Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI see several customer accounts that showing credit balance in A/R aging report. But when I go to the account, the balance is zero, no credit. There are some old inactive accounts and I thought I will clean them up but I don't understand this. There is no outstanding invoice to offset, just a credit amount.

Let me help you figure out why you see an open balance to your Accounts Receivable Aging report, @suepark268.

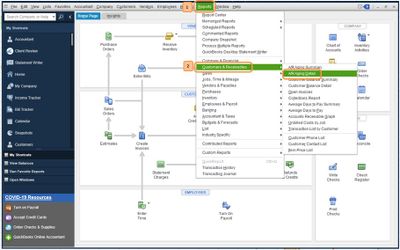

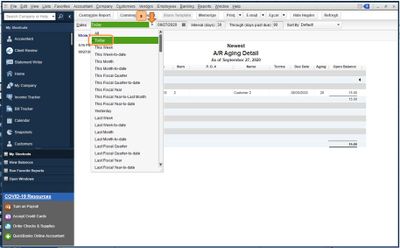

What's the reporting period you've pulled up? When running this report, we'll have to modify the date to Today to list each customer's current outstanding balance. This way, we can identify the customers that have active payables as of today and the number of days they have been outstanding. I'll show you how.

Once done, that should conform to customers' account balances. Refer to these articles to learn more about running an A/R Aging report and how to write off uncollectable balances:

Please let me know how it goes or if you have any follow-up questions. I'll be here if you need further assistance. Have a wonderful day, @suepark268!

Hi Liera,

Thanks for your input. Perhaps I did not explained myself clearly. The date on my report is Today as it is the default setting. And changing of the date does not change what I am having issue with.

I know sometimes there can be un-paid invoice with credit that offset each other and I can use the credit to pay the invoice.

What I am having trouble is that, in the A/R report, there are some customers that show credit balance as if they over-paid when the fact is that there is not any over payment. When I go to the customer account, it shows zero balance. However, the strange thing is that under customer information on the right side of the screen, it shows credit open balance. So, on the left side where all the customers name appear with their balance, it shows zero. But if I click on the customer 's name under the customer information shows open credit balance. The credits showing in these accounts represent one payment that should have paid the corresponding invoice.

I hope you can see what I am saying here. Thanks for your help.

Thanks for adding additional information about your concern, suepark268.

I'll make sure that you can get accurate reports at the end of the day.

The unusual behavior that you've encountered is a sign of data integrity issues. We can utilize the Verify and Rebuild tools to scan your company file and fix the data issue right away. Here's how to use it:

If the tool finds no error, then everything is fine with your company file, and no further action is needed.

If you find that your data has lost its integrity, we'll have to run the Rebuild tool to fix the damage. Feel free to follow these simple steps:

Additionally, here's an article that you can read to help streamline the reporting process and get the most out of QuickBooks’ financial reporting capabilities: Customize Reports.

As always, you can find me here if you have further questions or any other concerns. Have a great rest of the day.

Thank you KlentB for your response. I ran the Verify Data and found no problems with the data.

Due to these credit balance showing in some customers, the total amount of A/R is lower than what it should be. However, my Balance Sheet shows the correct amount which means I can leave it as is. But it just bothers me not knowing the reason.

Thanks,

I am having the exact issue with AP

Hello Ann,

Thanks for posting this reporting concern here in the QuickBooks Community. Chiming in to share additional insights for this discrepancy in the Accounts Payables balance.

The information you see on your financial reports is based on the report settings. Make sure the dates and the accounting method used is correct before running the data.

In your case, you can review the entries under accounts payable by clicking on the amount that shows the discrepancy. It will open the transaction list and you can run through the transactions and find the root cause. Sometimes, what causes a credit balance for A/P are overpayments or unapplied payments.

If the transaction detail matches correctly and the bill payments are applied, try to follow KlentB's suggestion to run the Verify/Rebuild Utility tool. This will diagnose and identify any data issues that causes the report to show incorrect data.

Please visit us again if you have other concerns with the processes in the program. I'll be right here if you need further assistance with the reports in QuickBooks too. Have a nice day!

I'm having the same issues with both aging reports...did you find a solution?

Nice to have you join this thread, @MHJ17.

I'd like to help and fix the issue you're having with your reports. To narrow down this matter, did you performed the troubleshooting steps shared by my colleagues above?

If not, I recommend performing them to get around this issue. If you have and the issue persists, I suggest updating your QuickBooks Desktop (QBDT). This way, we can guarantee the program is running with the latest feature and fixes.

I'll show you how:

Then run the Verify and Rebuild tool to fix any errors with your company file.

Once done, you might want to check out these articles that can help you manage your reports efficiently. These contains details on how to modify and access your reports outside QBDT:

I'll be around if you need more help running your reports in QBDT. You can also add in to your reply if you have any other QuickBooks concern. Keep safe and have a good one!

I had this exact problem as well. After lots of investigation, I realized that the invoices that were being paid off (by the Credit memo) were invoices that were dated into the future. As a result, when you pull an A/R Report dated today,...it will not (or does not) capture the future invoices (that are after the report date).

As a potential workaround. I've accelerated the date of said future invoices (to date of credit). This (to me) seems like an unnecessary step.

A better approach would be if the report would not pick up credits that have been applied to future invoices (as they aren't really outstanding A/R) .

For some evidence of my point of view,....,, we use a separate Revenue Accounting System (that pulls from our exact same QB general ledger) and that system does not have this same reporting problems in their A/R report.

I had this exact problem as well. After lots of investigation, I realized that the invoices that were being paid off (by the Credit memo) were invoices that were dated into the future. As a result, when you pull an A/R Report dated today,...it will not (or does not) capture the future invoices (that are after the report date).

As a potential workaround. I've accelerated the date of said future invoices (to date of credit). This (to me) seems like an unnecessary step. A better approach would be if the report would not pick up credits that have been applied to future invoices (as they aren't really outstanding A/R) .

For some evidence of my point of view,....,, we use a separate Revenue Accounting System (that pulls from our exact same QB general ledger) and that system does not have this same reporting problems in their A/R report. To me this is a flaw in the report as I don't want to know about a Credit if it's already applied to a future invoice.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here