Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

My sales tax is not appearing in my Sales Tax Payable account. HST is, but PST is not. I have been tracking the PST paid in my bill line items, and have been advised to include them on the sales tax liability account.

I have HST and PST items, I have the sales tax codes, H and P set to their respective items. I can print a P Sales Tax report from the Sales Tax List. From the Item List, i can print an Item report for HST, but the same report for PST is empty. Similarly, the PST is not appearing in my Sales Tax account.

What have i not connected properly?

Solved! Go to Solution.

Hello again, Lukes_mum.

I'm glad to see you were able to find where some of your troubles were with your sales tax items. Great job! Thanks for including your latest screenshot for where you're expecting to see a ledger account.

Here's how you can change the account the PST on Purchases sales tax item is associated to. I recommend speaking with an accountant first to learn how this may affect your books.

I hope that helps!

I'm also going to touch base with the rest of my team to ensure we're reviewing posts and the products customers have said they're using. I want to make sure we're able to help resolve issues and respond to questions as quickly and efficiently as possible!

Welcome back, Lukes_mum!

It's great to see your name pop up in community again and I hope QuickBooks Desktop is still working well for your business.

You have great attention to detail, and with what you're describing I'd like someone to take a look at the setup to make sure everything is as it should be. For instance, if the default PST code created by QuickBooks Desktop was deleted and set up again, there may have been an error during the set up process the second time around.

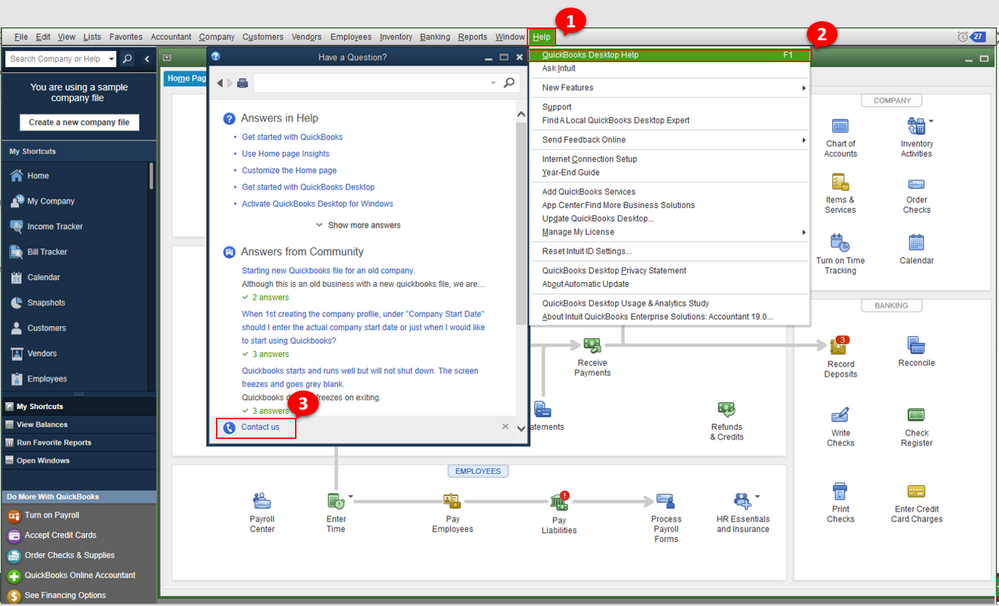

Another thing to consider is your tax codes. You mention HST, for instance. As a combined PST + GST tax code, the two portions of the code will always track to the HST/GST payable account instead of the PST being separated out. Learn more about how sales tax works in QuickBooks Desktop by pressing F1 on your keyboard to bring up the Have a Question? window. Click the Help tab, then the Search button to bring up the search bar. Type in keywords to find related articles. Here's an article from the Government of Canada website about sale tax: Overview of charging and collecting sales tax

One other thing to check before you call in is whether the PST account was accidentally made inactive or deleted. The quickest way to bring up the chart of accounts is to use the shortcut CTRL + A. From there, check the box at the bottom to Include inactive. You can use the search bar to search for the PST account specifically. You can make an account active again by right-clicking on it and choosing Make Account Active. If it was deleted, you'll need to recreate it and then make sure you tax codes are tracking to this new account.

For further troubleshooting, give phone support a call at 1-877-772-9158. Agents are available 24/7 for Pro and Premier users. Enterprise and ProAdvisor users can reach support from Monday to Friday between 9 a.m. and 8 p.m. ET. Here's more about support: Intuit QuickBooks Desktop software support policies

I hope that helps! Have a wonderful weekend. :)

Hi Laura -thank you for the useful advice and links. I use the P in cases like insurance, which only charges provincial tax.

