Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Good morning. I have 2 issues: 1) We did 1st payroll and it didn’t pick up the right bank account to direct deposit. We called QBO and they reversed the paper check and set up direct with me. A tax liability showed up in the wrong account’s bank registry and it is throwing off my QBO bank balance. I have been on the phone 3x and they don’t know how to fix it. 2) Bank transfer to close the wrong account to our new business account- he did it through the ATM since it was after hours and couldn’t deposit the single dollars and change- the transfer function won’t work because it is now $3.34 off. How do I go about correcting it? Accept the bank transfer and note the variance at the end of the month? Or accept the bank registry pull that is $3.34 less…Any suggestions would be greatly appreciated.

Thank you for the detailed information, @Jackie804.

Let's resolve your payroll and bank transfer issues so you can get back to working order.

For your payroll concern, you'll have to create a journal entry to transfer the tax liability to the appropriate bank account. However, I suggest seeking help from your accountant to help you identify the accounts to use for debit and credit. Here's how to create a journal entry:

Just in case you want to review and edit your payroll preferences, you can read this article for more guidance: Payroll accounting preferences.

On the other hand, if you're referring to the downloaded bank transfers that you can't accept due to the difference, you can utilize the Resolve Difference option. Let me guide you how.

However, if you're referring to something else about your bank transfer issue, you can post it below and provide additional information about it.

Please let me know if you need clarification about this, or there's anything else I can do for you. I'll be standing by for your response.

Problem 1- Payment was never made from the 1st account. The paper check was voided in the bank account but a federal tax liability showed up on the bank statement. You check the 2nd account bank registry all the federal tax payments made are there and it ties to the Payroll tax report. 1st account is showing ($432) for tax liability that I can’t delete but the associated check was voided and the liability was left behind that shouldn’t be there.

Problem #1- Bank account #2 and payroll tax report tie for all federal tax payments made and the chart of accounts shows no liabilities. Bank account #1 had the first pay check voided and then a federal tax liability showed up in the bank registry for some reason - I can’t delete the line item and it doesn’t show up on the bank statement so it shows it was $432 less in QBO than it actually is. How do I fix that?

Let me help fix your issue about the liability showing up on the first bank account, Jackie804.

I suggest contacting our QuickBooks Live Support Team so they can delete the tax liability for you. Check out this link for the contact details: Payroll Support.

Moving forward, please know that you can only use one bank account for payroll transactions. You need to select which one to use to prevent issues like this.

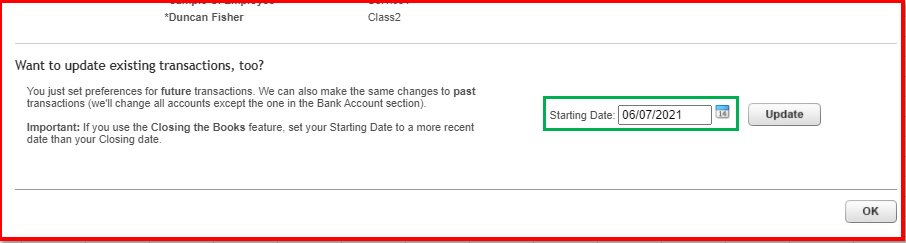

Or if you need to transfer all payroll transactions to the second account, make sure to update the settings to affect past entries. Let me show you how:

For more details about this, please browse this link: Set up Payroll account preferences.

Let me know if there's anything else I can help you with concerning payroll entries. I'm always right here to provide the information that you need.

I have contacted Payroll 2x. The first lady looked at my chart of accounts for the Fed Tax liability and got all confused. It is accurate for the payroll that hit the new account but that liability is lingering in the 1st account and no one can remove it for me to get my QBO balance correct. The second one emailed me the directions on how to close my account since all of her other calls had been regarding that (also note she was yelling at a kid to find her Uber dinner delivery up and down their street and a dog barking the entire time- lead me to wonder whether I should move elsewhere too).

Hi Jackie804!

Thanks for the reply. Allow me to join this post so I can help you with the payroll liability.

The best way to transfer the payroll liability to another account is by creating a journal entry. However, you'll want to seek some help from your accountant since this process affects different accounts from your Chart of Accounts.

I've added some articles you can check. This will answer the common question in filing and paying the payroll taxes:

Keep on posting here if you have additional concerns. Take care!

The liability should never have been applied to my 1st bank account. The check was voided entirely on this account. Then set up again on the 2nd account as direct deposit. All tax payments were processed on the second bank account. I can’t get my QBO amount to tie for this account and it now sits at -432.76 for QBO and $0 based on the actual bank balance. No federal tax payments were EVER made off this 1st account and the bank statements support this. There is no justification as to why the liability popped up in the bank registry and I am unable to delete it. I have spoken to 3 people in payroll and 1st said we can deal with it later, 2nd said you’re payments and liabilities for the 2nd account is right so I don’t know where it came from, 3rd gave me subscription cancellation info.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here