Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi there, nutesnoodle,

I can share some information about S-Corp Owners Health Insurance in QuickBooks Online.

Presently, QuickBooks enables you to set up and record S-Corp health insurance in your online payroll account. However, there isn't any automation for our system to allow S-Corp to pay your health insurance provider.

You'll need to get in touch with your health provider for your payment options.

Also, your S-Corp Owners Health Insurance is reported in Box 1 and the $ amount in box 14 with "S CORP OWNER". You just need to make sure you add the item to the employee. Here's how:

You can check out this article to know more about setting up S-corp: S-Corp health insurance

That should do it, nutesnoodle. Please notify me if you need further assistance. I'll be more than happy to help you anytime. Have a good one!

Setting this up is easy enough, but at step 7 I have a question. I can not find any examples online of how the "recurring amount" is distributed. Can I just put the whole monthly premium into the recurring amount box, or do I need to break it up over a 26 week period?

For example, if the monthly premium is $500 can I just put $500 in the box? After the first pay check will Quickbooks know not to implement this payment again until the next month? Or do I have to take the annual premium divided by the number of pay periods for my S-Corp? [(500*12)/26] = $230.77. Do I put this amount in the recurring payment box?

Let me help you set it up, Jhovenden.

The amount entered there depends on the employee's pay schedule/period. It means that you'll have to enter $230.77 in the box. Although, it's optional. You can enter the amount every time you create a paycheck for your employee.

Then, you can pull up any payroll reports, like Payroll Summary or Payroll Detail to check how much the employee paid already. Click Reports and enter the report's name in the Find report by name field.

If you have more questions, you can keep in touch with us. We're just around to help you.

I added the S-corp health insurance and when I run payroll it shows in the payroll, but, when I preview the payroll, the direct deposit amount doesn't show the additional funds. Is this supposed to be paid seperately?

Thanks for joining this thread, Egj13. I can help you figure out why S-Corp Health Insurance doesn't show on your Direct Deposit.

Let's check if you've added S-Corp Insurance as a regular pay type on your payroll. Here's how:

The following steps should let your S-Corp Insurance appear on direct deposit.

To learn additional details, check out add or change pay types in Online Payroll.

Please tag me in a comment if you have any additional payroll concerns. I'll be right here to help.

@GlinetteC thanks for the reply!

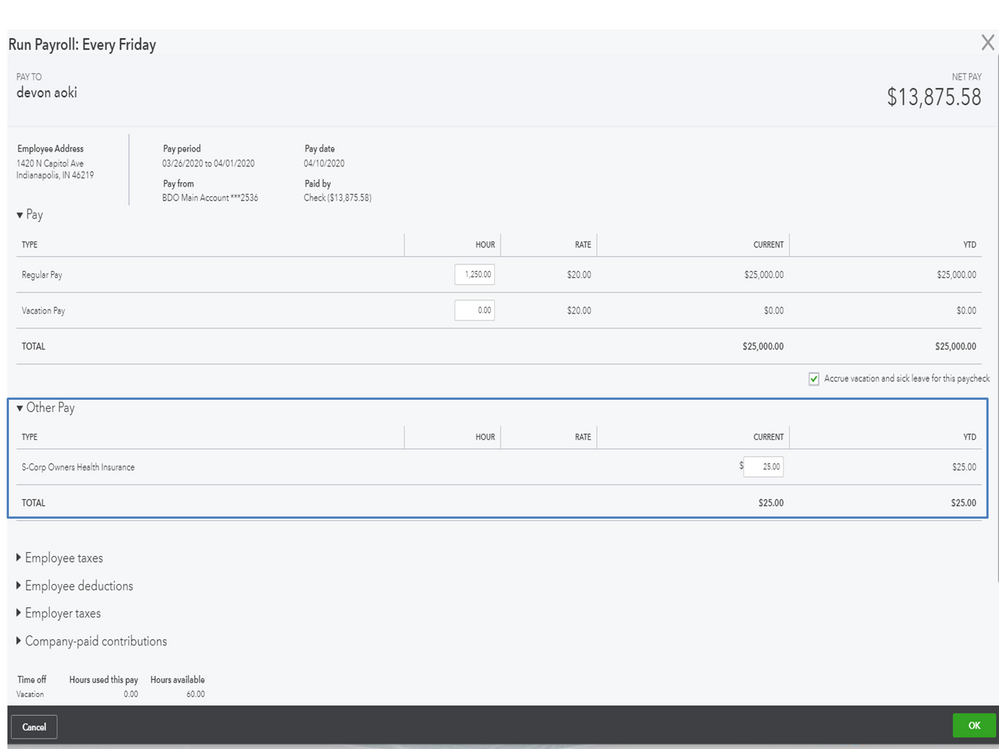

I had already followed the steps above. Here are some screen shots of what I am asking in the attac

Let me help you from here, Egj13.

