Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHow can I establish my opening balance after the bank information has been imported?

As an example, My actual opening balance was $100. But The info imported from the bank states as a MEMO that a transaction of $384.53 is my "Opening Balance from Bank". How can I remove this association and choose the correct transaction as the opening balance?

Thnx

Solved! Go to Solution.

Hello @oscortega:

This is one of my pet "peeves" when you hook up a bank feed initially. It goes back 90 days and then it enters whatever the balance is at that time AND it reconciles that transaction (causing a whole other issue). Here is a post I wrote on logging in and connecting the bank for the first time. And the steps you need to follow to remove that unwanted reconciled opening balance transaction.

I hope that helps you. If you need more help, feel free to reach out. Happy Sunday!

Lynda

Hi Lynda,

Thank you so much for sending me the link to your video. I did watch and it was very clear. I simply deleted the opening balance that QBO created. I now have as you did in the video a balance of zero when I go to reconcile.

My question now is maybe a silly one. I opened the bank account with $100. I was assuming (before watching your video) that this was my opening balance. But yoyr video made it claer to me that an opening balance is obviously a zero balance. The first transaction of course is just that...a first transaction. AM I correct? That minimum $100. dollar deposit used to establish a bank account is not an opening balance. It is simply the first transaction recorded?

@oscortega: Not a silly question at all. Yes, the $100 would be your first transaction. The opening balance should be zero the first time you reconcile. Code the $100 from wherever those funds came from. IE, another bank account in your business, you personally (code to your equity account), etc. Typically it is one of those two places mentioned.

Lynda

Hello @oscortega:

This is one of my pet "peeves" when you hook up a bank feed initially. It goes back 90 days and then it enters whatever the balance is at that time AND it reconciles that transaction (causing a whole other issue). Here is a post I wrote on logging in and connecting the bank for the first time. And the steps you need to follow to remove that unwanted reconciled opening balance transaction.

I hope that helps you. If you need more help, feel free to reach out. Happy Sunday!

Lynda

Hi Lynda,

Thank you so much for sending me the link to your video. I did watch and it was very clear. I simply deleted the opening balance that QBO created. I now have as you did in the video a balance of zero when I go to reconcile.

My question now is maybe a silly one. I opened the bank account with $100. I was assuming (before watching your video) that this was my opening balance. But yoyr video made it claer to me that an opening balance is obviously a zero balance. The first transaction of course is just that...a first transaction. AM I correct? That minimum $100. dollar deposit used to establish a bank account is not an opening balance. It is simply the first transaction recorded?

@oscortega: Not a silly question at all. Yes, the $100 would be your first transaction. The opening balance should be zero the first time you reconcile. Code the $100 from wherever those funds came from. IE, another bank account in your business, you personally (code to your equity account), etc. Typically it is one of those two places mentioned.

Lynda

Hi Lynda,

Thank you.

Can you explain what is an Equity Account? Would this simply be your current balance? meaning the end amount of funds regardless of liabilities across multple accounts (if more than one account)?

Or your equity account is the balance after liabilities have been deducted? Becasue liabilites must be factored in and deducted before equity can be said to be equity?

I cannot find a simple, clear definition online. Thnx

Hello @oscortega:

@lynda and Matthew @ParkwayInc here to give you a live discussion on what an equity account is and it's meaning to the business owner as well as its relationship to the other balance sheet accounts.

We hope that helps clarify this mysterious category on the balance sheet. Basically, like Matthew stated, think of it as your "business scorecard". Equity accounts are the financial representation of the ownership of a business. We get into more detail in the video.

Have a wonderful, prosperous week! If you have any more questions, feel free to reach out to us. And if you liked our answer, we would love a cheer or kudo!

Matthew and Lynda

I have a question for opening balance on accounts- is it possible to just have the starting balance on an account without having to affiliate it with another account? And are opening balances really equity? Doesn't equity mean the worth of your business? So if you started quick books with negative worth then your business will always have negative worth? I just don't think the starting balance (at the time you started quickbooks) is a good representation of your companies worth. Is there another account you can use for starting balance instead of Open Balance Equity? Because I know Open Balance Equity shows up on the Balance Sheet and I can't figure out how to zero out that negative amount from OBE. Even if I transfer it to another account then another account will be negative. How can I make it so that the OPENING BALANCES of my accounts don't show up on the Balance Sheet Report?

