Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello,

The business owner made a loan to a contractor so they could pay a large child support payment. The party is to pay back the loan in monthly payments. These payments will come out of their checks for work they performed for the company. How do I set this up to track it on Quickbooks Online?

Thank you

Maggie

Hi daisydays22.

I'm happy to help, you'll want to do a few things, set up a liability account, record the money received from the loan and then record the payment. Follow along below.

Step 1: Set up a liability account to record what you owe:

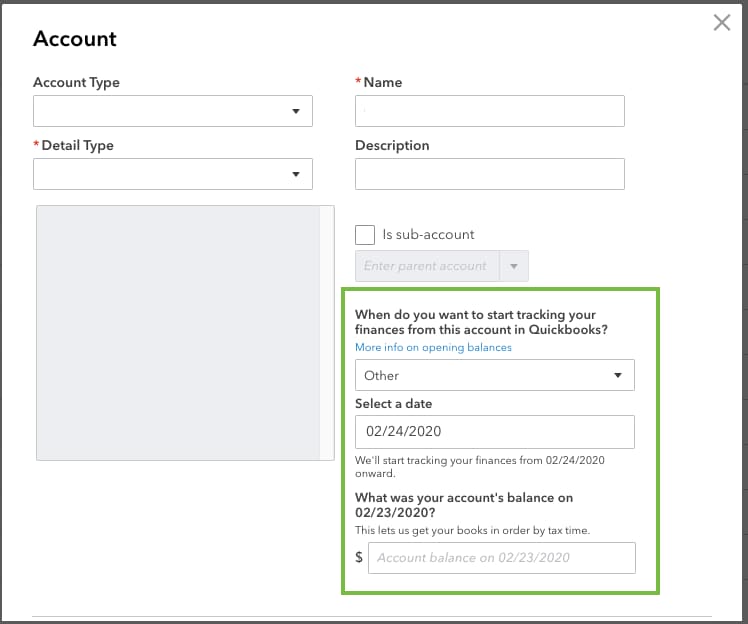

First, set up a liability account to record the loan:

Step 2: Record the money you got from the loan:

Now you have an account to track what you owe for the loan. If you plan to put your loan money directly into your bank account, create a journal entry.

This puts the entire loan amount into your bank account. Whenever you record expenses or purchases, you can select your bank account as the payment account.

If you plan to use your loan in a different way, to make a direct purchase for example, we recommend you reach out to your accountant. This can get tricky and they know how to handle the next steps. Don't have an accountant? We can help you find one.

Note: To pay and amortize the debt of an intangible asset, see the Amortization schedule in QuickBooks Online.

Step 3: Record a loan payment:

If you have any other questions, feel free to post below. Thank you and have a nice afternoon

Thank you for making an effort to help but the company didn't receive a loan. As my post stated "business owner made a loan to a contractor".

Can someone please provide assistance with my question?

The process is the same, Daisydays22.

You can follow the steps provided by my colleague. Then, set up the owner as a vendor. This way, it will show that the business owner made a loan to the contractor. Here's how:

As always, we suggest conferring with your accountant on the best way to handle this situation.

We're just around if you need our help. Feel free to reach out to us again.

How can you get it to show a credit balance to the vendor? If I try to enter as though we have overpaid the contractor (loan) it says it cannot be recorded and have to enter an amount greater than zero if you try to enter negative amount. If I save it as an expense with the loan amount it doesn't show for proper recording.

Let me shed some light with regard to your concern, @jen-glassco-gmai.

You can go ahead with recording the vendor credit and enter a positive amount. Doing so will affect the accounts payable thus creating credit in vendor balance. Here's how:

Here's an article you can read more about creating and managing credits from your vendors in QuickBooks.

To give you more tips about managing vendor credits and recording cash backs in QuickBooks Online, please check out these links:

I hope this helps. Reach out if there's anything I can assist you with. Have a good day.

Did you ever get an answer? I am trying to figure the same issue. I advanced some money and now I want to pay the contractor less the money he owes me. I can only figure out how to do this by writing a check. QB won't let me do this through direct deposit. UGH! QB can be so fustrating at times.

Hi there, Erin Sullivan. I want to make sure this is taken care of.

If you have recorded an existing vendor credit for the contractor, you can use bill payment. However, if the contractor is also your customer with an open invoice, you can move the Accounts Receivable balance to the Accounts Payable balance on your contractor.

You can create a journal entry to write off the credit balance for that specific vendor. I'll show you how:

Once done, apply a journal entry credit to an invoice in QuickBooks. You can check this article for more detailed steps: Apply a journal entry credit to an invoice in QuickBooks Online. Let's pay your bill to link the Journal Entry.

In addition, I recommend reaching out to your accountant for additional guidance regarding this matter. This way, we can ensure the accuracy of your books. If you're not affiliated with one, you can utilize our Find an Accountant tool to look for one in your area.

You may refer to this article to see different details on how QuickBooks lets you access each vendor's records, and edit and view the status of their transaction: View vendor transactions.

Let me know if you have any other questions about managing vendor credit or concerns related to QuickBooks. I’m always here to help. Have a nice day!

No, that didn't solve the issue. The issue I have is I need to pay a 1099 contractor (only a contractor-not a customer). The contractor borrowed money - an advance against from what I owe him. I want to deduct the amount he owes me without under reporting on his 1099 next year. For example I want to pay him $1200 and I want this amount to reflect on his 1099 next year and I also want to reduce his direct deposit to pay me back the $400 he was advanced, so his net would be $800. This can be done on the employee side but I can't figure out how to do this same type of transaction on the contractor side. Thank you for you assistance.

-Erin Sullivan

Accountant/CFO

Thanks for your reply, Erin.

Since QuickBooks Community is a public forum, we're unable to pull up your account information.

Performing this process in QuickBooks Online can be tricky. That said, I recommend working with your accountant. They'll be able to provide you with the best approach for handling these transactions.

If you don't have one, consider visiting this link provided by my colleague above to look for one in your nearby area: https://quickbooks.intuit.com/find-an-accountant/

You can always reply on this thread if you have other concerns about your transactions. I'm determined to help you succeed. Keep safe always.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here