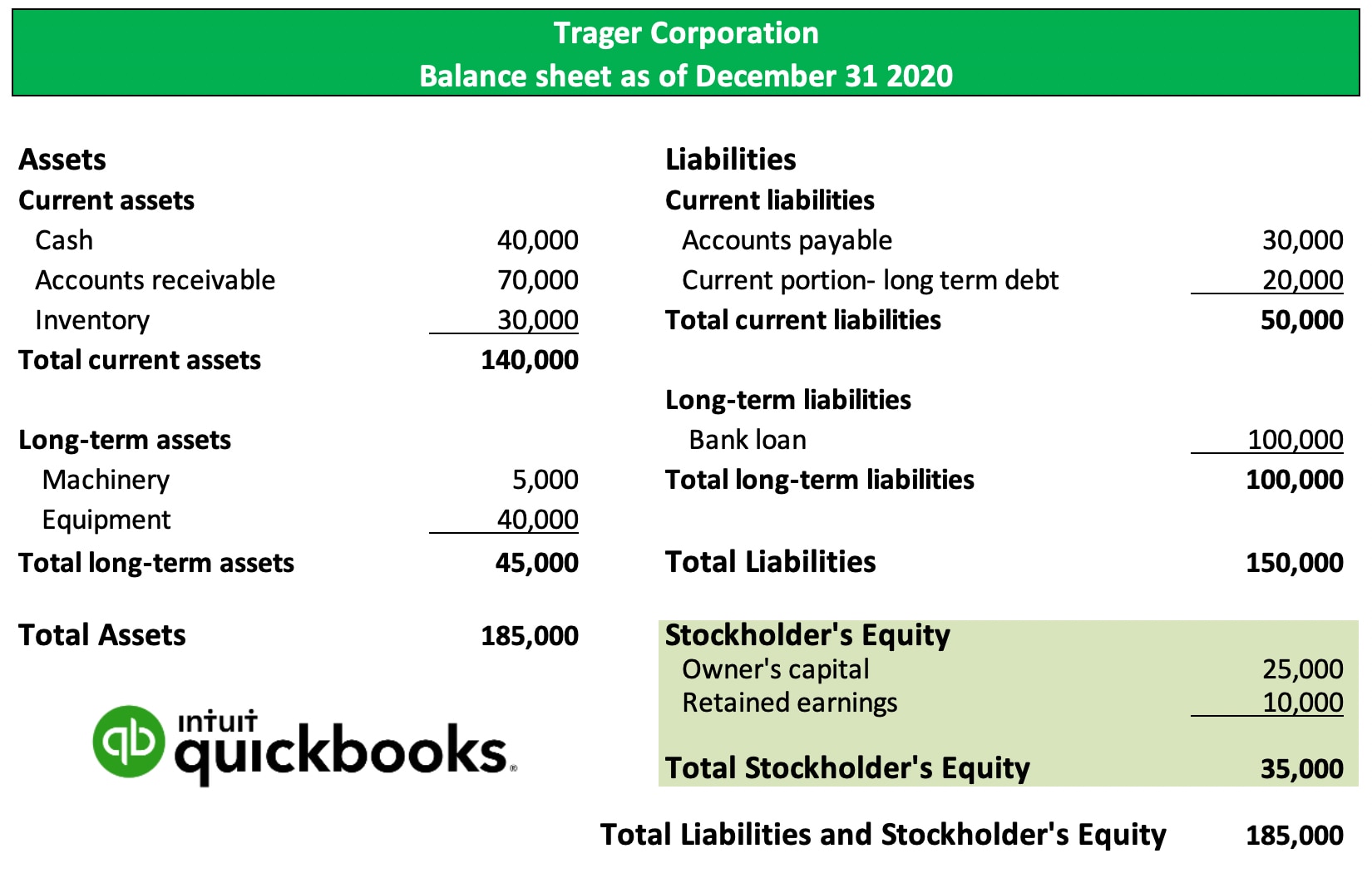

Retained Earnings On a Balance Sheet

Retained earnings can be found on the right side of a balance sheet, alongside liabilities and shareholder equity. Check out the balance sheet example below.

A balance sheet is a snapshot in time, illustrating the current financial position of the business. At the end of an accounting period, the income statement is created first, and then the company can decide where the allocation of cash and earnings will go.

