Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI didn't set up the chart of accounts. I have a line of credit that was entered as a bank when it should have been entered as a long-term liability. When I try to change it, i get this following error.

"This account is being used on a Check, Deposit, Payment or other transaction where an account of type 'Cash' or 'Undeposited Funds' is required. You must locate and change those transactions to use a different Cash account before you can change the Account Type of this account. To find the transactions using an Account, run an Account QuickReport, or use the Account Register."

What? what should I be looking for. Payment are made to the line of credit from the operating account, from the owners personal equity, etc. How do I track down the offending account and get this properly assigned?

Solved! Go to Solution.

You can use a long term liability account for a line of credit (LOC), but I prefer to use a credit card type account for that. It just makes it easier to show the withdrawal against the LOC and payments and interest, not to mention reconciling the account with monthly statements. And liability accounts do not always show as a choice for transactions. But which ever you choose ...

Create the new account for the LOC

run a report on the old LOC account

click on each transaction and edit it, change the account at the top to the new LOC account and save

then make the old LOC account inactive

Hello there, @paulapallo.

I can help you change your line of credit to long-term liability in QuickBoks Online.

The error message you're getting typically occurs if you have transactions attached to the account that you're trying to change. To be able to change account to long term liability, you'll need to delete the opening balance or other transactions associated to it.

Once done, you can now make changes to the accounts in the Chart of Accounts. I'd be happy to show you how:

Please reach out to me if you have more questions about this. I'd be more than happy to answer them for you.

You can use a long term liability account for a line of credit (LOC), but I prefer to use a credit card type account for that. It just makes it easier to show the withdrawal against the LOC and payments and interest, not to mention reconciling the account with monthly statements. And liability accounts do not always show as a choice for transactions. But which ever you choose ...

Create the new account for the LOC

run a report on the old LOC account

click on each transaction and edit it, change the account at the top to the new LOC account and save

then make the old LOC account inactive

I agree, create the new correct account, move transactions, make old account inactive if in QBO or delete in Desktop. Even when an account has never had transactions QBO only allows you to make it Inactive, not deleted

Thanks for the credit card suggestion. I just never thought of that, but, it was easy as pie to change the LOC from Bank to Credit Card and it will NOW show up in the correct place on the balance sheet. Thanks for the ridiculously simple solution.

How do you see interest when using a line of credit as Credit Card? do you manually add this because It does not generate for me. My interest is included in the automatic payment.

I created a new expense account (6410-00). It shows up around account 4400-00. How do I bring it down so it's located under account 6400-00. Thanks. HR

Thanks for joining on this thread, @9875.

I’m here to help make sure expense account 6410-00 is located under the 6400-00 account. You can change the order in just a couple of minutes.

Here’s how:

I've attached a screenshot on how the account number's arrangement looks like after following these steps.

For future reference, here’s an article that can help keep your accounts organized and easy to find. It also contains links that will guide you on how to hide an account: Use account numbers in your chart of accounts.

Stay in touch if you have any clarifications or other concerns. I'm more than happy to answer them for you. Have a great rest of the day.

I get this so far but when i look to do this, it says there are 128 pages of transactions.... do i need to go in and re classify each of these to the new account? also do I then have to reconnect the bank account to this new account? If so do i then have to add each one and reconcile all over again?

this sounds like an incredible amount of work. any help would be appreciated.

Thanks for joining this thread, @Clearvision12.

If you're recategorizing all transactions from your old account going to the new account, you can edit the old account category with the new one. You have the option to update the category of an account in COA, depending on what type of account you'll be changing it to.

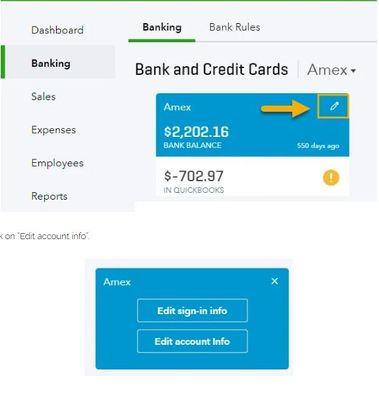

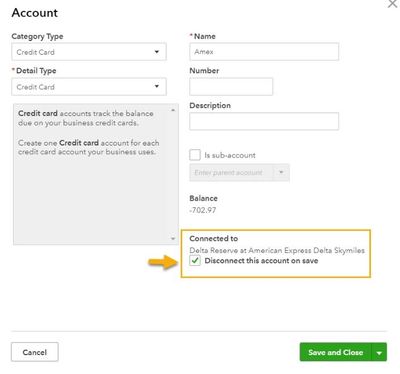

If it's connected to online banking, you'll have to disconnect it first so that we can make the necessary changes to it. Once done, reconnect the bank to the account. Not to worry, you won't need to reconcile all over again. Let's get started.

Here's how to disconnect an account connected to online banking:

Then, here's how to edit the account:

After that, go back to the Banking Center and reconnect the new account to QuickBooks Online.

Before doing the process, you'll want to reach out to your accountant for additional advice with regards to this matter.

In case you're having problems downloading or getting an error, check out this link: What to do if you see a bank error or bank transactions won’t download.

I'm always here if you have additional questions. Have a beautiful day!

thank you so much I have changed this to be a credit card account as someone above mentioned and it seems to have connected back to the bank etc. Thank you so much for your help on this. Hoping this is what works. Have a great day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here