You’ve made an excellent choice reaching out for assistance with your accounts receivable aging report, Cjentzsch. Let’s get it done in QuickBooks Online!

While QuickBooks Online (QBO) doesn't have a dedicated report named Accounts Receivable Aging by Customer, we can easily create one using the Accounts Receivable Aging Summary report. This report can be customized to provide a detailed breakdown of your accounts receivable, organized by customer name and categorized into aging buckets.

This customization will allow you to clearly see outstanding balances and how long they are past due. I’ll guide you through the modifications to ensure a seamless process.

Here's how:

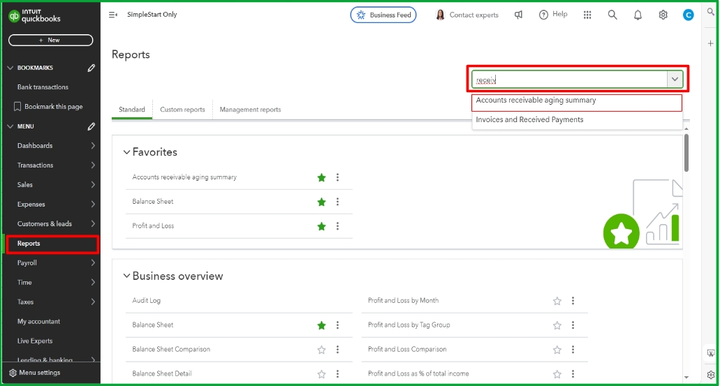

- Go to Reports in the left menu

- Search for and select Accounts Receivable Aging Summary report.

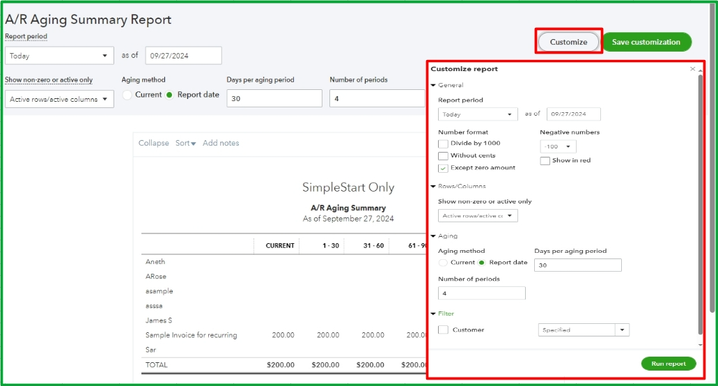

- Click Customize at the top right.

- In the Filter dropdown, choose if you want to specify the customer.

- In the Aging dropdown, set aging to your desired aging buckets.

- Under Columns, uncheck any other columns you don't need

- Click Run Report.

I've included screenshots for visual reference:

If you need more information to see which customers have past due balances and how long each transaction is past due, you can run an A/R Aging detail report. The report is available in any QBO version.

Additionally, you can easily export these reports to Excel for further analysis or team collaboration, allowing for in-depth examination and the flexibility to modify the data as needed.

Moreover, I'd like to share these resources to help you balance your accounts and personalize your reports in QBO. One article provides tips on customizing reports to fit your business needs, while others cover managing uncollectible balances. Helping you handle bad debts and maintaining accurate account balances:

The Community Team is always ready to respond and assist if you have questions or concerns about generating a report in QBO or have any other queries related to the program. We encourage you to utilize the Reply button. We're excited to assist you and look forward to supporting your business success.