I'd like to know more about this, though. How did it go after trying the steps provided by my colleague? Did it show on the Direct Deposit payroll?

Also, we're unable to see any screenshots or any attachments on your post. Please click the Camera icon to add your screenshots when you reply. Or, click the Paperclip icon to attach any links.

You can always get back to this thread with more information. We'll reply as soon as we can.

@Kristine Mae sorry, here are the files. You can see in the first that I added the insurance. In the 2nd, it shows that it was added. In the third, when run the preview, the net pay does not reflect the additional $350. Will it not process in the same transaction? Do I have to pay this separately? If yes, do I then enter the additional payment as a separate expense?

I appreciate the screenshots you've provided, Egj13.

Let me share some insight about S-corp owner's health insurance in QuickBooks. The S-Corp owner's health insurance will tax the amount but not include it in the employee's Net pay. The tax tracking type typically used for this payroll item is S-Corp Pd Med Premium.

To learn more about recording S-Corp health insurance, you can refer to this article: Set up and record S-Corp health insurance.

You’re always welcome to visit the Community if you any questions about QuickBooks. Please know I’ll be right here to make sure you're taken care of.

Thanks for the help.

So I need to process two checks to the employee then? One for their pay and one for their healthcare? How do I track the second payment for healthcare?

Allow me to jump in on this thread, Egj13.

I'm here to share additional details about the S-corp owner's health insurance. You don't need to create two checks for your employee's pay and for their health insurance. In QuickBooks, you can enter the amount for the insurance when you run payroll.

There are three ways on how to record S-Corp health insurance, and we've listed them in this article: Set up and Record S-Corp Health Insurance.

Additionally, I've included an article that'll help learn more about how pay types affect your employees: Supported Pay Types and Deductions Explained.

You can always get back into this post if you have more questions. I'll keep an eye on your response. This way, I'll be able to assist you immediately.

@CharleneMaeF thank you for jumping in!

In the screen shots above, when I preview payroll the net amount doesn't include the insurance amount. So I'm assuming the payroll deposit will be the net amount. Are you saying that the payroll deposit will be the net amount plus the insurance amount? If so, why doesn't QB show this somewhere?

I am learning about the S Corp pay and am curious about the answers to Egj13's questions. I have been searching QuickBooks community everywhere and there is very limited information about how exactly the S Corp pay works.

Hey there, SB91.

Thanks for stopping by the Community. I'm happy to help you out today. With S-Corps, you need to run your own monthly or quarterly estimated tax payments. If you're self-employed you pay both the employer and employee portion of the social security and medicare tax. I'm including a few helpful articles for you to check out down below.

If there's anything else I can help with, feel free to post here anytime. Thanks for dropping by and have a nice afternoon.

Hi, I don't feel as if the question about S-Corp has been completely resolved. I undersant that I need to set-up and record S-Corp health insurance via one of three options as per AileneA response. However, it does not appear that the S-Corp Insurance premium which I am trying to run in my payroll is being added to the direct deposit.

Is there a clear answer here? Is there a means by which I can add the premium to the direct deposit (what I want), or do I need to cut a separate check for the premium pay out?

Thanks for following this thread, jhovenden.

I appreciate following the steps shared by @AileneA and sharing with us the result. We’ll have to open the paycheck and review the payroll information.

When a payroll item is a setup in QBO, the amount added or deducted should show on the paycheck or direct deposit. For your S-Corp Insurance, let’s go to the Other Pay section to review check the amount.

Here’s how:

If the amount doesn’t show, let’s open the Employee details for the worker and review the pay types added. I've included a screenshot for visual reference.

Otherwise, we’ll have to add the pay type again and make sure it’s associated with the correct employee. I suggest following the steps shared by my colleagues above.

For future reference, let me share this guide that contains resources to help prepare for the year-end filing for taxes, forms, and your books: QuickBooks Online year-end guide and checklist.

Keep in touch if you need more help with QBO. I’ll be right here to assist further. Enjoy the rest of the day.

Hey Rasa-Lila, thanks for the response.

I have everything set up as you have pictured, and the 'S-Corp Health Insurance' does show up under 'Other pay' on the pay stub. However, the amount being deposited directly into the employee's account does not include the health insurance premium.

I am asking if there is a way to get that amount directly deposited in addition to the normal salary or if I have to cut the employee a check for that payment? As things are now, the employee's gross wages less taxes (i.e. Net Pay) is the ONLY monies being deposited into her account. The additional 'S-Corp Health Insurance' is being recorded by QuickBooks and on the sub, but it is NOT being added to the direct deposit or Net Pay amount.

Can you provide more clarity on this?

Hi there, @jhovenden.