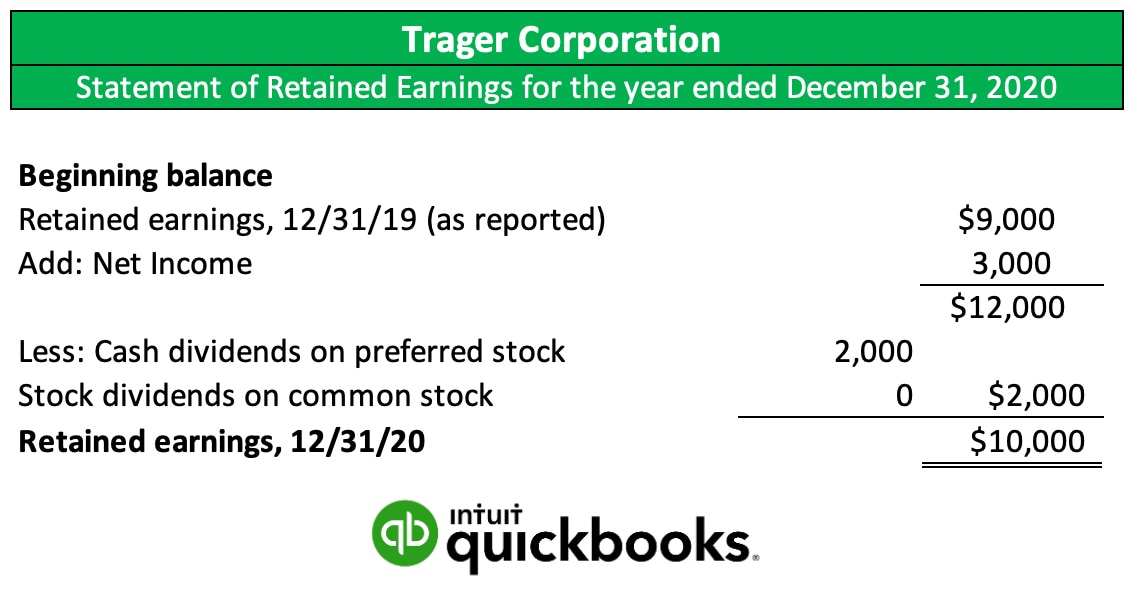

Statement of Retained Earnings

Depending on the company’s management, they will either create a separate retained earnings statement or sometimes prepare a combined statement of income and earnings. A retained earnings statement displays what’s going in and out of the retained earnings account. It reflects the accumulation of profits and the distribution of those profits to the owner or shareholders.

This statement is a vital indicator of a business’s overall financial standing. A high retained amount typically illustrates a company is in good financial health, while long-term negative amounts could be a sign of financial distress. It also displays all dividends- cash and stock- that have been given to shareholders per accounting period.

Common mistakes to avoid when calculating retained earnings

Although calculating retained earnings appears to be a simple process (since, well, it uses a simple formula), mistakes can create inconsistencies that affect your financial reporting. You should always be on the lookout for these mistakes:

- Neglecting possible prior period adjustments: check for possible—or known—errors in your prior period’s balance sheet and make the necessary adjustments. Mistakes happen, but this simple step avoids carrying them over into the future.

- Not adjusting for errors or changes in accounting policies: Always adjust your calculations taking into consideration any changes in accounting principles, like switching inventory valuation or depreciation methods.

- Ignoring tax implications: shareholder dividend distribution may have associated tax implications like dividend distribution tax. Ignoring this could cause an overstatement of the dividend capacity of the corporation, misleading stakeholders about the company's actual financial health.

FAQ

How is beginning retained earnings calculated?

To calculate the beginning retained earnings, follow this formula:

Beginning Retained Earnings = Retained Earnings + Dividends – Net Income/ Loss

The beginning retained earnings figure is required to calculate the current earnings for any given accounting period. You can find this information on your business’s balance sheet.

How do you calculate an increase in retained earnings?

To calculate the increase in a business’s retained earnings, you must first divide the specific accounting period’s retained earnings against the beginning retained earnings of the same period. Then multiply this number by 100 to find out the percentage increase of your earnings within that period.

Thanks to the professional accounting software available, retained earnings can be calculated automatically, ensuring fewer mistakes and an accurate depiction of your business’s financial position. With Quickbooks’ reporting function, companies can readily view and understand their finances thanks to the available balance sheet summaries and reporting features. Try it free today!