I wrote my previous question before I watched your video that you posted. Very great informative video!

But I have a new question why does a positive (+) (starting balance in bank account) show up as a negative (-) number when categorized as "other current assets". And negative (-) (starting balance loan on equipment) become a positive (+) number when categorized as "fixed asset" on the balance sheet?

Greetings, @Vitan.

I'll be happy to provide some clarification on this Opening Balance Equity issue. Rather than the worth of your business, Equity is more aptly defined as an individual's worth in the business. This is also often referred to as Capital. For example, if an individual invests $20,000 in the company but also brings in a $10,000 liability, their initial Capital is $10,000 (investment minus liability).

Is it possible to create an opening balance without affiliating it with another account?

QuickBooks Online uses double-entry accounting, so this initial capital is necessary for recording the Opening Balance of new accounts. Generally this only occurs when a new set of books is opened, as any accounts created thereafter can have both ends originate from within the business. For instance, a new bank account can have its beginning balance fed by transferring from an existing account or a loan will contribute its asset and liability simultaneously.

How does this represent my business's worth?

Remember that the Balance Sheet doesn't necessarily represent the wellness of your business, rather it proves that every balance has an origin and is equally and oppositely represented elsewhere in the records. Statements like the Profit and Loss that report income are more adequate for determining your company's success for a given period. Once your decided accounting period has ended and the books are closed, your Net Profit/Loss will flow into Retained Earnings and help balance your Owner's Equity. This way, even if you begin a period with negative equity, it will be increased if the business is doing well.

Much of this information is explained in detail in these resources and I strongly encourage you to check them out:

I also recommend getting in touch with an accounting professional for a personalized opinion. Every business is unique and they can make suggestions for handling those Opening Balances that are a perfect fit for your company. Look into the Intuit Find-A-ProAdvisor site to find certified professionals in your local area that are sure to have the answers you're looking for.

With this information, you'll be an Equity master before you know it. Please know I'm always available here for all of your questions and concerns. Thanks for reaching out, wishing you continued success.

Hi Lynda,

Thank you for the additional video. A lot more information than I expected. LOL.

If I understand correctly, I can delete the opening balance equtiy that the QBO forced in from my inital bank download as per the first video. Then Categorize the $100. deposit (Chk transfer) which came from my personal account to my business account upon opening the business account as "Owners Investment"?

Greetings, oscortega.

Thanks for being part of the QuickBooks family. Helping out with updating your opening balance is my priority.

In cases like this, you’ll need to delete the opening balance equity that QuickBooks forced in from your initial download. Before performing the process, I recommend consulting with your accountant to ensure your records are in ship-shape.

To change the account opening balance:

For future reference, check out this article on how to Change an account opening balance on a bank account.

Thanks for giving me the opportunity to help. I value the success of your business. Have a great day ahead.

Lynda,

I followed your video and deleted the beginning balance that QB generated, but what if I need the beginning balance to be something other than zero?

Your video was very helpful! My issue is an opening balance equity that suddenly appeared, throwing off my reconcile. It is on a Homeowners Association account,so deleting stuff is looked at very suspiciously! Do you have any suggestions for me?

Thanks for joining this thread, @omp-hoa.

The opening balance equity may show on the register for the following reasons:

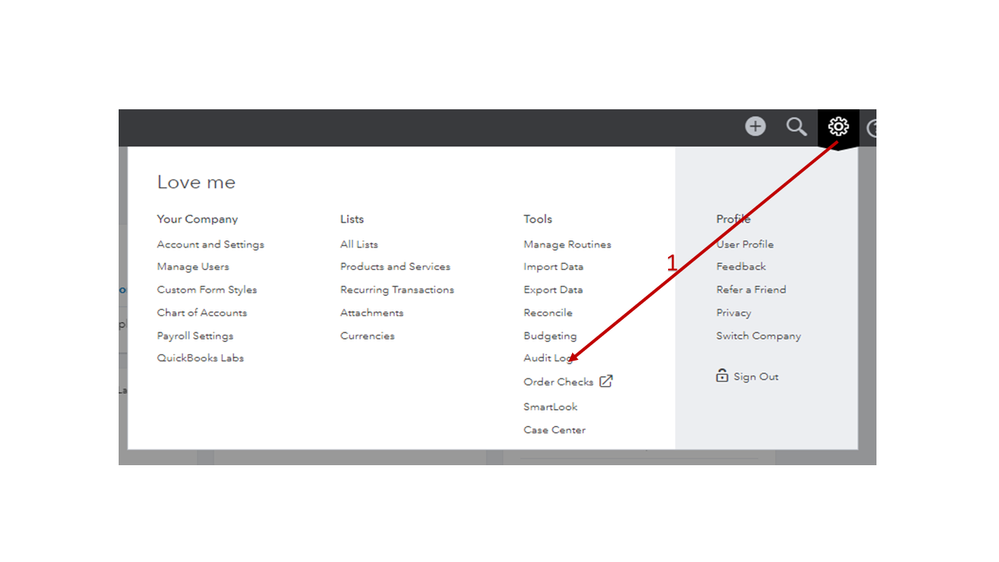

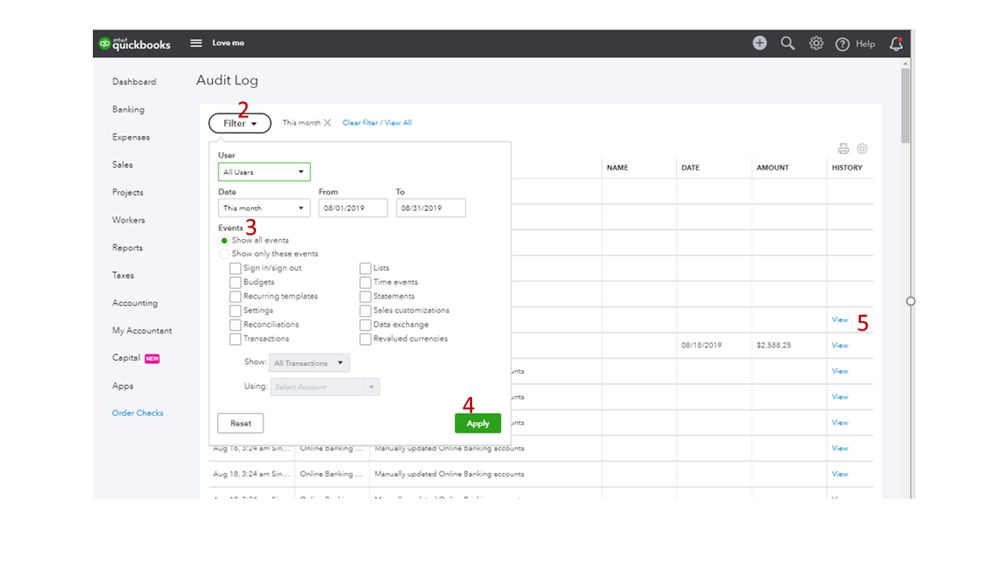

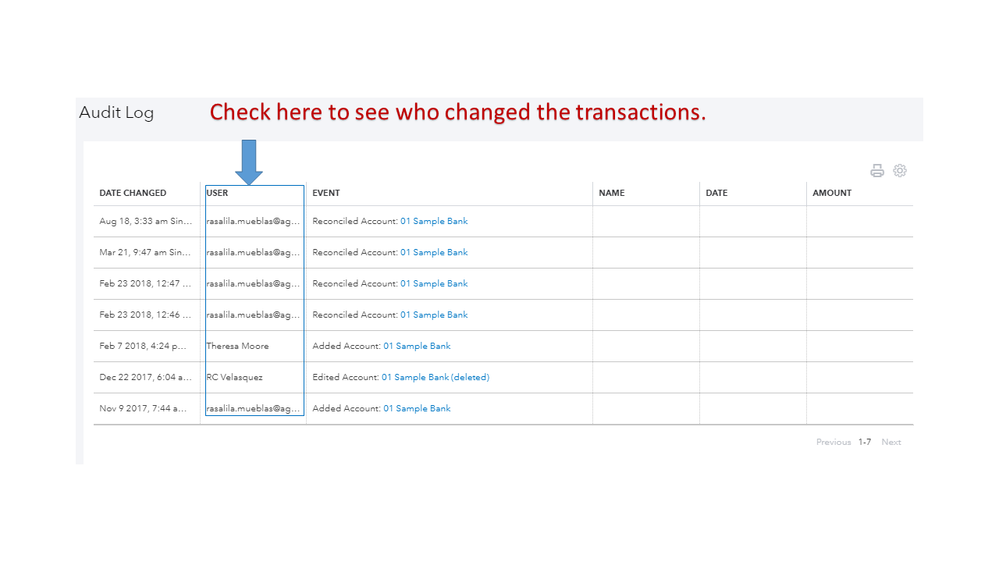

Let's run the Audit Log Report to check who created the account. This is a built-in tool that can help see the history of changes made to transactions and who added them.