I'm here to share additional details about the S-corp owner's health insurance. You don't need to create checks for your employees to pay and for their health insurance. In QuickBooks, you can enter the amount for the insurance when you run payroll.

There are three ways on how to record S-Corp health insurance:

Here's how to record the S-cop as an Employee tax loan:

1. Select the Workers tab.

2. From the Run Payroll drop-down, select Fringe benefits only.

3. Select Yes, my business will pay the taxes. (By selecting this option, we will record the amount of employee tax as a loan, you will need to enter a repayment amount as an Employee Tax Loan deduction.

4. Change the Adjustment Date if necessary.

5. Select Preview Payroll.

6. Review the Fringe Adjustment then, select Submit Payroll at the bottom.

You may check the other options on how to record S-corp by visiting this article with the detailed steps: Set up and Record S-Corp Health Insurance.

Additionally, I've included an article that'll help learn more about how pay types affect your employees: Supported Pay Types and Deductions Explained.

You can always get back into this post if you have more questions. I'll keep an eye on your response. This way, I'll be able to assist you immediately.

I have a similar question. I have just found out I need to enter this for our shareholder/owner. As we are in the middle of March should I divide the premium for the entire year (including premiums from Jan-to date) in the recurring total moving forward so that the entire year of premium is accounted for come next December? Is there a way to just enter the total amount as a year item rather than per paycheck? Or should I just start at the next paycheck what that semi-monthly premium would amount to without accounting for previous months?

Thank you, appreciate your help!

Hello @A User 2,

Let me help share how you can enter health insurance in your employee's paycheck in QuickBooks.

Normally, it is recommended to enter the insurance in each paycheck for your employee to avoid messing up the calculation of your taxes. But, you have the option to enter the total amount of the insurance as you create the last paycheck for your employee this year.

When ready, this article will give you the steps based on the set which best describe your situation: How to set up S-Corp health insurance in your Online Payroll account?

Additionally, I've also included this reference for a compilation of articles you can use while working with us: Help Articles for QuickBooks Online Payroll.

If there's anything else that I can help you with, please let me know in the comments below. I'll be here to lend a hand.

Hi @jhovenden . Did you ever get the answers you needed? I am in the same situation. It's recording the s-corp shareholder's health ins as a liability, and not actually paying it out on his paycheck. I thought since it's under an "Other Pay Type" it would pay it out, or at least have that option. Whatever you can share with me would be GREATLY appreciated! Even a link to another response would be great. Thank you!

The question in this thread was asked several times, without a good explanation, about why the S-Corp owner's health insurance premium isn't included in the net pay, it only shows as other pay. The purpose of using the S-Corp owner's health insurance premium pay type in payroll is to allow the premium to be taxed and reported as wages on the W2 and on the P&L.

If you want to reimburse the owner through payroll for the premiums they paid personally, you would add another payroll item called something like Health Insurance premium reimbursements, which would increase their net pay. But you have to remember to map that reimbursement item to the same account the S-corp owner's health insurance premium is mapped to in payroll settings. (i.e. S-Corp liability account)

In payroll settings, map the S-corp Owners Health Insurance to the S-corp liability account. Then when the medical premiums are paid by the S-corp, (either through reimbursement in payroll as mentioned above, or by a separate check to the owner or health insurance company), be sure it is posted to the same S-corp liability account, reducing the liability to zero, washing it out.

"Health and accident insurance premiums paid on behalf of a greater than 2-percent S corporation shareholder-employee are deductible by the S corporation and reportable as wages on the shareholder-employee's Form W-2, subject to income tax withholding. However, these additional wages are not subject to Social Security, or Medicare (FICA), or Unemployment (FUTA) taxes if the payments of premiums are made to or on behalf of an employee - The bottom line is that in order for a shareholder to claim an above-the-line deduction, the health insurance premiums must ultimately be paid by the S corporation and must be reported as taxable compensation in the shareholder's W-2."

I'm an S-Corp company that pays the owners insurance directly with the group insurance premium, but needs to be recorded in wages. Not re-reimbursed. The owner does not pay for the insurance. I've been told that that amount needs to be recorded in Box 1 wages only as per federal regulations, not box 12. I am still unclear how to set up this S-Corp Owner's health insurance and have it record correctly. And there is no S-Corp Owner's health insurance to select. I would think that Quickbooks should have that automatically since that is the proper way to record on w-2 per fed's. I am told through conversation with tech that it should show at year end. If not, when the preview w-2's come out, I can call and have them manually change it. I have little faith that it will compute properly since there is no way to designate in the employee profile that they are XX% owner of company.

For the health insurance premium to show on the W2, in the employee settings in QBO, under "Pay Types", and under "Additional Pay Types", select S-Corp Owners Health Insurance, and enter the amount of the premium. Just be sure to Map this in payroll settings to the correct Chart of Accounts.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here