As far as setup, maybe you can spot something? I've included both the P and H info, for comparison. I've also noticed that for P, the tax is built back into the amounts in the P&L.

It's nice to have you back here, @Lukes_mum,

Your set up looks fine. However, PST it is not reflecting the reports, you might want to review the transactions one at a time. There are instances when incorrect sales tax codes are assigned to them or to the item.

To drill down the report, click to open each line item and manually make corrections by adding the correct tax code. If it is set up right, I would do LauraAB's suggestion to contact support for further assistance.

They can review your tax set up and provide an in-depth detail why this is happening. Check out the steps below to get our contact information:

Please feel free to post an update here on how the call goes. I am here if you need help with QuickBooks. Have a great weekend!

Hi - Thank you both for your help. Just by chance something caught my eye, so i investigated further. There were innumerable (:smileylol:) Sales Tax Items, most of which were turned off. I discovered one of these inactive items was the one P was referenced to. I think that has solved that problem.

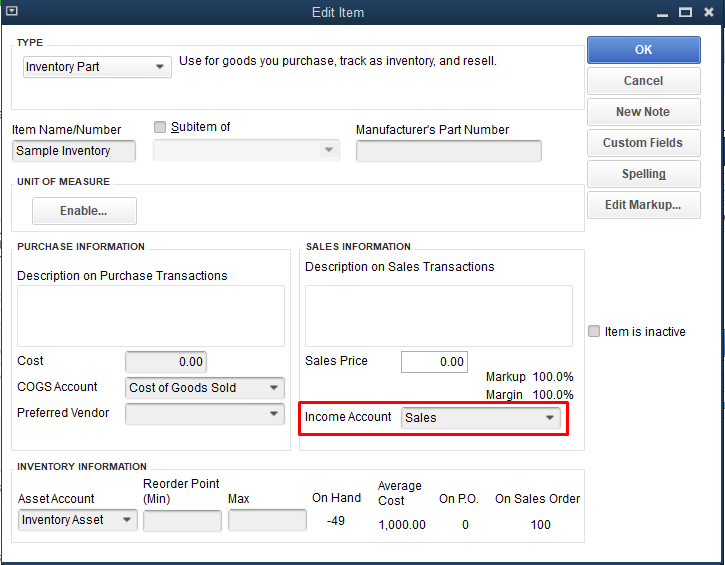

However, this other PST Item uses a different sales account - 3500 vs the 2200 I want. can I reassign the account, and if so, where?

Welcome back to our forums, Lukes_mum,

Definitely! You can assign a sales account posting directly on the product/service item. Perform the steps below to update them:

QuickBooks Desktop:

Any sale from this item will automatically post on the new account.

Please update me if you have any other questions about this topic. You have me here to assist you further. Have a nice day!

Hi Jen_D - I'm using QB Desktop. Could you help me with that one? and just to clarify, I want to assign the Leger Account the sales tax gets written to -

Hello again, Lukes_mum.

I'm glad to see you were able to find where some of your troubles were with your sales tax items. Great job! Thanks for including your latest screenshot for where you're expecting to see a ledger account.

Here's how you can change the account the PST on Purchases sales tax item is associated to. I recommend speaking with an accountant first to learn how this may affect your books.

I hope that helps!

I'm also going to touch base with the rest of my team to ensure we're reviewing posts and the products customers have said they're using. I want to make sure we're able to help resolve issues and respond to questions as quickly and efficiently as possible!

Thank you again for all your help.

Hi,

Why won't it let me double tap on the agency name. If I press on it a breakdown of GST and PST shows up.

Hope to hear from you soon.

Thank you

Hey there Bottle,

Thanks for chiming in on this thread. To ensure your QuickBooks Desktop file is running as designed, I recommend using the QuickBooks Tool Hub to fix common errors. Once this has been completed, follow these steps;

1-Select Sales Tax from the top menu bar

2-Choose Manage Sales Tax On the Tax Accounts and Payments page

3-Double-click on the Agency

4-Select the Sales Tax Settings tab

5-Check the box Track tax on purchases separately to and use the ▼ dropdown menu to choose the appropriate account, Click OK to save.

If you require further assistance, I recommend reaching out to our support team outside of the Community. They'll be able to verify your account details in a secure setting, as well as view your screen to better assist you. You can reach them by following the method in this link.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here