I have a few easy steps to open it:

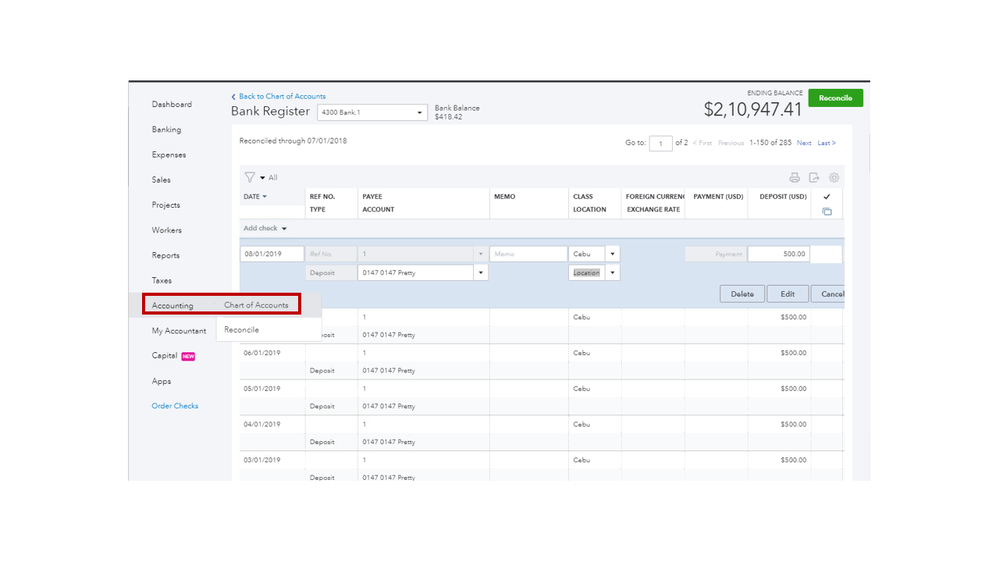

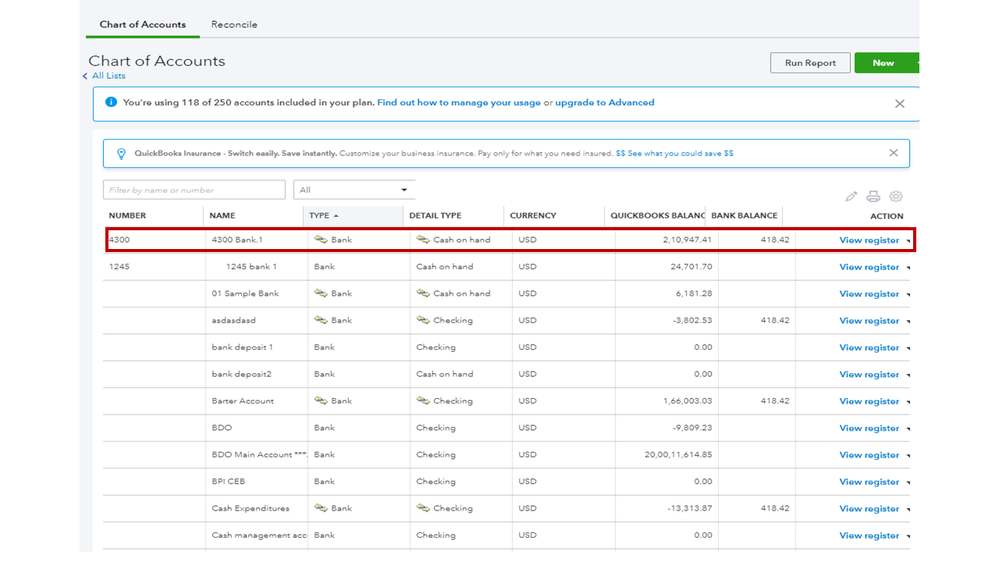

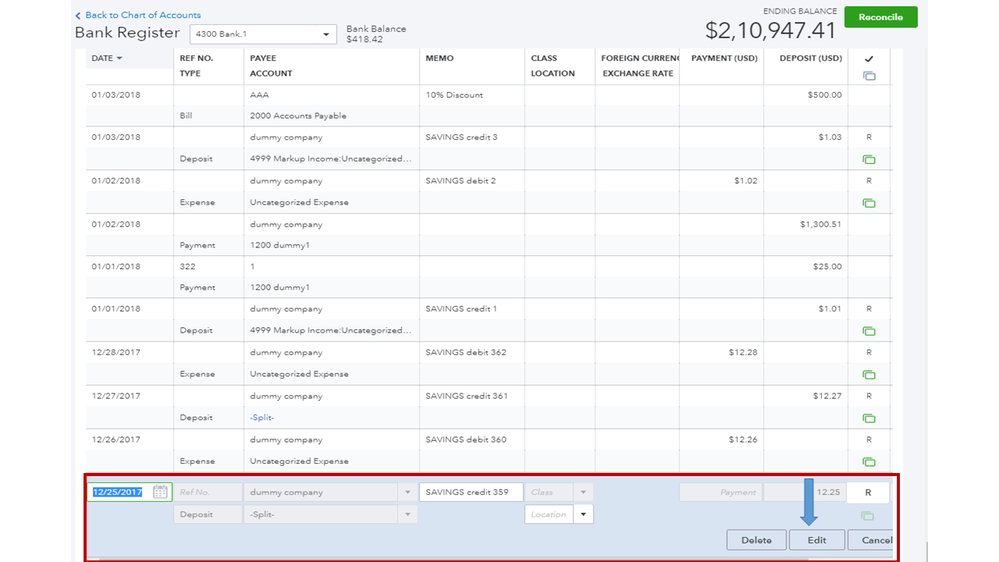

If you want to remove the opening balance equity, you can delete it in your account. Here's how:

As always, I recommend consulting with an accountant. This is to ensure your records are tiptop shape.

For additional resources, the following contains detailed steps on how to add or edit transactions in the register: Modify transactions in QBO.

Keep in touch if you have any further questions or concerns. I’ll be more than happy to assist further. Wishing you the best.

We have been using QBO since 2019. However, this year, two journal entries have been inexplicably added to our Opening Balance Equity account. One is an increase from April, and the other is a decrease from July. What could have caused this, and how do I fix it? It's not like its from when we first added the bank account in 2019.

Hello there, Jhanse121.

We can look into the transaction journal of your Journal Entries to help us identify why there's a decrease and increase. Let me show you how:

If you're unsure how to manage your journal entries, you can get in touch with an accountant to help you handle it.

Here are a few references that you can check out:

I'm just around if there's anything else that you need help with. You take care and have a great day!

Hi, your post has been super helpful but I have one other question going off of what you said. I have removed my 100$ "opening balance" like you suggested and now am working on categorizing it the right way as my first transaction.....What if when I opened my business checking account I had to transfer the 100$ from my personal checking account to fund the initial 100$?, after reading into it further I understand this may have been a mistake and count as comingling personal/business accounts? Since that initial transaction I've kept everything separate ( business credit card for business expenses ), payroll to pay myself as an employee of my s corp etc... but for me to categorize that initial 100$ deposit I would have to link my personal checking account to my quickbooks online account correct? which I've red is seen as a red flag by the IRS and recommended not to do? Please advise, any help appreciated

Hello Boknows609,

I'm glad that you found my colleague's answer super helpful. Let me continue to help you with your initial deposit.

You won't need to connect your personal account since it's not part of your business. Simply record the initial deposit as a deposit since it's a money-in transaction. Then, you can categorize it as capital or owner's equity. You can ask an accountant how to properly categorize it.

Please don't forget to mark your first transaction as reconciled (mark it with R).

Let me know if you have other questions in mind.

Hello Lynda,

could I simply change the date and amount in the opening balance equity to the values that match my bank statement for the older information imported?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here