Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I'm trying to write off an item on AR. I have the member listed on the AR report. I was able to create the credit memo. However, not able to apply the credit memo (received payment) due to no open invoice. How can I complete the process?

Solved! Go to Solution.

It’s great to see you in the Community, simtreasurer86.

I know how important for you to be able to complete the process of writing off the A/R. This will ensure your financial records are in order.

In QBO, you'll need to have an open invoice to apply the credit memo. This is to keep your your accounts receivable and net income stay up-to-date. Check out this article for more details: Write off bad debt in QuickBooks Online.

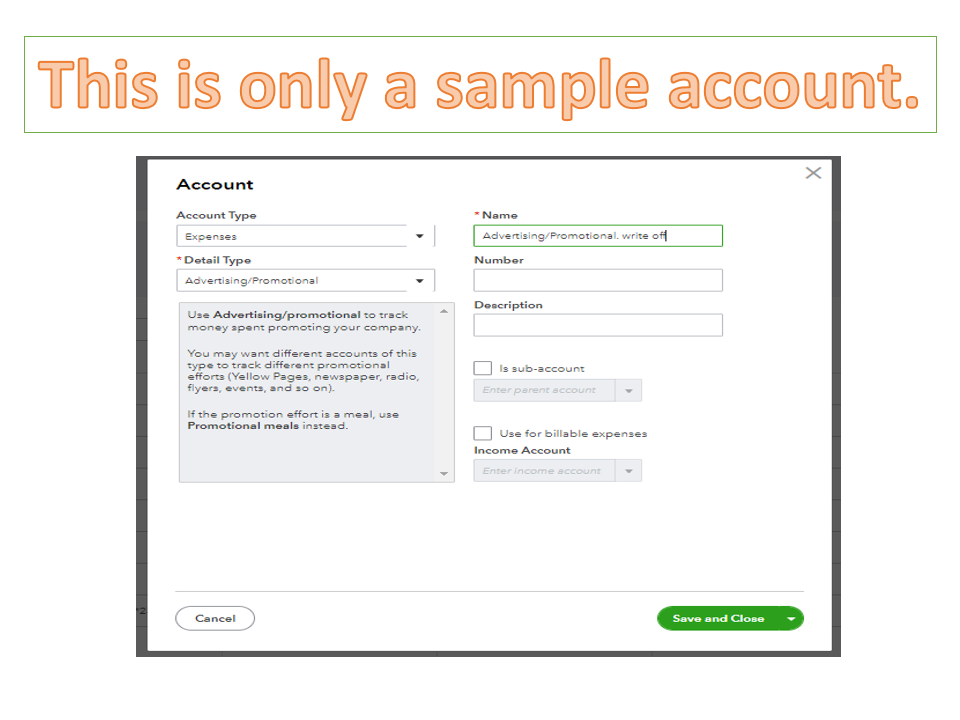

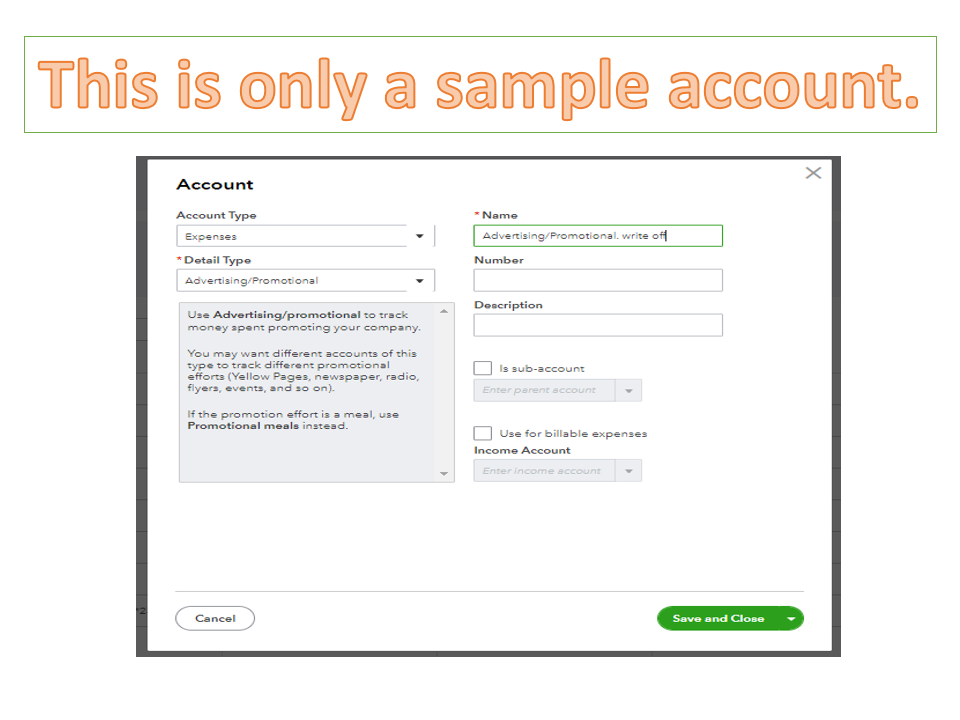

If this for an item, set up an expense account and create an invoice to write it off. The process will reduce the item count in your inventory.

To create the account:

Next, create an invoice for the item. Once done, run the Profit and Loss Report to see the income and cost of goods amount.

To complete the process, follow the steps in this article. Make sure to proceed directly to Create a journal entry up to the Apply the credit memo section: Write off inventory items given as promotional samples.

You can read through these articles to learn more about creating a customer refund. From there, you’ll see the steps on how to apply a credit memo and record an overpayment.

Keep in touch if you need help with QuickBooks. I’m more than happy to assist further. Wishing your business continued success.

It’s great to see you in the Community, simtreasurer86.

I know how important for you to be able to complete the process of writing off the A/R. This will ensure your financial records are in order.

In QBO, you'll need to have an open invoice to apply the credit memo. This is to keep your your accounts receivable and net income stay up-to-date. Check out this article for more details: Write off bad debt in QuickBooks Online.

If this for an item, set up an expense account and create an invoice to write it off. The process will reduce the item count in your inventory.

To create the account:

Next, create an invoice for the item. Once done, run the Profit and Loss Report to see the income and cost of goods amount.

To complete the process, follow the steps in this article. Make sure to proceed directly to Create a journal entry up to the Apply the credit memo section: Write off inventory items given as promotional samples.

You can read through these articles to learn more about creating a customer refund. From there, you’ll see the steps on how to apply a credit memo and record an overpayment.

Keep in touch if you need help with QuickBooks. I’m more than happy to assist further. Wishing your business continued success.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here