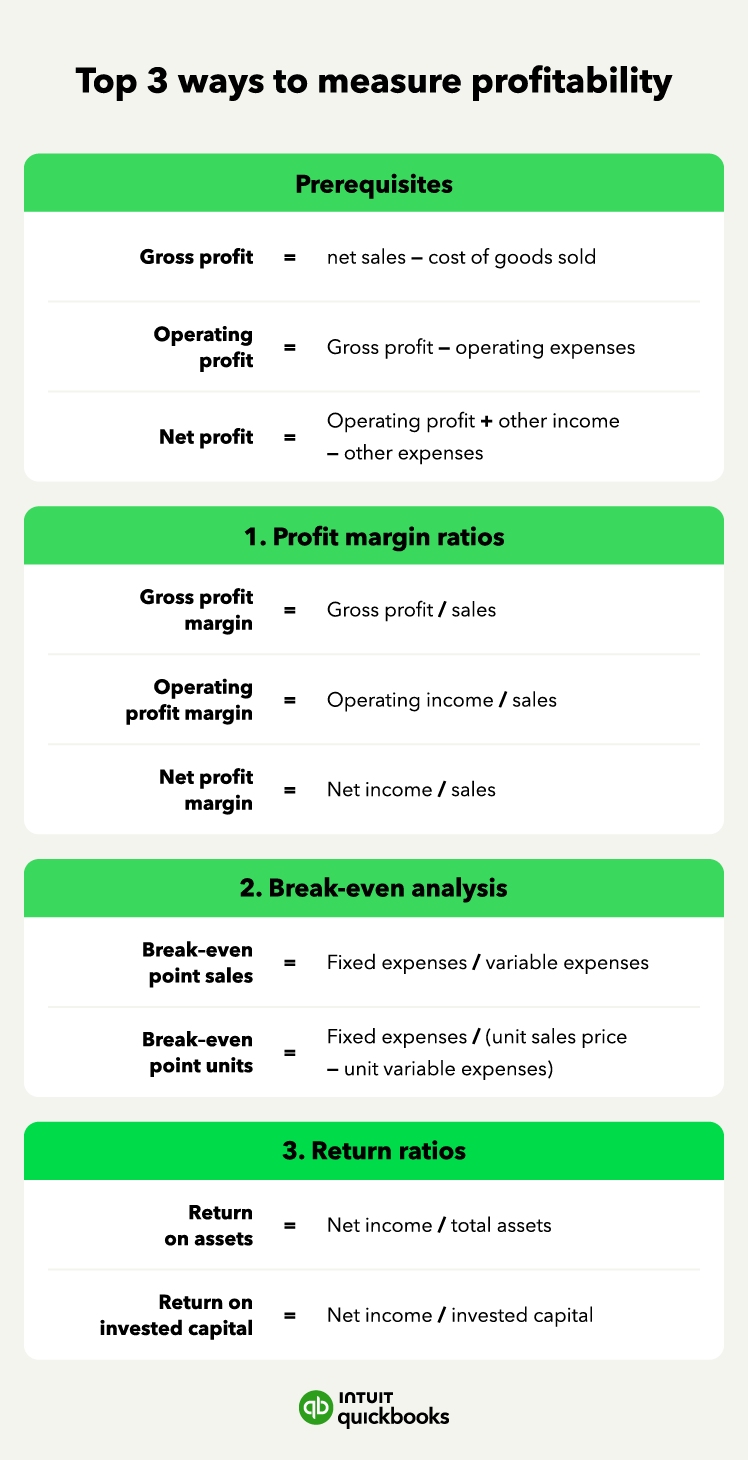

The next step is to turn these calculations into ratios. Ratios are useful because they're a better predictor of health and long-term growth than a simple dollar figure.

Here are three ratios you can use to get a more accurate understanding of the inner workings of your business.

Gross profit margin ratio

Your gross profit margin ratio measures what percent of your selling price is a profit.

Gross Profit Margin = (Gross Profit/Sales) x 100

Let's look at a simple example. Say you run a cleaning company. Your business makes $10,000 cleaning houses, but you spend $5,000 on cleaning supplies.

Step 1: Gross Profit = Net Sales - COGS

$20,000 - $5,000 = $15,000 in gross profit

Step 2: Gross Profit Margin = (Gross Profit/Sales) x 100

($15,000/$20,000) x 100 = 75%

This tells you that out of every dollar you make cleaning houses, 75% of it is a profit after covering your costs.

Operating profit margin ratio

While gross profit margin ratio looks at profitability, it doesn't consider all of your operating costs.

Your operating profit margin ratio takes into account the cost of your cleaning supplies as well as other operating expenses, like the cost of advertising and marketing, insurance, or hiring an employee to help you keep up with your clients.

Operating Profit Margin Ratio = (Operating Income/Sales) x 100

Let's say you spend another $3,000 per month on operating expenses.

Step 1: Operating Profit = Gross Profit - Operating Expenses

$15,000 - $3,000 = $12,000 operating profit

Step 2: Operating Profit Margin Ratio = (Operating Profit/Sales) x 100

($12,000/$20,000) x 100 = 60%

Your operating profit gives you an idea of how efficient your company is. You can use this number to compare your business to your competitors in the industry.

This is also the best ratio to measure the ability to turn sales into pre-tax profits.

If you find your operating margin is stagnant over time, this can indicate an increase in operating expenses.

Net profit margin ratio

Net profit margin, also referred to as "profit margin," is the big-picture view of your profitability.

Certain industries such as banks, insurance companies, and real-estate companies tend to have sky-high profit margins, while other industries are more conservative.

You can use standards in your industry as a benchmark. Comparing your net profit margin every year can help you evaluate your company's performance.

Net Profit Margin Ratio = (Net Profit/Sales) x 100

Your net profit margin ratio accounts for all of your costs. In addition to your operating costs, it also considers any interest or taxes.

Your net profit margin ratio tells you how much profit you have after considering all of your expenses, including paying off any debts or taxes.

Let's say you spend another $1,000 per month on debts and taxes.

Step 1: Net Profit = (Operating Profit) - (Other Expenses)

$12,000 - $1,000 = $11,000

Step 2: Net Profit Margin Ratio = (Net Profit/Sales) x 100

($11,000/$20,000) x 100 = 55%

This means your actual profit after taking care of your operating costs and all other expenses is 55%.