Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I'll help you view your non-taxable transactions on a report, eisenarmsllc.

You can only see the transactions with taxes in the Sales Tax Liability report. To view the non-taxable sales, let's run and customize the Taxable Sales Detail report.

Here's how:

For more details about the process, you can check out this article: Create a Non-Taxable Sales Report in QuickBooks Online.

In case you still need to enter non-taxed items in QuickBooks, I'll guide show you how:

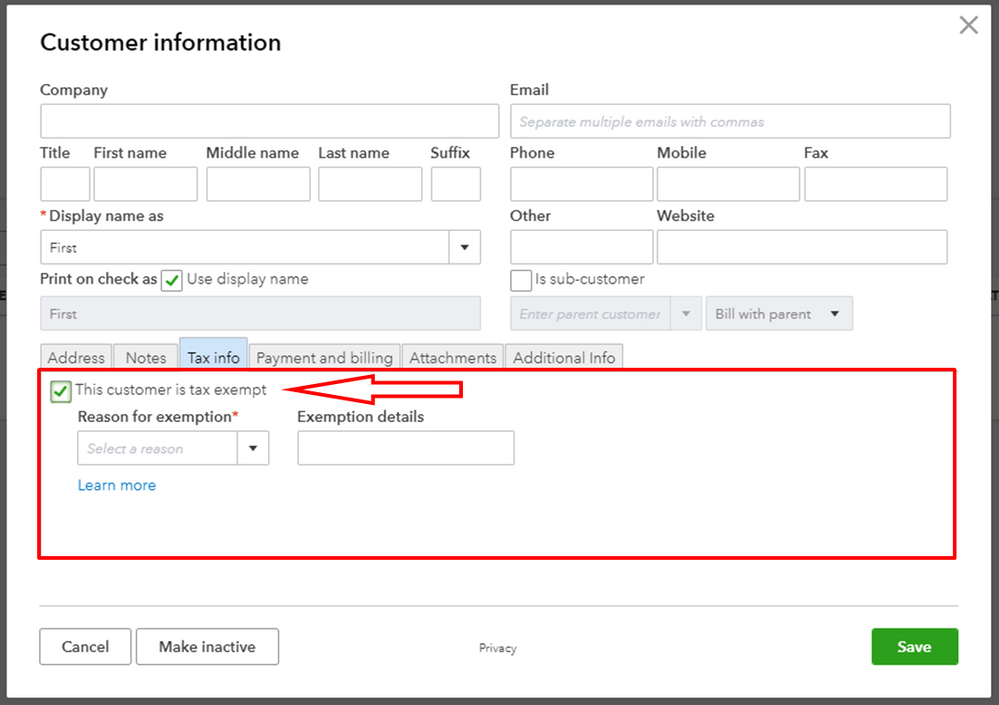

Also, you need to check the taxable status of your customer. If a customer is listed as tax-exempt and has a valid address, the tax-exempt status won't apply to any invoices or sales receipts created for them.

Once done, you can now create invoices with non-taxable sales. If you've already created invoices, you need to open each of them and re-select the item. Doing this will also remove the sales tax amount.

Additionally, I'm adding these articles as your guide while managing sales taxes in QuickBooks Online:

Please fill me in if you have additional queries about running sales tax reports and making non-taxable invoices. It's always my pleasure to help. Keep safe.

Customers are not all taxable or non-taxable - depends on if I'm doing a service or selling an item inside or outside of my state. It's not all one way or the other. Same thing with my inventory - sell it out of my state = no sales taxes - and that requires me to not use your Sales Tax Liability Report because it's not show all my sales. Funny how your technical support called me back telling my ONLINE software isn't updating and how I need to spend more money and get more services. I'll be shopping around.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here