Your billing processes play a major role in your cash flow. When you send your invoices and bills to customers right away, you keep things running smoothly and revenue flowing into your business bank account. Feel like you’re spending too much time on your invoicing process? Automatic billing may be a time-saving solution for your small business if you have recurring invoices that go to customers each month.

Invoicing Tips: Schedule and Automate Your Invoicing or Billing Process

How Does Automatic Billing Work?

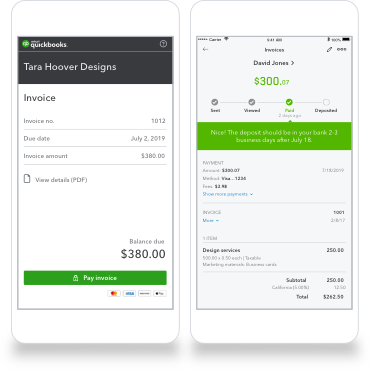

While some businesses enter customer invoices manually, you can automate the process. In your accounting software, you set up the invoice to go out automatically at whatever interval you choose. Imagine you run a landscaping business and offer a monthly maintenance plan for a set amount. You can automate the billing process in software, such as QuickBooks Online , to generate monthly invoices for the agreed-upon amount for all of your customers who are on that maintenance plan. The software automatically sends the bills out each month on the day you assign, so you don’t have to create and generate the invoices manually every month.

Why Consider Automatic Invoicing?

One of the biggest draws for businesses of all sizes is the time and money you save. If your accounting software automatically generates invoices and sends them to clients, you can reclaim the time you would normally use to create those invoices to perform other business-related activities. Since your time is money, you can also cut your business expenses by letting QuickBooks handle your recurring invoices for you. Plus, you don’t have to worry about forgetting to send the invoices, which helps to keep working capital flowing. You may even get paid faster when the invoices go out promptly on a regular basis, because your clients get the invoices right away. It also helps build positive relationships with your customers, as they know what to expect.

What Automatic Invoicing Software Is Available?

QuickBooks lets you generate automatic invoices for your clients. You also have the option to use billing apps for automated invoicing , many of which integrate into QuickBooks to help you track the invoices and payments. If you’re a field services professional, you may want to use an app such as Intuit Field Service Management ES. Compatible with QuickBooks, this app lets you track the tasks and time you spend working for a client. Then, it generates invoices automatically based on your entries. This option adds automation to billing, even if it’s not a recurring bill situation.

Whatever your business, you can help your cash flow and take some duties off your plate when you automate billing. QuickBooks Online helps you create and send smart invoices that help you get paid 2x faster. Try it free today.